Jobs data from the United Kingdom, though mixed, ultimately increase the possibility of June rate cuts. However, we may need to wait for the UK inflation data next week for a stronger confirmation. For now, we await the US PPI today and the CPI tomorrow.

Key Points

- UK Job data point to potential rate cuts, but next week’s Inflation Data will be a bigger determinant.

- US PPI today and CPI tomorrow may dictate the direction of the pair in the meantime.

- The 1.25700 remains the level to break for a continuation of the recent rally.

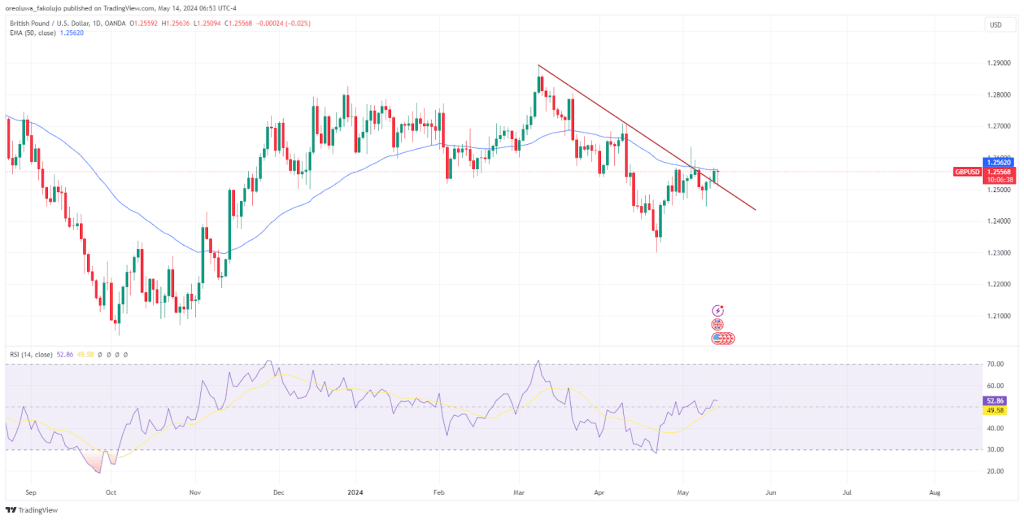

GBP/USD Daily Price Analysis – 14/05/2024

The pair recorded a 0.28% rise on Monday. Having dipped during today’s Asian and early London sessions, the pair looks to be recovering all its losses ahead of the New York session with a pin-bar formation.

Tuesday morning, the UK’s jobs reports were released. Unemployment rose to 4.3% from 4.2%, and labor productivity dropped. Wage growth (bonus inclusive), however, came in unchanged at 5.7%. Investors are looking at these figures and thinking the UK is on track for potential June rate cuts. Next week, the interest rate direction should become a little clearer with the release of the UK Inflation data.

Across the Atlantic, the Greenback has remained steady. For the most part of the year, it was buoyed by consistently delayed rate cuts amidst sticky inflation. Hawkish comments from Fed officials have also helped to prop up the currency. As a result, the US Dollar Index, which tracks the value of the USD against 6 other top currencies, has risen by 3.74% so far. More recently, though, the Fed has taken a less hawkish stance, with NFP and Job reports from the country showing signs that the economy is finally slowing down.

Having said that, a lot will hinge on the PPI data, which will be released later today, and the CPI data slated for tomorrow.

From a purely technical perspective, the pair looks to be mounting a resilient challenge against the bearish trendline that’s guarded price action for about 2 months now. Yesterday’s bullish price action saw the trendline breached. Even the RSI confirmed this by edging slightly above the 50 midpoint. However, there remains some work for the bulls to do, as the 50 EMA remains a strong dynamic resistance to overcome.

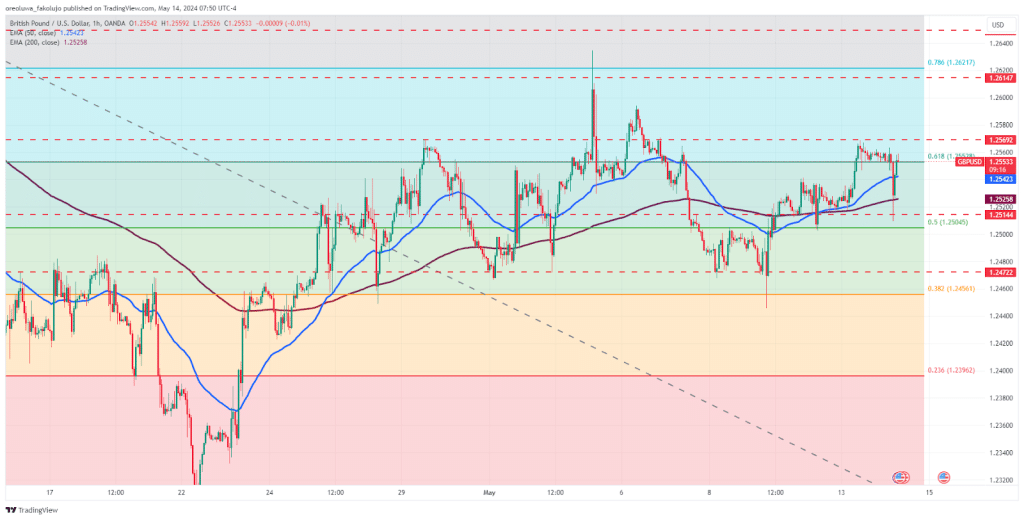

GBP/USD Technical Analysis – 14/05/2024

The 50 EMA line crossing over the 200 EMA line suggests that the pair is now looking bullish on the hourly chart. True to it, the price has only trended upwards from the 9th of May. However, the price now seems to be stuck between the 0.618 (1.25528) Fibonacci retracement level and the 1.25682 resistance. Should the price beat this resistance level, we may see a further rise to the 1.2617 resistance level, sitting just below the 0.786 (1.26217) fib level.

Should this bullish push fail to materialize, though, a fall back to the support zone formed by the combination of the 1.25045 price level and the 0.5 (1.25045) fib level. Another support level awaits the price at 1.25144.

Key Economic Data and News to Be Released Today

News from the United States will be taking the headlines today, with the PPI data coming in. Economists expect the figure to be at 0.3%, a 0.1% increase over last month. Should the actual figure come as forecasted, it could shore up the strength of the Greenback, sending the pair back down. On the other hand, a lower-than-expected figure might just be the catalyst the pair needs to continue its rally.

GBP/USD Key Fibonacci Price Levels – 14/05/2024

Based on the 1hr chart, the key Fibonacci Price levels for the GBPUSD are these:

| Support | Resistance |

| 1.25528 | 1.26217 |

| 1.25045 | 1.27095 |

| 1.24561 | |

| 1.23962 |

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.