Key Points

- UK elections to sink pound?

- FOMC minutes to show 2024 cuts?

- NFP day looms.

- Brace for GBPUSD volatility.

UK Elections To Sink Pound?

On Thursday, the time for talking in the UK will stop, and the public will find out who the next Prime Minister will be. The polls are extremely grim reading for Rishi Sunak and the Conservative party, with Keir Starmer’s Labour expected to win in a historic landslide. The question for traders then becomes, what does this mean for the pound?

Well, there is a consensus that a Labour majority would be negative for the pound. This is because the markets generally prefer continuity over change. So, in the medium term, we could see the pound push lower to 1.22000. In the short term, it could be argued that the pound’s weakness has already been priced in with the move lower seen in the last six weeks. However, do not rule out a move down to 1.25000.

FOMC Minutes To Show 2024 Cuts?

Traders eagerly anticipate the FOMC meeting minutes being released today. It still remains very open whether the Federal Reserve will cut interest rates twice or once. According to the CME Fed Watch Tool, the possibility of no cuts seems to have been priced out for now. This places a lot of emphasis on high-impact data such as the FOMC meeting minutes, as any slight change in wording can change the narrative and impact the US Dollar.

If the FOMC meeting minutes show language geared more toward two cuts this year, GBPUSD could spike higher at the end of today’s session. However, we have seen how hawkish the Federal Reserve is relative to other central banks, and more of this could continue the dollar grind higher.

NFP Day Looms

The data just keeps coming, and we should all have Friday bookmarked in our diaries as it is US Non-Farm Payrolls Day! This is widely regarded as the most volatile event in our monthly economic calendars, and this release should be no different. We have often seen the previous figure revised, so this is something that can cause a surprise in the markets. Last time out, Non-Farm Payroll data came in at 272,000, and a revised figure lower could send GBPUSD higher because of a weaker dollar. This depends on the actual figure, which is currently forecast at 194,000.

Brace For GBPUSD Volatility

Although the short-term direction of GBPUSD remains unclear with all the significant events coming out in the next couple of days, one thing is for sure: we should all be bracing for volatility, and when traded correctly, fruitful gains are on offer.

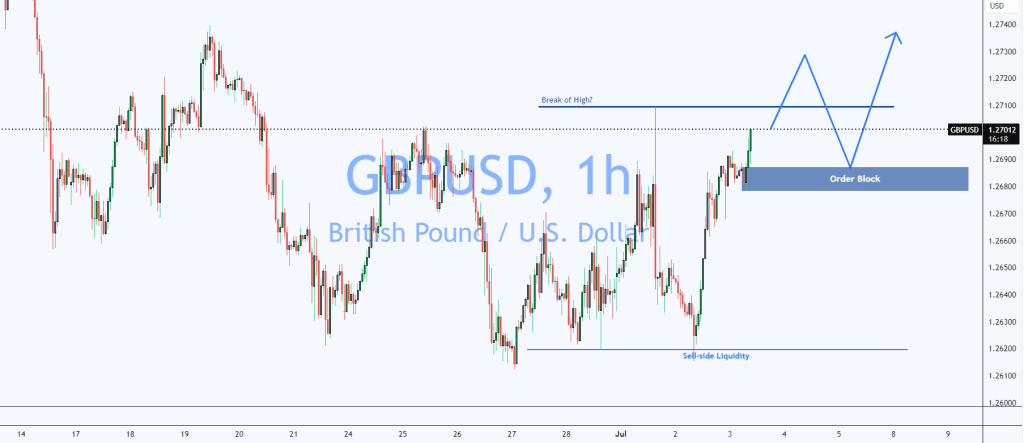

As mentioned in my previous GBPUSD article, the price has reacted strongly to a daily Fair Value Gap. Zooming into the H1 timeframe, you can see the market failed to create a new lower low and grabbed sell-side liquidity before making a sharp move higher. The opportunity could come if the high at 1.27100 is breached, as a bullish order block is situated within the bullish market structure, which could act as a fantastic support area for a move even higher in the short term.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.