Key Points

- A bullish bias for silver remains valid.

- The FOMC Minutes and US NFP are this week’s key silver market drivers.

- Pullback buys on the daily timeframe are appropriate given the current XAG/USD market dynamic.

Market Overview

2024 has been a huge year for silver (XAG/USD). Prices are up more than 30% as traders and investors have piled into precious metals. Now that Q3 is underway, questions surrounding Fed monetary policy and geopolitics will be the key market drivers ahead of New Year’s Eve.

FOMC Minutes

The cardinal rule for commodities is this: a weaker USD equals rising prices. Silver is no different, as many traders view it as an ideal inflation hedge.

Wednesday’s FOMC Minutes release will give the markets a view of the United States Federal Reserve‘s (Fed) inner dialogue. Despite the current interest rate stance of “hold the line,” there are mixed opinions on the future of Fed policy. Several Federal Open Market Committee (FOMC) members have gone public, leaving the door open for further rate hikes. Others have stated that it’s time for rate cuts. Last week’s statement from FOMC member Fed Governor Bowman sums up the situation:

“Should the incoming data indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower the Federal Funds Rate to prevent policy from becoming overly restrictive. However, we are still not yet at the point where it is appropriate to lower the policy rate. I remain willing to raise the target range for the Federal Funds Rate at a future meeting should progress on inflation stall or even reverse.”

At 2:30 PM EST Wednesday, we will get an inside look at the FOMC’s ongoing policy debate. Is there significant progress being made on inflation? Where do expectations for economic growth stand? Can we expect rate cuts or rate hikes later this year?

The answers to these questions have the potential to send silver reeling. For now, a bullish bias is warranted as prices close in on the 30.000 handle.

Technical Outlook

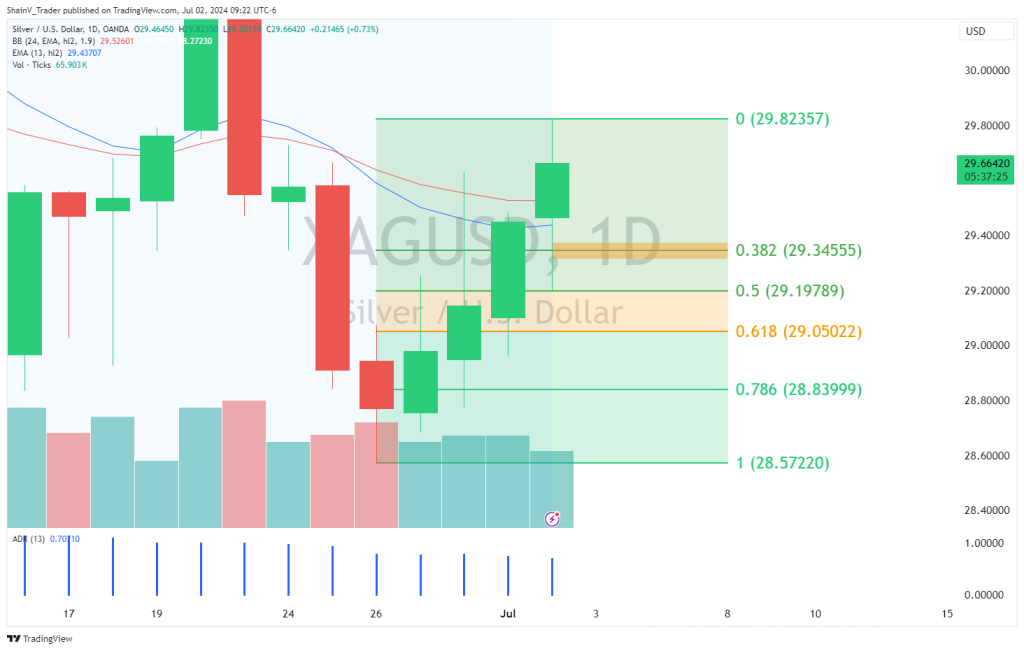

It’s been a solid week for silver, posting nearly 2% gains in the first 48 hours of trade. The XAG/USD is holding above the Monthly 38% Fibonacci Retracement (28.48), thus an upside bias is appropriate to open Q3 2024.

Given the bullish market read, buying pullbacks isn’t a bad way to trade the action. The daily timeframe’s 38% and 62% retracement areas are solid buy-side entries. These price points are 29.3455 and 29.0502, respectively. Bids from either area offer short-term, positive expectancy market entries.

It’s A Holiday Week In The US

If you’re in the markets this week, remember that Thursday marks Independence Day in the United States. The US stock markets and CME futures will feature an early halt to trading. However, forex and crypto will remain open, although limited liquidity is expected.

On Friday, the release of US Non-Farm Payrolls for June will be the financial headliner. This economic event is likely to be challenging to trade. Limited US liquidity is likely as many market participants will be out of the office on holiday. You are advised to exercise caution when trading this event.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.