The EUR/USD sits on the 1.084 support level as investors await the Fed’s interest rate decision and economic projections today.

Key Points

- ECB President Lagarde said rate cuts are likely in June, bringing downward pressure on the EUR in the London Session.

- Investors will now have their focus on the FOMC’s interest rate decision and economic projections later today.

- The 1.084 price level currently holds the price as a critical support level.

EUR/USD Daily Price Analysis: 20/03/2024

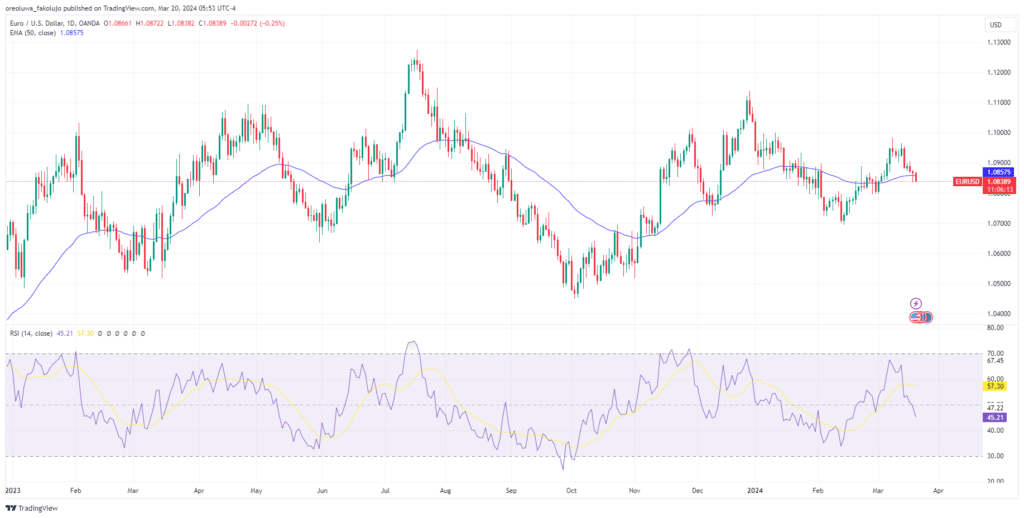

The EUR/USD lost 0.06% on Tuesday and fell by an extra 0.25% in today’s London session alone ahead of the FOMC meeting later today.

As investors anticipate the United States’ interest rate decisions, the CME FedWatch tool puts the likelihood of a rate cut in June at 64%, up from 55.1% on Tuesday. Coupled with the declining US Treasury bond yields, the selling pressure on the Greenback could start to compound.

In the Eurozone, the ECB president testified today that rate cuts will likely happen in June if the inflation and wage data align with their projections. “If these data reveal a sufficient degree of alignment between the path of underlying inflation and our projections,” Lagarde said, “ and assuming transmission remains strong, we will be able to move into the dialing back phase of our policy cycle and make policy less restrictive.”

That, coupled with the lower-than-expected German PPI data, which came in at -0.4% today, has contributed to the downward pressure on the EUR we’re seeing today.

On the technical front, the pair does not look to have picked a side. Price action flows rather sideways even though the price has just dipped below the 50 EMA, and the RSI line has just fallen below the midpoint during the current trading session.

EUR/USD Intraday Price Analysis – 20/03/2024

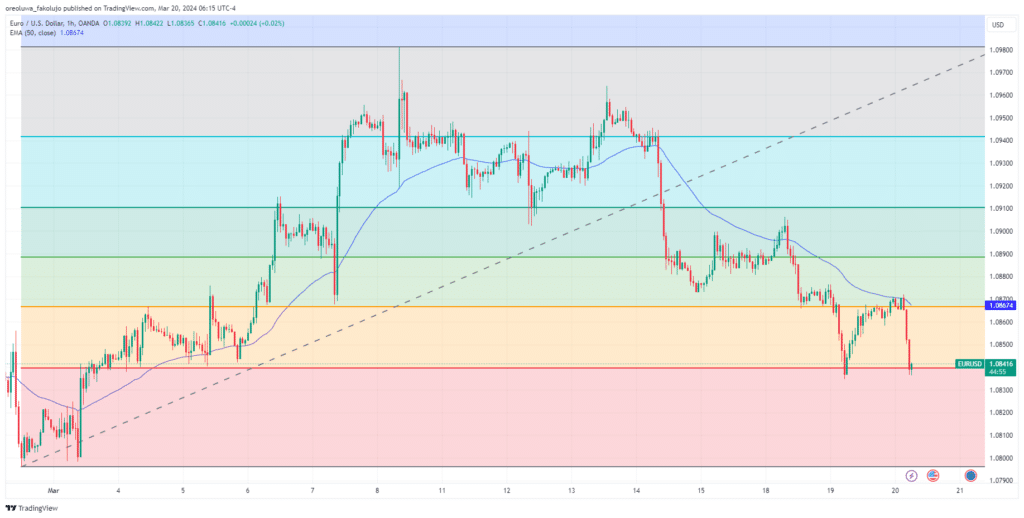

Plotting the Fibonacci retracement tool from the most recent daily swing low of $1.07960 to the daily swing high of $1.09813, you’ll notice that the EURUSD is about to complete a technical reversal to the bearish side on the 1hour chart. Every key Fib level in its way has been cleared, leaving the 0.236 level ($1.08397)as the only support before the price approaches the swing low.

That same level has proven to be sturdy in the past, as the price made a sharp bounce off it during the London trading session on Tuesday. Only the equally sturdy 0.383 Fib level ($1.08668) was able to bounce the price back down today.

If the price bounces off the $1.08397 level once again, we may see another challenge of the 0.382 resistance level. From there, we may see more resistance-level tests of 0.5 ($1.08887), 0.618 ($1.09105), and 0.786($1.09416).

Key Economic Data for the EUR/USD Pair – 20/03/2024

We already had ECB president Largade’s testimony during the London session today. But most importantly, in the New York session, the FOMC interest rate decision and economic projections will be taking center stage. If there’s a hint of impending rate cuts from these data, we might see a bearish pressure on the Greenback.

On Thursday, investors will have their eyes on the Initial Jobless Claims from the US as another economic indicator that may offer further insight into the Fed’s interest rate decisions.

EUR/USD Key Fibonacci Price Levels 20/03/2024

Based on the 1hr chart, the key Fibonacci price levels for EUR/USD are these:

| Support | Resistance |

| $1.08397 | $1.08668 |

| $1.07960 | $1.08887 |

| $1.09105 | |

| $1.09416 | |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.