Key Points

- Dovish Fed expectations have brought an August correction to the Greenback.

- Key Support for the EUR/USD resides in the 1.1035-1.1050 area.

- Friday is an important news cycle, featuring EU CPI and US PCE Prices.

Market Overview

August has been a sluggish month for the USD. Values are down across the majors, culminating in the USD Index sliding 2.75% for August. One of the big movers during this period has been the EUR/USD. Rates are up 2.6% and holding above 1.1100. With September’s Fed meeting approaching, FX traders are aggressively pricing forthcoming rate cuts.

US Mortgage Rates Fall

During Wednesday’s US pre-market hours, the weekly MBA 30-year mortgage rates were released to the public. Rates fell to 6.44%, the lowest level since April of 2023. The result was a 0.5% gain in new mortgage applications, a massive increase from last week’s -10.1% decline.

Falling 30-year mortgage pricing suggests that long-term lenders expect the Fed to adopt dovish monetary policy. But, its not just lenders. At this point, the entire world is eagerly awaiting the Fed to cut rates for the first time in several years.

The CME FedWatch Index currently assigns a 63.5% chance of a ¼ point rate cut and a 37.5% chance of a ½ point rate cut at the September meeting. This is as dovish a FedWatch reading as we’ve seen in many months. Without a doubt, the promise of accomodative Fed policy is having a negative impact on the Greenback — and is a bullish driver of the EUR/USD.

EUR/USD: Technical Outlook

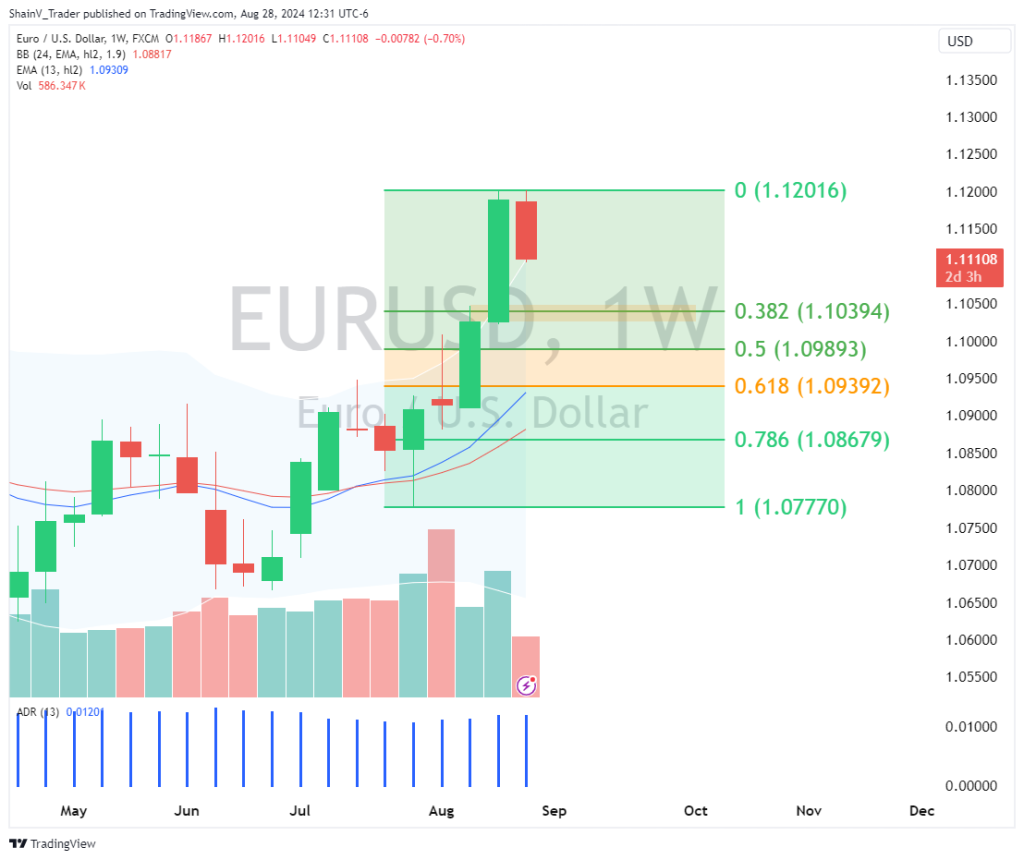

August’s trend is up for the EUR/USD. So, the gameplan is simple: buy pullbacks! The weekly chart gives us a great level to target. With a bit of luck, it will come into play later this week.

The Weekly 38% Fibonacci Retracement (1.1039) is a key support level for the intermediate-term trend. If the EUR/USD extends its weekly loss, then this area is a solid zone to buy.

Late-Week Trade

If you’re trading the EUR/USD, there are a few economic events worth watching for the next 48 hours. German CPI (Thursday, London Session), US GDP (Thursday, US Session), EU CPI (Friday, London Session), and US PCE Price Index (Friday, US Session) are all scheduled ahead of Friday’s closing bell.

Each of these items has the potential to shake the EUR/USD to its core. However, the inflation metrics are Friday are the headliners. EU CPI and US Core PCE will move the market. If you’re active in the EUR/USD during these releases, have your stops down and leverage in check!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.