The EUR/USD is sitting right above the $1.078 support level today, while technical indicators suggest the pair is headed lower.

Key Points

- Last week, the USD gained momentum versus most currencies on strong GDP data.

- Today, the pair has consolidated for most of the Asian and London AM sessions.

- The $1.078 level currently holds the price as a critical support level, with the pair’s short-term outlook appearing to be bearish.

EUR/USD Daily Price Analysis – 01/04/2024

Last Friday was relatively flat for the EURUSD, with the pair only rising by a meager 0.05%. As of writing time, the pair has lost about the same amount today, currently trading at $1.07882.

The Dollar benefitted from a largely positive economic data week last week. The QoQ GDP was higher than expected, and the unemployment claims report was positive. On Friday, Personal Spending was also reported to have risen considerably. In addition, Governor Chris Waller made hawkish remarks, saying there was no need to rush rate cuts.

Across the Atlantic, German retail sales fell by an unexpected 2.7% YoY in February and 1.9% MoM. French CPI data and consumer spending both came out worse than expected. Also, several ECB officials have made remarks supporting President Christine Lagarde’s comment about a potential June rate cut.

When you compare all of these side by side, the European economy isn’t performing as well as its American counterpart at the moment, which may heap downward pressure on the EURUSD.

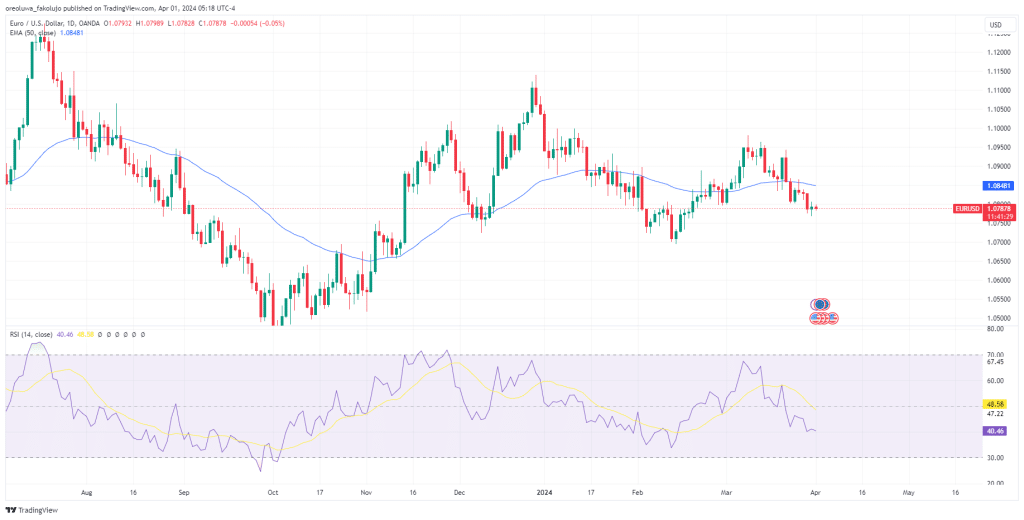

Technically, the outlook for the EURUSD has gradually turned bearish, with the price dipping well below the 50 EMA and the RSI falling deeper beneath the midpoint (as seen in the daily chart below).

EUR/USD Intraday Price Analysis – 01/04/2024

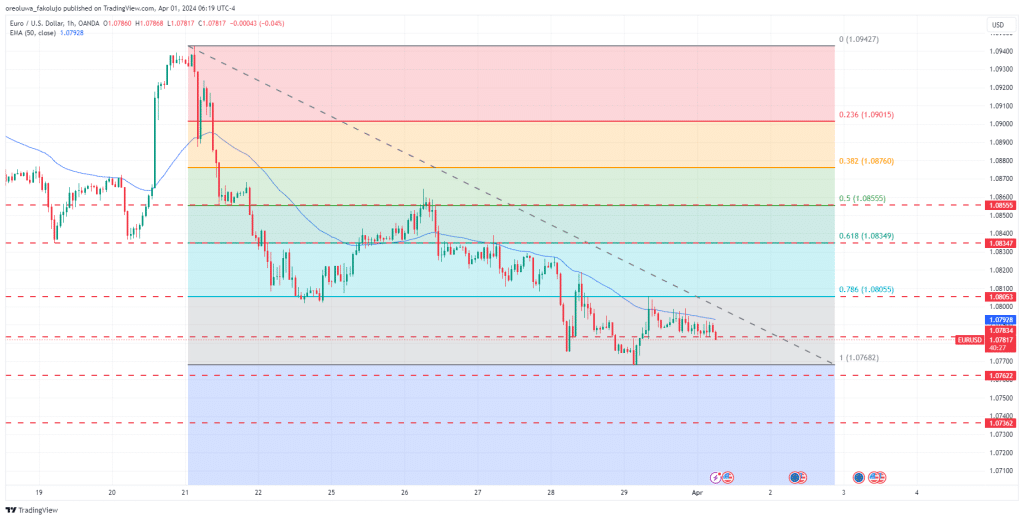

The Asian and London AM sessions have mostly seen sideways movement, with the EUR/USD price just above the 1.07841 support level. If the price falls below this key level, the monthly low of 1.07682 will be exposed. If that doesn’t hold the price, we might see the price tumble further down to the 1.7362 support level.

On the upside, the 1.08053 resistance level is the one to watch. And beyond that, we have the $1.08349 (0.618 FIb level), $1.08555 (0.5 Fib level), and $1.08760 (1.08760 FIb level) resistance levels to challenge.

Key Economic Data for the EUR/USD Pair – 01/04/2024

The US Non-Farm Payrolls data on Friday will be the focus for investors, alongside the Eurozone flash inflation report for March, which will be released on Wednesday. Before then, we have a key US manufacturing data set to be released today, which will give us more insight into the strength of the US economy.

EUR/USD Key Fibonacci Price Levels 01/04/2024

Based on the 1hr chart, the key Fibonacci price levels for EUR/USD are these:

| Support | Resistance |

| $1.07682 | $1.08055 |

| $1.08349 | |

| $1.08555 | |

| $1.08760 | |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.