The EUR/USD pair is displaying a cautious recovery as traders anticipate upcoming economic data and central bank policy decisions. Key technical levels offer a battleground for market direction.

Key Points

- EUR/USD shows signs of recovery but faces resistance ahead.

- Market volatility persists amid central bank policy anticipation.

- Key support was at 1.07600; the break below could see a descent towards 1.07367.

EUR/USD Daily Price Analysis – 08/02/2024

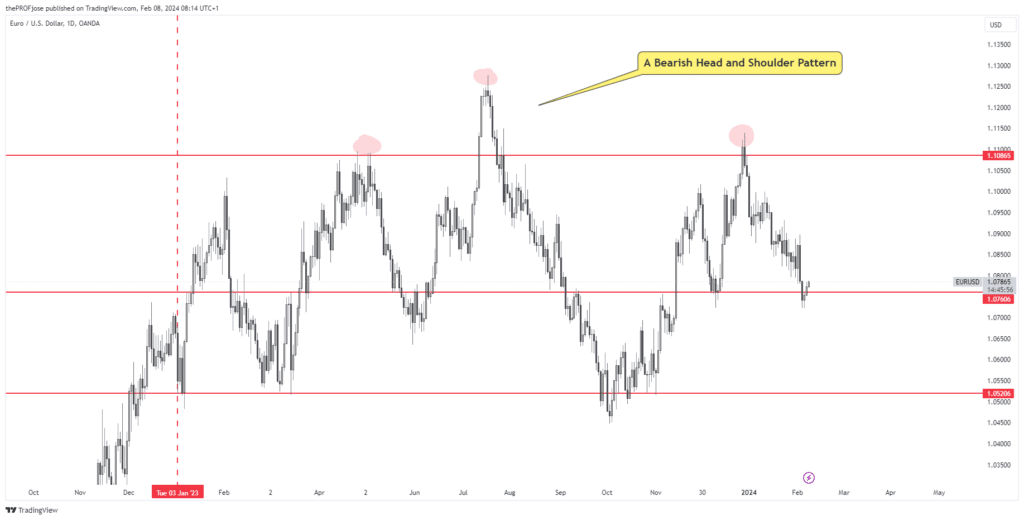

Over the past few weeks, what started as a bullish year has quickly turned into a series of consolidations, with buyers and sellers consistently driving prices between 1.11000 and 1.05000. However, we seem to be heading for a prolonged downtrend in recent days, with price forming a head and shoulders pattern on the daily timeframe. A weak US dollar and rate cut expectations from the Federal Reserve can be the major catalyst for a further decrease.

Yesterday, the EUR/USD made a modest recovery of 0.16% from recent lows, suggesting a possible trend reversal. However, the pair remains within a volatile range, with the potential for consolidation as the market seeks direction amidst varying economic signals.

Key Economic Data and News to Be Released Today

Today, traders will closely monitor the release of the wholesale inventories report and upcoming jobless claims data. These releases have the potential to significantly influence the EUR/USD pair’s trajectory as they provide insights into economic health and central bank policy directions.

EUR/USD Technical Analysis – 08/02/2024

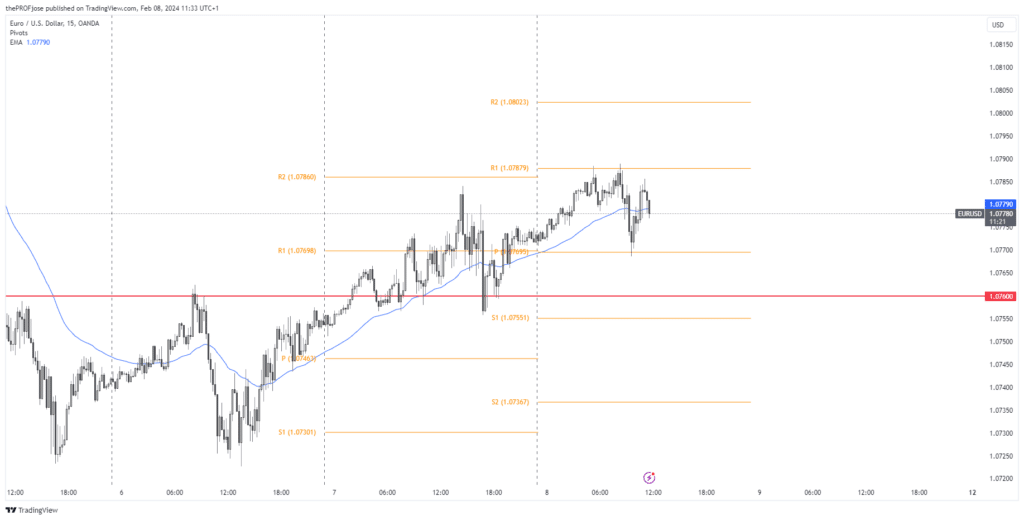

Taking off from where the price left off yesterday, the EUR/USD pair, currently trading at 1.07800, has gained 0.08% in the early morning session.

In the short term, the pair seems to have gained some momentum, rising from 1.0720 to nearly 1.0780. Yet, a quick look at a higher timeframe reveals that this increase may be a price correction. Traders should carefully watch the resistance level of 1.07879.

EUR/USD Fibonacci Key Price Levels 08/02/2024

Based on the 15-minute chart, here are the key support and resistance levels to watch as of 08/02/2024.

| Support | Resistance |

| 1.073695 | 1.07879 |

| 1.07551 | 1.08023 |

| 1.07367 |

Traders should watch these levels for potential breakouts or rebounds, as they could dictate short-term market movements. Technical indicators on the 15-minute currently show upward momentum, but fundamental factors and upcoming data releases will likely be the decisive factors for the pair’s direction.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.