Silver reached its highest price since February 2021 earlier in the session, supported by strong market fundamentals and rising gold prices, with predictions it might exceed $31 by the end of 2024.

Key Points

- Slowing US inflation has shifted market expectations towards a dovish Fed, raising the likelihood of a September 2024 rate cut to 75%.

- Upcoming US economic data and Fed officials’ speeches today could impact silver prices, especially if the tone is hawkish.

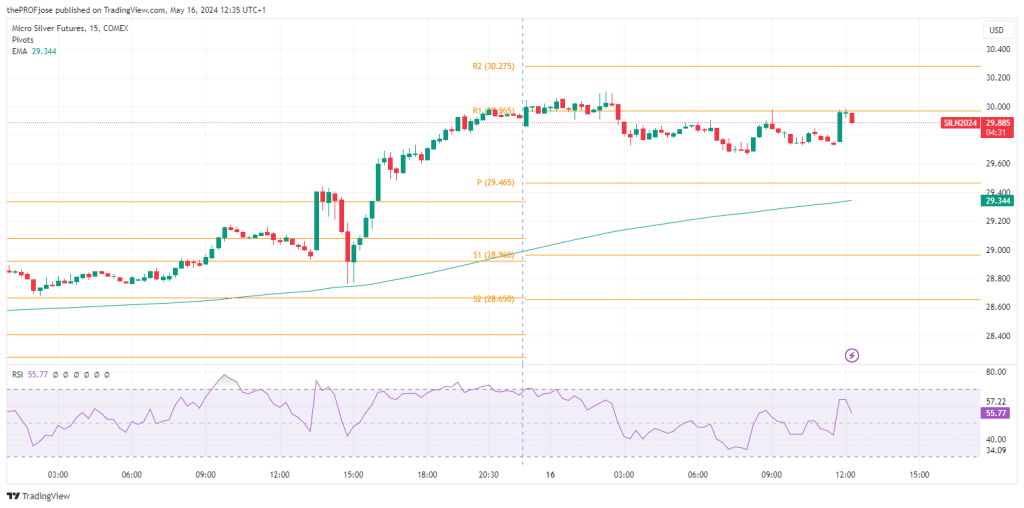

- Technically, silver is bullish on the 15-minute timeframe, trending above the 200 EMA with room for further gains indicated by the RSI.

Silver Daily Price Analysis – 16/05/2024

Yesterday, silver saw a notable increase, closing at $29.671 after opening at $28.61350, marking a substantial rise of 3.70%. This surge was driven primarily by a weakening US dollar and declining Treasury yields, which dropped to their lowest since early April. The dollar index lingered near a one-month low, making dollar-priced silver more attractive to holders of other currencies.

Silver opened slightly above its previous close in today’s session and has since moved up by 0.52%, currently trading at $29.890. Earlier today, silver has touched its highest price since February 2021, reflecting robust fundamentals in the precious metals market. Analysts at ANZ have projected that silver could climb above $31 by the end of 2024 amid rising gold prices and strong market fundamentals.

The recent US CPI data reveal a slowdown in inflation, which has shifted market expectations towards a more dovish monetary policy stance. This anticipation is further supported by the increase in market probabilities for a Fed rate cut in September 2024, now standing at 75% according to CME’s FedWatch Tool. With a weakening dollar and Fed officials, including Neel Kashkari, advocating to reassess the restrictive policy rates, Silver’s allure is enhanced as lower rates increase the attractiveness of non-yielding assets.

Key Economic Data and News to Be Released Today

Traders will focus on a slew of US economic data set to be released later today, including Building Permits, Housing Starts, Initial Jobless Claims, the Philly Fed Manufacturing Index, and Industrial Production. Moreover, speeches from Fed officials like Barr, Harker, Mester, and Bostic could provide further cues. Hawkish tones from these speeches might strengthen the dollar, potentially capping gains for Silver in the short term.

Silver Technical Analysis – 16/05/2024

Silver is still observed to be bullish on the M15 timeframe wildly, as it is trending above the 200 EMA smoothly. Although the price has been tightly bound within a range today, the overall bias is bullish.

Confirming the bias, the RSI is far from being overbought, showing there’s still more room for the precious metal to move slightly higher. For traders looking to enter a long position, a break above the high of the day might be a good place to look for an entry.

Silver Fibonacci Key Price Levels 16/05/2024

Short-term traders planning to invest in Silver today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 28.785 | 29.780 |

| 28.477 | 30.088 |

| 27.980 | 30.586 |

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.