Fibonacci Cheat Sheet [FREE DOWNLOAD]

As we mentioned throughout this course, the Fibonacci trading tool is one of the most reliable and profitable trading strategies you can use to find entry and exit points in forex trading. Even advanced traders are using this trading strategy to predict price movements and to know where to place stop loss (and take profit targets) market orders.

So keeping that in mind, let’s recap what we’ve learned about trading using Fibonacci retracement levels and key Fibonacci ratios. Remember, Fibonacci Retracement Levels are watched and used by many forex traders, which is why Fibonacci levels are so effective and valuable in trading currency pairs.

- How to use Fibonacci retracement levels?

- How to use Fibonacci retracement Levels with trend lines?

- Using Fibonacci retracement level with support and resistance levels

- Using Fibonacci Retracement Levels to place stop loss orders

- Using Fibonacci Retracement Levels with candlesticks

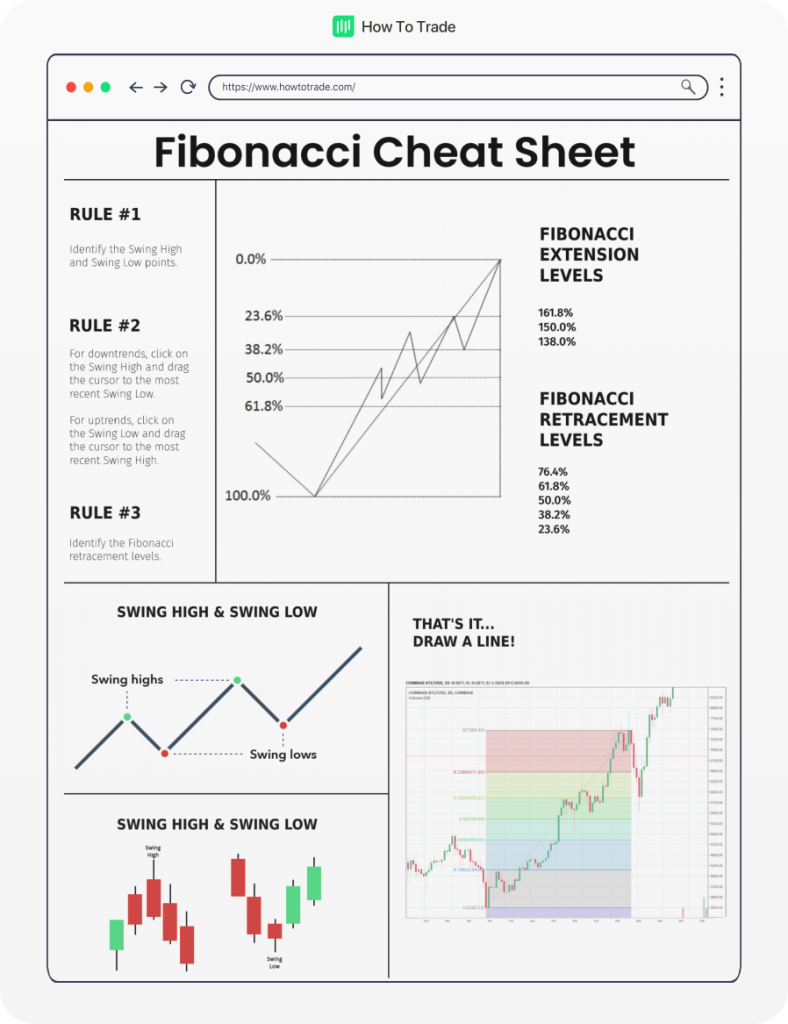

To help you remember all the different methods of the Fibonacci retracement tool, we have prepared a Fibonacci retracement cheat sheet for you. But first, let’s go through the key points to using Fibonacci retracements.

Fibonacci Retracement Strategy – Key Points

First and foremost, the Fibonacci retracement tool is a predictive technical analysis indicator that Forex traders use to identify the potential support and resistance areas and help you find key price levels to enter or exit a trade. And, like other technical indicators, the Fibonacci trading tool can be applied to any time frame and any type of Forex chart.

The key Fibonacci retracement levels to keep an eye on are: 23.6%, 38.2%, 50.0%, 61.8%, and 76.4% (not including Fibonacci extensions). These numbers are known as the Fibonacci golden ratio and are used by many traders as a predictive technical indicator in analyzing price action movements in financial markets. Before you can apply Fibonacci levels to your charts, you need to identify swing high and swing low points. A swing high is a candlestick with at least two lower highs on both the left and right of itself. A swing low is a candlestick with at least two higher lows on both the left and right of itself.

Then, you need to draw Fibonacci retracements on your chosen charting software. For downtrends, you’d click on the swing high and drag the cursor to the most recent swing low. For uptrends, you’d click on the swing low and drag the cursor to the most recent swing high.

And that’s it…. well in a nutshell anyway. If you skipped the previous lessons, then I would definitely recommend you read through them.

HowToTrade Fibonacci Retracement Levels Cheat Sheet

To help you memorize all of the above, we have prepared a cheat sheet with everything you need to remember in order to use Fibonacci trading tools and help you along the way.

In our cheat sheet, you can find key Fibonacci ratios that you need to remember, including Fibonacci Retracement Levels and Fibonacci extension levels. We also added the three rules to keep in mind when you identify and draw Fibonacci levels on a price chart. At last, you can also find an example chart showing you how the Fibonacci sequence levels should be drawn.

Well, there ya go!

To sum up, a Fibonacci ratio is a vital trading tool in technical analysis. If you master the skill of identifying and drawing Fibonacci retracements on your trading charts, you can develop a trading strategy with a high percentage of winning trades.

In the next course, you’ll learn about moving averages and how to use these technical analysis tools in your forex trading. Meanwhile, feel free to download our Fibonacci retracement levels cheat sheet by hitting the Download button below.

Download the Fibonacci Levels Cheat Sheet HERE