- Forex currency correlation is a statistical way to measure the relationships between two FX currency pairs.

- Forex correlation coefficient is a way of measuring the level of correlation between FX currencies. It ranges from -1 to 1, with -1 representing no correlation at all and 1 representing complete correlation.

- To trade correlations, traders look for signs to enter a trade by monitoring two currency pairs with a positive or a negative correlation to hedge their position or find trade opportunities during the day when one pair is making a move before the other.

The dynamic of nature, just like financial markets, is that two variables can have a positive or negative correlation from one to the other. The Forex market is not any different. Some currency pairs move in the same direction, while other FX pairs move in the opposite direction.

With time, you’ll be able to spot these Forex correlation pairs naturally. However, at the beginning of your trading journey, you might want to use a Forex correlation cheat sheet. And if you are in the early stage of your trading career, then feel free to download our FX correlation cheat sheet. You can print it or save it anywhere you want.

Table of Contents

Table of Contents

Forex Correlation Cheat Sheet Download

Here’s our correlated Forex pairs list PDF to download for free where we have included the Forex currency correlation table to help you identify currency pair correlation easier.

Forex Correlation Cheat Sheet PDF [Download]

What is Forex Correlation?

Forex currency pairs correlation is a statistical way to measure the relationships between two FX currency pairs. If two currency pairs usually move in the same direction, it means they have a positive correlation. On the other hand, if two currencies move in the opposite direction, then it means they have a negative correlation. Simple as that.

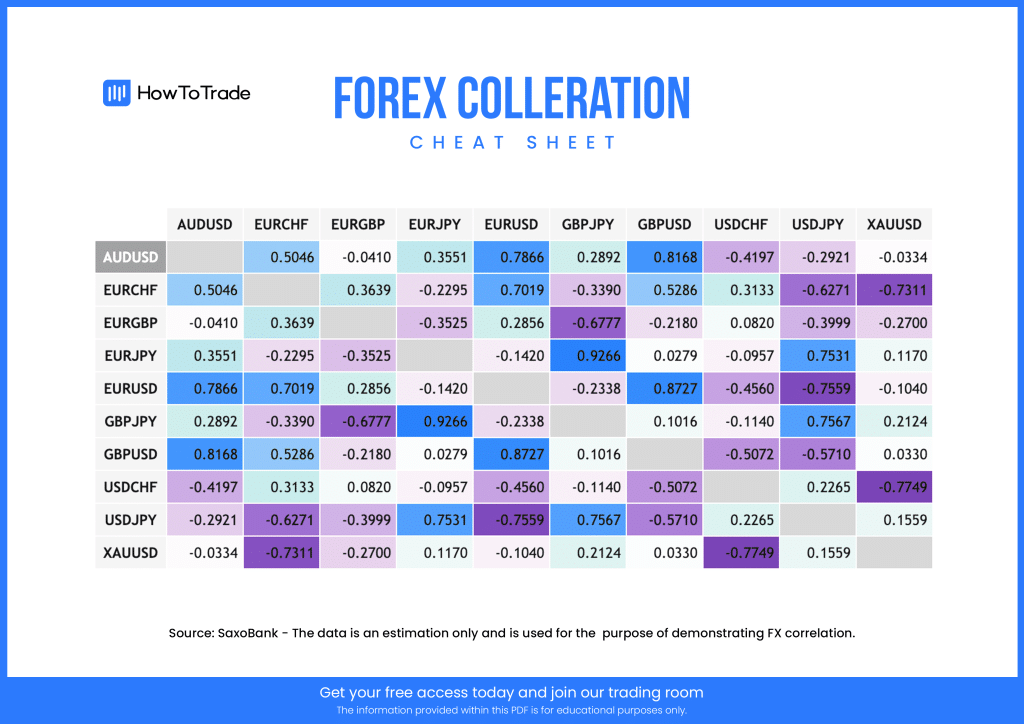

The way of measuring Forex correlation is known as the correlation coefficient. It ranges from -1 to 1, with -1 representing no correlation at all and 1 representing complete correlation. However, you should note that many sites and platforms show FX correlation from -100% to 100%. To get an indication of Forex correlation, many retail traders use a Forex currency correlation table, also known as an FX correlation matrix. It looks like our cheat sheet image above.

Now, in essence, currency pairs are a combination of two national currencies that trade one versus the other. Each currency represents the economic value of a nation. For example, the GBP/USD is the currency pair for the British Pound and the US Dollar. The EUR/USD consists of the Euro and the US Dollar. So, both currency pairs contain the US dollar as the quoted currency.

In the case of GBP versus the EUR – as the Eurozone and the United Kingdom are closely tied to each other economically, there is a high probability that the two currency pairs will move in the same direction, meaning they have a positive correlation. Traders will use the correlations between the two pairs to identify situations when one currency pair lags behind the other.

At the same time, some currency pairs have a negative correlation. For example, the EUR/USD and the USD/CHF are negatively correlated. Therefore, buying or selling the two currency pairs simultaneously will create a hedge. So, let’s assume that you buy the EUR/USD, but to hedge your exposure, you also buy the USD/CHF. Then, not only can you hedge your position, but you can also close your position when you see a small profit. It is, therefore, an excellent strategy for long and short-term trading.

How to Trade Forex Correlation?

Trading forex currency pairs using the correlation strategy is pretty straightforward. Traders who use this strategy usually look for signs to enter a trade by monitoring two currency pairs with a positive or a negative correlation to hedge their position or find trade opportunities during the day when one pair is making a move before the other.

For example, if you know that one currency pair will move in the same direction as another currency pair, then you have a strong indicator to find a trading opportunity. When one forex pair makes a move and the other stays at the same level, traders can enter a position buying the lagging asset.

At the same principle, traders might use a negative asset correlation to use the same method. Typically, the EUR/CHF and the EUR/JPY correlate negatively, which means the two FX pairs move in opposite directions. As such, when you spot a scenario when the two pairs perfectly correlate and move in the same direction, there’s an opportunity to take a trade, assuming that the latest price movement is unlikely to be sustained.

We also suggest you learn more about correlations in financial markets. It will provide a tool and knowledge that will help you analyze the markets with not too much complexity. For example, gold prices tend to correlate negatively with the stock markets. Or, crude oil prices tend to correlate positively with global growth and equity prices.

Examples of Forex Correlations

All currency pairs correlate with each other, negatively or positively, or somewhere in between. Typically, currency pairs with close economic ties have high correlations and vice versa. And, if you know which currency pairs perfectly correlate with others, you can use this knowledge to find successful trades and effectively manage your risk.

So, to understand how FX correlations work, let’s take a closer look at some of the most highly correlated Forex pairs in the foreign exchange market.

NZD/USD and AUD/USD

As expected, these two major currency pairs have a very high correlation. And why not? New Zealand and Australia have very close economic ties and similar economic policies.

According to MyFXbook, the NZD/USD and AUD/USD correlate 92.7% monthly, 96% daily, and 81.5% hourly. So, whenever you notice that one pair is moving before the other, you should stop and analyze both currency pairs. If you can’t notice anything on the news that can explain the uncorrelated movement between the two, there you go, you have a trade.

EUR/USD and GBP/USD

The EUR/USD and GBP/USD are positively correlated Forex pairs as the United Kingdom and the Eurozone have close economic relationships and geographic closeness. The two currency pairs, which are also the most widely traded pairs in the Forex market, have a correlation coefficient of 87%, according to SaxoBank.

EUR/JPY and GBP/JPY

The Japanese yen (JPY) is the third-most traded currency in the FX market after the USD and the Euro. Geographically, Japan is isolated from other parts of the world, and, as a result, other factors impact its economic growth (China, oil prices, weather, etc.). The Euro and the British Pound are the national currencies of the UK and the Eurozone – two areas that are closely linked. So, it is unsurprising that the correlation between the EUR/JPY and GBP/JPY stands at 92.6%!

Other FX currency pairs that positively correlate with the EUR/JPY include the CAD/JPY, USD/JPY, and NZD/JPY.

Over to You

In summary, correlations play a significant role in Forex trading (and other markets like the stock market). Therefore, traders keep their eyes open and monitor these Forex correlation anomalies in the markets to find successful trades. And logically, it usually works.

To start, we suggest you download our Forex correlations cheat sheet. This will help you familiarize yourself with FX currency pairs with the highest and lowest correlations.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.