Low-volume stocks often fly under the radar of mainstream investors but offer unique trading opportunities for those willing to navigate their complexities.

- Low-volume stocks are those with limited trading activity (typically under 10,000 shares daily), leading to reduced liquidity and wider bid-ask spreads.

- These stocks can experience significant price spikes, are highly sensitive to news, and provide opportunities for traders utilizing tools like Level 2 data.

- They pose challenges such as low liquidity, unpredictable price swings, and susceptibility to manipulation, requiring careful planning and patience.

This guide explores the characteristics, rewards, risks, and strategies associated with low-volume stocks, helping you understand whether these assets align with your goals and risk tolerance.

Table of Contents

Table of Contents

What is Considered a Low Volume Stock?

Just from the name, low-volume stocks refer to stocks that consistently have lower trading activities going on when compared to their peers. Generally, stocks that typically trade an average volume of 10,000 shares a day (or less) are referred to as low-volume stocks.

One thing that sets these stocks aside from others is their limited liquidity. Unlike high-volume stocks, low-volume stocks can go through long stretches without any trades occurring. This lack of buying and selling activity often leads to wider bid-ask spreads, making it more challenging for traders to enter or exit positions at favorable prices. At the same, these wider spreads can also work in your favor if you correctly predict the stock’s price movement.

In general, such low-volume stocks are commonly found in specific niches, including smaller companies, emerging industries, or even undervalued segments of well-established sectors. They may represent companies with solid potential or those currently facing challenges, such as financial instability or limited market presence.

Generally, stocks that typically trade an average volume of 10,000 shares a day (or less) are referred to as low-volume stocks.

How to Trade Low-Volume Stocks?

If you’re going to be trading low-volume stocks, you need to get ready to bring on your best game when it comes to careful planning, strategic analysis, and having a lot of patience.

Unlike stocks with high trading volume, trading these assets can either amplify your returns or expose you to substantial risks if not managed correctly. To help you get started, here’s a breakdown of how to trade low-volume stocks effectively:

1. Find Stocks with Low Volume

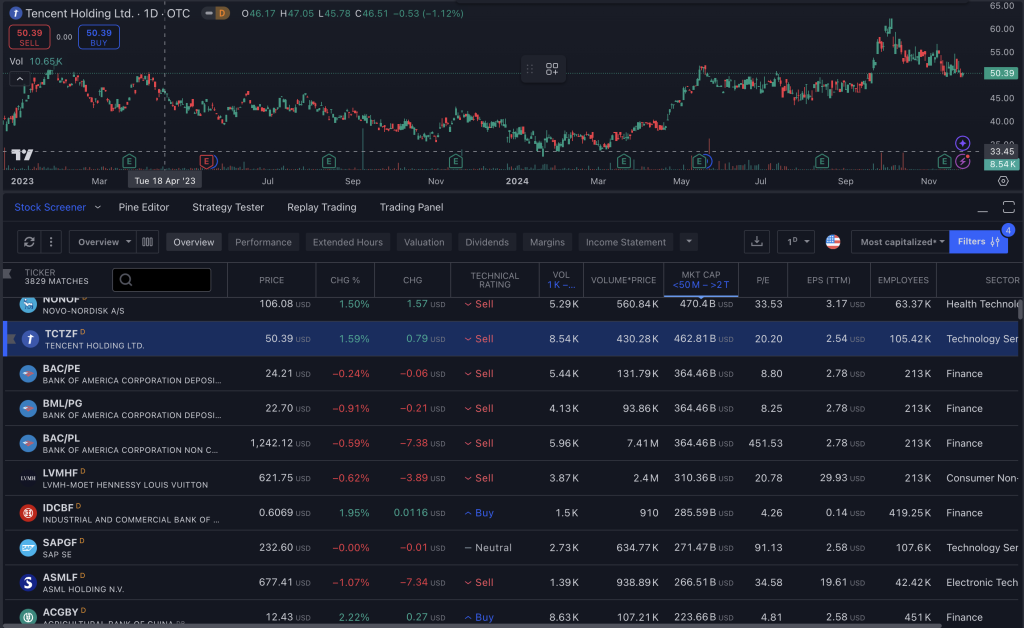

The first step is identifying stocks with low daily average trading volume. While you could manually search through market listings, using screening tools is far more efficient. Many platforms, like Finviz, TradingView, or Yahoo Finance, offer customizable low-volume stock screeners that allow you to filter stocks based on daily volume thresholds. For that purpose, you can set your criteria to highlight stocks trading fewer than 10,000 shares daily.

We recommend that you keep an eye out for stocks that align with your risk tolerance and strategy. As mentioned earlier, some low-volume stocks may be undervalued, while others may represent niche opportunities in emerging sectors. So, you’ll want to stick to what works for you here.

2. Use a Volume Technical Indicator

When it comes to technical analysis, volume indicators are essential tools for timing or adding confluence to your trades. Indicators like the Volume Indicator, Volume Moving Average (VMA), or On-Balance Volume (OBV) can help you spot trends in trading activity.

For instance, a sudden spike in volume could signal an upcoming price move, offering a timely entry point. Conversely, decreasing volume might indicate waning interest in the stock.

Here’s an example:

As you can see, analyzing volume patterns alongside price movements helps you to identify whether an increase or decrease in volume supports a price trend.

3. Use Level 2 Market Data

Level 2 market data is a tool that offers a deeper view of the order book, showing the buy and sell orders at various price levels. This data is crucial for trading low-volume stocks because it helps you understand liquidity and identify optimal entry and exit points.

For example, if the bid-ask spread is unusually wide (a common feature of low-volume stocks), Level 2 data can guide you on how to navigate those gaps strategically. This can be especially useful when planning trades to minimize slippage.

For a deeper dive into using Level 2 data, check out this guide on Level 2 market data and how to use it.

4. Analyze the Company’s Fundamentals

Since low-volume stocks are often tied to smaller or less established companies, a thorough analysis of the company’s fundamentals is essential.

Look into factors like revenue growth, debt levels, market positioning, and recent news. Positive fundamentals can sometimes explain why a low-volume stock might experience sudden demand, leading to potential price spikes.

5. Be Patient

Patience isn’t just a virtue—it’s a necessity when trading low-volume stocks. The wide bid-ask spread often means you’ll need to wait longer for your orders to execute. Impatient traders may end up settling for less favorable prices or missing out on opportunities altogether.

Additionally, price movement in low-volume stocks can be erratic. Rushing into a trade without waiting for confirmation signals, such as volume-backed trends or strong fundamentals, can lead to unnecessary losses. Patience also extends to exiting trades, as finding buyers or sellers to match your order size can take time.

Trading Low-Volume Stocks – Rewards and Risks

At this point, you may be wondering why bother trading stocks with low volumes when you can easily invest your money into better-known, high-volume ones.

Well, that’s a valid thought. But let’s look at it this way: For traders willing to embrace the challenge, these stocks can provide opportunities unavailable in high-volume markets. You can often see a 2 or 3-digit percentage in daily change – something that does not often occur in more established stocks.

However, you also need to remember that stock trading involves risks, and it’s equally important to approach them with caution, as the risks can outweigh the rewards without proper trading strategies in place.

So, let’s take a closer look at some of the rewards of trading low-volume stocks.

Rewards of Trading Low-Volume Stocks

Let’s start with the major reason why traders flock to trading low-volume stocks in the first place: their potential for huge price spikes. Since these stocks are not heavily traded, even a small increase in demand can send their prices soaring. This creates opportunities for traders to capitalize on significant gains within a short timeframe. If you are a pro trader, you should easily understand why these stock price movements can make low-volume stocks a lucrative venture.

Additionally, low-volume stocks are ideal for traders who use tools like Level 2 data, which provides insight into the order book and allows for precision in timing trades. This granular data can help identify potential turning points in price movement, giving skilled traders an edge.

Lastly, another key advantage is their sensitivity to news and earnings reports. Because these stocks often have fewer market participants, any positive announcement—such as strong earnings, a new product launch, or a favorable industry development—can lead to substantial price movement. For traders who stay ahead of the news, this sensitivity can be a powerful edge over the market.

Risks of Trading Low-Volume Stocks

While the rewards can be tempting, the risks associated with low-volume stocks are just as significant. The first and most notable challenge is difficulty in entering and exiting positions. Especially exiting positions.

Essentially, low trading volume means fewer buyers and sellers, which can leave you stuck in a position longer than intended or force you to sell at a less favorable price.

Also, price movements in low-volume stocks can also be highly unpredictable. Because these stocks are thinly traded, a single large transaction or a small shift in sentiment can result in extreme price swings. This volatility makes it challenging to predict trends and increases the likelihood of losses. Ultimately, it can affect your ability to achieve consistency in trading.

Another major concern is price manipulation. With fewer participants, low-volume stocks are more susceptible to being influenced by a single entity or group. Tactics like “pump and dump” schemes, where prices are artificially inflated before being sold off, can trap unsuspecting traders.

Lastly, many low-volume stocks are associated with smaller or struggling companies, increasing the risk of bankruptcy. Investing in such stocks without thoroughly researching the company’s financial health can lead to significant losses, especially in the long term.

Patience isn’t just a virtue—it’s a necessity when trading low-volume stocks. The wide bid-ask spread often means you’ll need to wait longer for your orders to execute. Impatient traders may end up settling for less favorable prices or missing out on opportunities altogether.

Best Low-Volume Stocks/ETFs

Identifying low-risk stocks among low-volume equities requires careful analysis, as the low total trading volume often correlates with higher volatility and potential risks. However, certain low-volume stocks exhibit characteristics that may appeal to risk-averse investors. Here are a few examples of low-volume stocks and Exchange-Traded Funds:

1. Bio-Rad Laboratories (BIO.B)

- Current Price: $330.15

- Market Capitalization: $9.24 billion

- Average Trading Volume: 23 shares

Bio-Rad Laboratories specializes in life science research and clinical diagnostic products, serving diverse markets like biotechnology, healthcare, food safety, and academia. Operating through its Life Science and Clinical Diagnostics segments, the company delivers reagents, instruments, and software that address specific niches in the diagnostics and research markets. Established in 1952, Bio-Rad continues to innovate and expand globally, making it a noteworthy player in the life sciences sector.

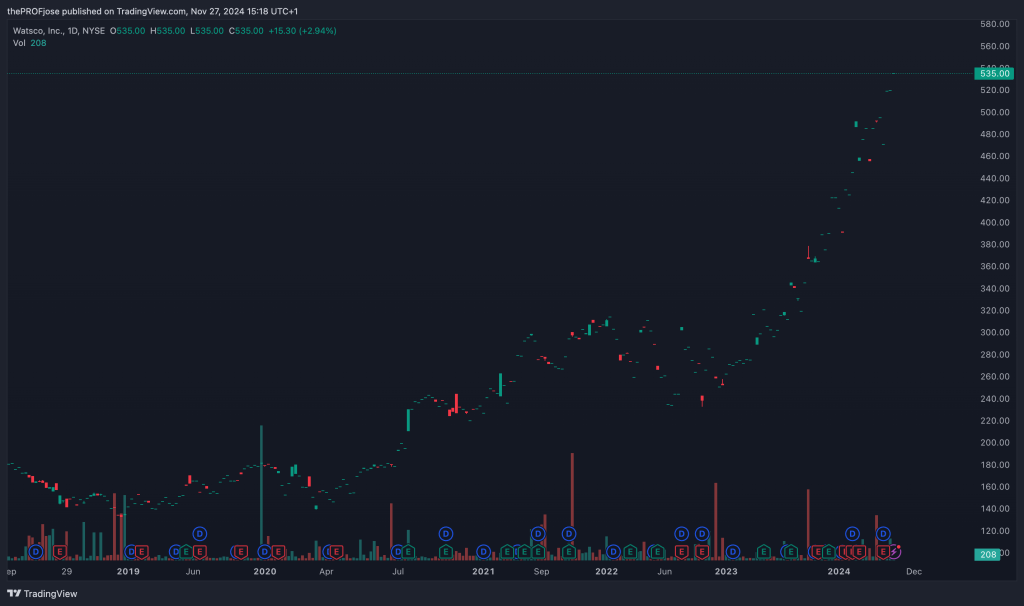

2. Watsco (WSO.B)

- Current Price: $535.00

- Market Capitalization: $21.60 billion

- Average Trading Volume: 116 shares

Watsco, Inc. distributes HVAC (heating, ventilation, and air conditioning) equipment and related supplies across North America, with exports to Latin America and the Caribbean. Its extensive portfolio caters to both residential and light commercial markets, with a focus on replacement and new construction needs. Established in 1945, Watsco’s strong position in the distribution market makes it a reliable stock for long-term investors.

3. Moog (MOG.B)

- Current Price: $214.67

- Market Capitalization: $6.87 billion

- Average Trading Volume: 162 shares

Moog Inc. is a global leader in motion control systems, catering to aerospace, defense, and industrial markets. The company’s expertise spans military and commercial flight controls, space vehicle systems, missile steering, and advanced industrial systems. Founded in 1951, Moog’s innovation-driven portfolio positions it as a key player in high-precision engineering and motion control technology.

4. John Wiley & Sons (WLYB)

- Current Price: $52.90

- Market Capitalization: $2.87 billion

- Average Trading Volume: 176 shares

John Wiley & Sons, a 200-year-old company, specializes in academic research and professional education. It offers journals, books, and digital content across physical sciences, life sciences, and humanities. Its platforms, like Literatum, also serve scholarly societies and publishers. With a focus on education and corporate learning, Wiley is a cornerstone of academic and professional development worldwide.

5. Clover Leaf Capital (CLOE)

- Current Price: $12.50

- Market Capitalization: $62 million

- Average Trading Volume: 179 shares

Clover Leaf Capital Corp. operates as a special purpose acquisition company (SPAC) focusing on the cannabis industry. Although it currently has no significant operations, its mission is to acquire or merge with cannabis-related businesses. Founded in 2021, Clover Leaf offers speculative opportunities for investors aiming to capitalize on the expanding cannabis market.

6. iShares U.S. Industry Rotation Active ETF (INRO)

- Current Price: $28.59

- Market Capitalization: $16.58 million

- Average Trading Volume: 237 shares

INRO is an actively managed ETF that seeks long-term capital appreciation by investing in U.S.-listed companies across various industries. Its low trading volume and market capitalization suggest limited liquidity, which may pose challenges for investors.

7. Simplify U.S. Equity PLUS Downside Convexity ETF (SPCX)

- Current Price: $23.58

- Market Capitalization: $10.61 million

- Average Trading Volume: 1,561 shares

SPCX aims to provide exposure to U.S. equities while incorporating strategies to mitigate downside risk. Its unique approach may appeal to investors seeking growth with a level of protection against market downturns.

8. Invesco S&P SmallCap Consumer Discretionary ETF (PSCD)

- Current Price: $115.86

- Market Capitalization: $27.81 million

- Average Trading Volume: 1,882 shares

PSCD focuses on small-cap U.S. consumer discretionary companies, aiming to track the performance of the S&P SmallCap 600® Capped Consumer Discretionary Index. Its low trading volume indicates limited liquidity, which may affect trade execution.

9. Guru Favorite Stocks ETF (GFGF)

- Current Price: $32.17

- Market Capitalization: $36.03 million

- Average Trading Volume: 1,886 shares

GFGF is an ETF that actively selects U.S.-listed companies favored by prominent long-term investors. Its strategy may appeal to those looking to align with the investment choices of renowned market participants.

10. First Trust RiverFront Dynamic Emerging Markets ETF (RFEM)

- Current Price: $64.31

- Market Capitalization: $28.94 million

- Average Trading Volume: 1,946 shares

RFEM seeks to provide capital appreciation by investing in emerging market equities. Its focus on dynamic allocation strategies may offer growth opportunities in developing markets.

Is It Good or Bad to Trade Low-Volume Stocks?

Deciding whether trading low-volume stocks is good or bad is hard, and it isn’t black or white. It ultimately depends on your trading goals, risk tolerance, and strategy. These stocks present both opportunities and significant challenges. So, while they are suitable for some traders, they can be potentially unsuitable for others.

On the positive side, low-volume stocks can offer exceptional opportunities for profit. Their sensitivity to news and market events often leads to sharp price movements, creating room for traders to capitalize on volatility. For those equipped with the right tools, such as volume stock indicators, Level 2 market data, and the skills to analyze the company’s fundamentals, low-volume stocks can reveal hidden gems that high-volume markets may overlook.

However, investing involves risk, and the risks of trading these stocks should not be underestimated. The lack of liquidity can make entering and exiting positions a frustrating experience, often resulting in less favorable pricing or prolonged holding periods. Without thorough research, a patient approach, and the development of a trading strategy, trading low-volume stocks can easily be a mess.

So, the question of whether trading low-volume stocks is good or bad boils down to preparation. If you’re willing to invest time in understanding these stocks, they can offer unique opportunities to diversify and profit. However, if you prefer more predictable and liquid markets, sticking to high-volume stocks might be the better choice. Like any trading decision, stick to what aligns with your trading goals.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.