The Asian is one of the three prominent forex trading sessions. While most traders focus on other trading sessions due to their relatively high volume of forex transactions, there are a lot of great trading opportunities in the Asian session, especially if you know what currency pairs to trade.

- The best pairs to trade during Asian session are USDJPY, AUDJPY, AUDUSD, NZDUSD, and EURJPY. You can also trade crosses of the JPY, AUD, and NZD.

- During this trading session, you want to pay attention to economic reports from Australia, New Zealand, Japan, and China.

- Because the Asian session is notorious for its range-bound price action, traders often resort to range and breakout strategies.

In this piece, you’ll learn:

- What pairs are best to trade during the Asian session

- The main characteristics of the Asian session that’ll give you deeper insights when trading the session

- Top trading and risk management strategies for trading this session.

Table of Contents

Table of Contents

- When is the Forex Asian Session?

- What are the Major Characteristics of the Asian Session?

- What are the Best Currency Pairs to Trade in the Asian Session?

- What are the Strongest Factors Influencing the Currency Pairs in the Asian Session?

- What are the Top Trading Strategies for the Asian Session?

- What are the Top Risk Management Strategies for Asian Session Trading?

- Case Study: Successful Asian Session Trading Scenario

When is the Forex Asian Session?

The Asian forex session is one of the major trading sessions in the global currency markets, alongside the London and New York sessions. It typically starts at 00:00 GMT (7:00 PM EST) and runs until 09:00 GMT (4:00 AM EST). This session is primarily driven by market activity in the Tokyo financial markets, but it also includes important financial centers such as Sydney, Hong Kong, and Singapore.

What are the Major Characteristics of the Asian Session?

The key to exploiting the Asian trading session for profit is in your understanding of these crucial characteristics:

1. Lower Liquidity

Liquidity in the Asian session is generally lower compared to the London and New York sessions. This is mainly due to fewer global market participants being active during these hours. While major financial hubs like Tokyo, Hong Kong, and Singapore may drive liquidity, the volume remains lower than the European or North American sessions. As a result, you’ll notice that pairs don’t tend to move much during these sessions.

2. Volatility Peaks Around News Releases

News releases are notorious for forcing sharp market movements in the forex market. And if there’s any country’s news releases you want to pay attention to in the Asian session, it’ll be the Japanese.

The Japanese yen (JPY) dominates trading during the Asian session, especially when there are economic releases about GDP, unemployment figures, or interest rate decisions by the Bank of Japan. This makes pairs like USD/JPY, EUR/JPY, and GBP/JPY more volatile during key news announcements

3. Session Overlap with Sydney

Asian pairs aren’t the only ones active during the Asian session. Pairs of currencies from the Australian continent are also active, thanks to the overlap between Tokyo and Sydney trading sessions. Pairs involving the Australian and New Zealand dollars (AUD/USD, NZD/USD, AUD/JPY) tend to show more movement in this overlap as traders react to both Australian and Japanese market conditions.

4. Predictable Range Movements

Due to lower liquidity and fewer market participants, currency pairs tend to trade in tight ranges during the Asian session. This makes it ideal for range traders or those using technical indicators to exploit small price movements. Traders can capitalize on these conditions using scalping or range-bound strategies.

What are the Best Currency Pairs to Trade in the Asian Session?

These are the top forex pairs to trade in the Asian session.

| Pair | Most Active | Liquidity | Influencing Factors | Correlations/Relationships |

| USDJPY | Tokyo Session | High | – Bank of Japan (BOJ) Monetary Policy – US Federal Reserve Policy- Bond Yield Differentials | Nikkei 225 (positive) |

| AUDUSD | Sydney/Tokyo Sessions Overlap | High | – Australian economic data – Commodity price fluctuations – Chinese economic performance and policy decisions | Gold and Iron Ore |

| AUDJPY | Sydney/Tokyo Sessions Overlap | Medium | – Chinese economic data – Commodity price fluctuations – Interest rate differentials between Australia and Japan | ASX200 |

| NZDUSD | Sydney/Tokyo Sessions Overlap | Medium | – New Zealand economic data – Global dairy prices and auctions | Agricultural sector (especially dairy products) |

| EURJPY | Tokyo/London Sessions Overlap | Medium | – ECB monetary policy and Eurozone economic data. – BOJ policy decisions and Japanese economic indicators | Global Stock markets |

1. USDJPY

USD/JPY is the most liquid and actively traded pair during the Asian session. The Japanese yen is heavily influenced by the economic news coming out of Japan and the United States, such as GDP reports, inflation data, and monetary policy decisions from both central banks.

Given Japan’s massive export market and significant role in global trade, its currency tends to move based on trade balances, political shifts, and central bank activity. The interest rate differential between the United States and Japan is another factor that significantly affects the movement of this pair.

Furthermore, the gap between US and Japanese government bond yields often correlates with USD/JPY movements.

During times of global uncertainty when people would rather stay off risky investments, the JPY often appreciates as investors seek a safe-haven currency. This can lead to a decline in the USD/JPY pair. A testament to this is the coronavirus-induced global lockdown in 2020. Notice that the pair trended downwards for the rest of the year.

If you need help analyzing the pair for potential trade opportunies, we do regular USDJPY market analysis every week. Check it out here:

2. AUDUSD

The Australian dollar is susceptible to commodity prices, especially metals like gold and iron ore, which play a significant role in Australia’s export economy. During the Asian session, AUD/USD experiences heightened activity due to Australian economic announcements like employment reports and central bank decisions by the Reserve Bank of Australia.

The major influencing factors of this pair are the Australian employment data and RBA rate decisions. Other influences include GDP and inflation reports. You may also notice some correlation between the trends of this pair and that of gold. This is because the country is a significant exporter of the precious metal.

You can keep yourself updated with our regular gold Market Analysis here:

3. AUDJPY

AUD/JPY combines the dynamics of both the Australian and Japanese economies, making it a favorite for traders looking to capture movements driven by the respective region’s economic releases. The currency pair benefits from commodity-driven flows in Australia and the export-driven Japanese economy.

You’ll notice the most activity on this pair during announcements from the RBA and BOJ. Additionally, since AUD/JPY is considered a carry trade favorite due to Australia’s historically higher interest rates compared to Japan’s low rates, you may expect some volatility when there’s a shift in the interest rate differentials.

Don’t be surprised if you notice the Chinese economic data affecting this pair. This is because China is Australia’s largest trading partner. And if something happens to your biggest trade partner, you’ll likely feel it.

4. NZDUSD

New Zealand’s economy, like Australia’s, is deeply tied to commodities, particularly dairy products and agricultural goods. It’s not as liquid as its Australian counterpart but still boasts a respectable amount of liquidity. NZD/USD is highly responsive to changes in commodity prices, which makes it a favored pair during the Asian session. News from New Zealand, such as trade balances, economic growth reports, and announcements from the Reserve Bank of New Zealand (RBNZ), can move this pair.

The pair is most volatile when economic news related to New Zealand’s dairy industry or trade relations with China, its major trading partner, are released. A good example is the Global Dairy Trade (GDT) auction results. The pair also becomes active during the overlap with the Sydney session.

5. EURJPY

Agreed, the euro is from a different time zone. However, the EUR/JPY still exhibits significant volatility during the Asian session, particularly when there are geopolitical or economic shifts in Europe; even more than the USDJPY sometimes. The yen’s activity in response to Japanese news, coupled with macroeconomic developments in Europe, makes EUR/JPY an attractive pair for traders during quieter periods in the session.

You’ll notice some volatility on this pair during the Asian session when news from Japan overlaps with broader global trends impacting the euro. For instance, policy decisions by the European Central Bank (ECB) or geopolitical developments in the Eurozone can affect this pair, particularly when Japanese markets are also active.

Want to know what pairs to trade during the London and New York sessions? We got you covered:

What are the Strongest Factors Influencing the Currency Pairs in the Asian Session

Here are the strongest factors that influence the top forex pairs during the Asian session:

1. Economic News Releases

The Japanese yen (JPY) is heavily influenced by economic data releases such as GDP figures, unemployment rates, inflation reports, and industrial production data. The Bank of Japan’s (BOJ) decisions on monetary policy also create volatility, particularly in pairs like USD/JPY and EUR/JPY. BOJ announcements on interest rates or quantitative easing measures can lead to rapid movements in these pairs

Economic reports from Australia and New Zealand are critical for pairs like AUD/USD, AUD/JPY, and NZD/USD. Key indicators include employment reports, trade balances, and commodity price shifts. The Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) also play significant roles, with interest rate changes or policy guidance influencing market sentiment.

Although China’s yuan (CNY) is not directly traded in many forex pairs, China’s economy significantly impacts AUD/USD and NZD/USD because of their close trade ties. Chinese economic reports, especially around manufacturing, GDP growth, and trade data, can influence the direction of these pairs during the Asian session.

2. Commodity Prices

Both Australia and New Zealand are major commodity-exporting nations, with Australia focusing on metals like iron ore and gold. At the same time, New Zealand is a key exporter of dairy and agricultural products. Any fluctuations in commodity prices, particularly for gold, iron ore, or oil, directly affect the value of these currencies. Rising commodity prices generally strengthen the AUD and NZD, while declining prices can weaken them.

Changes in global demand or supply shocks (e.g., trade disputes, natural disasters, or sanctions) can affect commodity prices. For instance, trade tensions between China and other countries may affect Australia’s economy and, thus, the AUD/USD pair.

3. Interest Rate Differentials

Interest rate differentials play a massive role in the Asian session, especially for cross pairs like AUD/JPY and GBP/JPY. Countries with higher interest rates tend to attract capital flows as traders engage in carry trades (borrowing in low-interest currencies like JPY to invest in higher-yielding currencies like AUD or GBP). Changes in interest rate policies from the BOJ, RBA, or Bank of England (BoE) influence these flows, often leading to substantial shifts in foreign exchange trading prices during the Asian session.

Statements from central banks, especially those that involve interest rate guidance or inflation targeting, can have a pronounced impact on currency pairs. For example, when the BOJ maintains or changes its ultra-low interest rate policy, it often moves the JPY, while announcements from the RBA and RBNZ can drive the AUD and NZD, respectively.

4. Global Risk Sentiment

The Japanese yen is often considered a “safe-haven” currency, which means it tends to appreciate during global uncertainty or economic stress. If there is global risk aversion, such as during geopolitical crises or economic downturns, traders tend to move capital into JPY pairs like USD/JPY or EUR/JPY, leading to JPY strength.

Conversely, the AUD and NZD are considered “risk-on” currencies because they are tied to global growth and the demand for commodities. When risk sentiment is positive (risk-on), traders tend to buy AUD and NZD as they expect higher returns from these currencies. However, during risk aversion (risk-off) times, capital flows out of these pairs and into safer assets like JPY.

5. Geopolitical Events

Political and trade developments in the Asia-Pacific region can affect the performance of the AUD, NZD, and JPY. For instance, tensions between China and the U.S. or new trade agreements between Asia-Pacific nations can alter currency flows. Japan, being a major economic power in Asia, often sees its currency affected by regional geopolitical shifts.

Since Japan, Australia, and New Zealand are heavily involved in global trade, disruptions caused by trade wars, tariffs, or sanctions can affect their currencies. For instance, AUD and NZD often respond to news about China’s trade relations, given that China is a major trading partner for both countries.

6. Market Sentiment and Speculation

During the Asian session, speculative trading is often more prominent due to fewer global market participants, which can create exaggerated price moves. Pairs like USD/JPY and AUD/JPY usually experience sudden bursts of volatility as traders react to news or key levels, particularly in lower-liquidity markets.

Support and resistance levels are crucial in determining market sentiment during the Asian session, especially with pairs like AUD/JPY or USD/JPY, where technical indicators can influence short-term price movements. During these quieter hours, traders may rely heavily on chart patterns, Fibonacci retracements, or pivot points.

What are the Top Trading Strategies for the Asian Session?

Trading during the Asian session requires strategies that align with the session’s unique characteristics, such as lower liquidity, tighter ranges, and sudden bursts of volatility around news events. Let’s explore key trading strategies that can be effectively used during this session:

1. Range Trading

The Asian session is known for lower liquidity compared to the London and New York sessions. This often results in currencies trading within a well-defined range. Range trading works particularly well during this session because price movements tend to be more contained, with fewer large breakouts.

To capitalize on such trades, identify established support and resistance levels during the session on the 1-hour or 4-hour charts. You can also use oscillators, such as the RSI and the Stochastic, to see if the price is overbought or oversold. And when the price is overbought and approaching a resistance level, you can expect a reversal to the downside. Conversely, you can expect a bullish reversal when the price is oversold and at a support.

Pairs like the USD/JPY, AUD/USD, and EUR/JPY tend to respond well to this strategy.

2. Breakout Trading

While the Asian session is typically quieter, volatility can spike around economic news releases, particularly from Japan, Australia, and New Zealand. Breakout strategies aim to capture these sudden moves when the price breaks out of established ranges. Breakouts tend to occur when markets absorb new information, like central bank decisions or major economic data.

To trade this, identify key support and resistance levels that the price has been testing repeatedly. Use indicators like Bollinger Bands to confirm that volatility is tightening before an anticipated breakout. Finally, set pending buy and sell orders just above resistance and below support to automatically enter a trade if the price breaks out.

The USD/JPY and the AUD/JPY tend to be responsive to such a strategy.

4. News Trading

Economic news releases from Japan, Australia, and New Zealand often have a pronounced effect on forex prices during the Asian session. News trading aims to capitalize on the immediate volatility following these releases, such as employment data, GDP figures, or central bank announcements.

To be sure you don’t miss out on any opportunity that may arise from a news release, stay updated on the economic calendar. You can then trade the breakout of price levels immediately after the news, as prices tend to move swiftly in the direction of the data surprise.

Be cautious of whipsaw movements, though. And only trade when the market’s reaction is apparent, especially for data like interest rate decisions or inflation reports.

You may try this on pairs like the USD/JPY, AUD/USD, AUD/JPY, and NZD/USD.

5. Carry Trade

A carry trade involves borrowing in a low-interest currency (e.g., JPY) to invest in a higher-yielding currency (e.g., AUD). This strategy works well in low-volatility conditions, like those often seen in the Asian session, as it capitalizes on interest rate differentials.

To trade this, identify pairs with significant interest rate differentials, such as AUD/JPY or NZD/JPY. Open a long position in the higher-yielding currency (e.g., AUD) and a short position in the low-yielding currency (e.g., JPY). Hold the trade to accumulate interest over time while taking advantage of steady price appreciation.

What are the Top Risk Management Strategies for Asian Session Trading?

Risk management during the Asian session is crucial due to its unique market dynamics, including lower liquidity, narrower ranges, and sudden price spikes around key economic releases. Here’s a detailed guide on how to effectively manage risk during the Asian session:

1. Adjust Position Size for Low Liquidity

The Asian session typically has lower trading volumes than the London or New York sessions, which can lead to more erratic price movements due to thinner order books. Large orders can cause significant price fluctuations, so traders should adjust their position sizes accordingly.

We recommend that you reduce position sizes to manage risk in thin markets. Lower liquidity can amplify losses if the price moves sharply against a position. Smaller trades allow greater flexibility in managing positions and limit the risk of excessive drawdowns.

2. Use Tighter Stop-Losses

The tighter trading ranges in the Asian session make it essential to use appropriate stop-loss levels. During times of low volatility, placing a wide stop-loss can lead to unnecessary exposure, as prices tend to oscillate within smaller ranges. However, sudden volatility spikes (e.g., from economic news releases) could still cause sharp moves.

So, set stop-loss orders just outside key support or resistance levels identified in your trading plan. For range-bound markets, stops should be placed just beyond the upper and lower boundaries of the range. This ensures the position is closed if the market moves in an unexpected direction while also allowing flexibility to capture profits within the typical price action of the Asian

3. Be Cautious Around News Events

Economic reports from Japan, Australia, and New Zealand, as well as central bank announcements (e.g., the Bank of Japan or the Reserve Bank of Australia), can create sharp price movements during the Asian session. These events are often the primary drivers of volatility during this session.

Before trading, check the economic calendar to avoid taking positions ahead of major news releases unless you are specifically trading news. Consider reducing exposure before high-impact events to avoid getting caught in sudden, unpredictable moves. If trading the news, use wider stops and be prepared for increased volatility

4. Consider Currency Correlations

Some currency pairs are more correlated than others, which means that holding multiple positions in highly correlated pairs (e.g., AUD/JPY and NZD/JPY) can increase risk exposure. Movements in one currency can affect others, leading to unintended cumulative risk.

To tackle this, monitor the correlations between currency pairs and adjust positions accordingly. If you hold positions in two or more correlated pairs, consider reducing position sizes or choosing one pair to trade to minimize risk exposure. Traders can also hedge positions by trading pairs with negative correlations.

Case Study: Successful Asian Session Trading Scenario

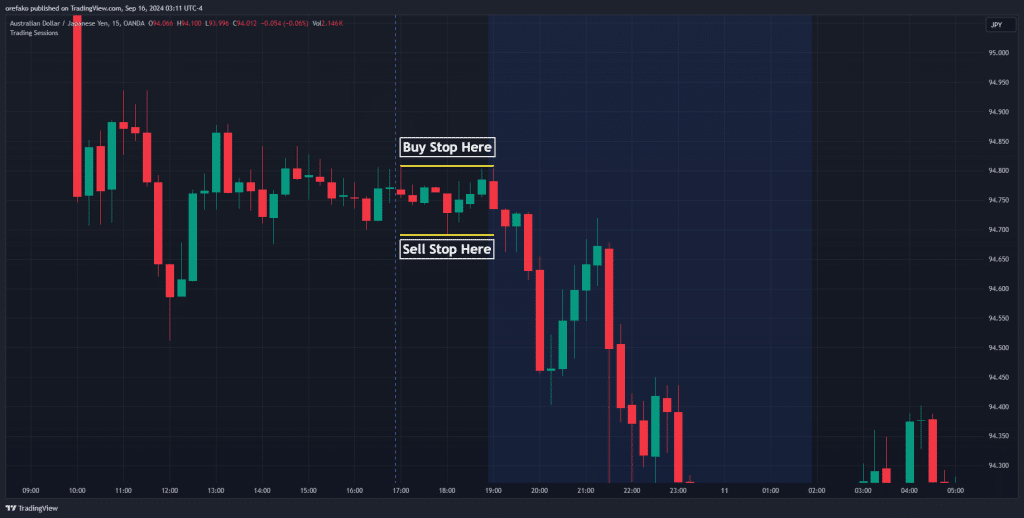

The overlap between the Sydney session, which begins at 5 PM ET, and the Tokyo session, which starts at 7 PM ET, is crucial for these pairs. If you open any of the Asian session pairs we mentioned earlier, you’ll notice a pattern: Some form of low volatility from the beginning of the Sydney session until the Tokyo session starts. And almost immediately, volatility returns.

This often presents opportunities for the breakout trading strategy, just like in the AUDJPY example from the 10th of September in our chart below.

See how the price was practically locked up in a range from the beginning of the Sydney session until 7 PM, when the Tokyo session opens. Almost immediately, we get more volatility. What you could have done to take advantage of this breakout was to place buy and sell stop orders on either side of the range. This way, your trade gets triggered as soon as the breakout occurs.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.