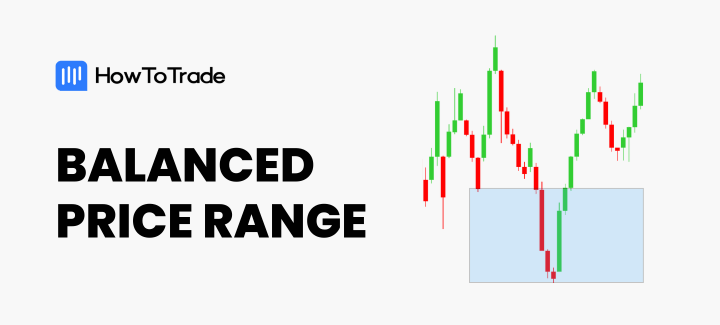

- A BPR is a market condition where the price moves rapidly up and down, creating an overlap between two “fair value gaps.” This overlap signifies areas of high interest for traders.

- The sensitivity of BPRs to price movements makes them vital for predicting market reactions. They are significant points where the price often retests, attracting smart money traders and influencing market direction.

- To identify a BPR, mark the fair value gaps on both the buy and sell sides of the price and find the overlapping area. This area indicates the balanced price range.

To be a successful trader, you need to know what patterns provide accurate trade signals. Balanced Price Range (BPR) is one of these critical concepts that can aid your understanding of the market and help you find trade opportunities.

In this article, we will understand what a balanced price range is, why it is important, and help you to identify its presence on the price chart. Digging deeper into the details of BPRs will equip you to make measured and tactical trading decisions.

Table of Contents

Table of Contents

What is the Balanced Price Range (BPR) in Trading?

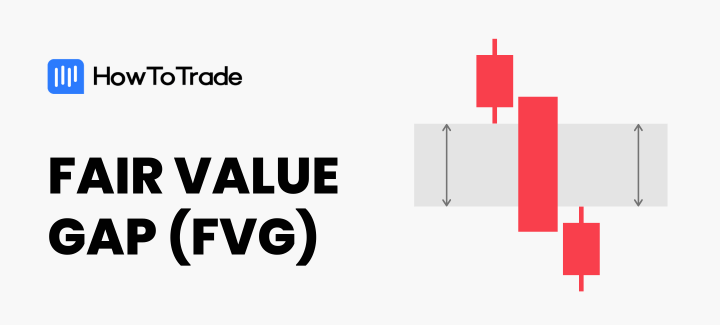

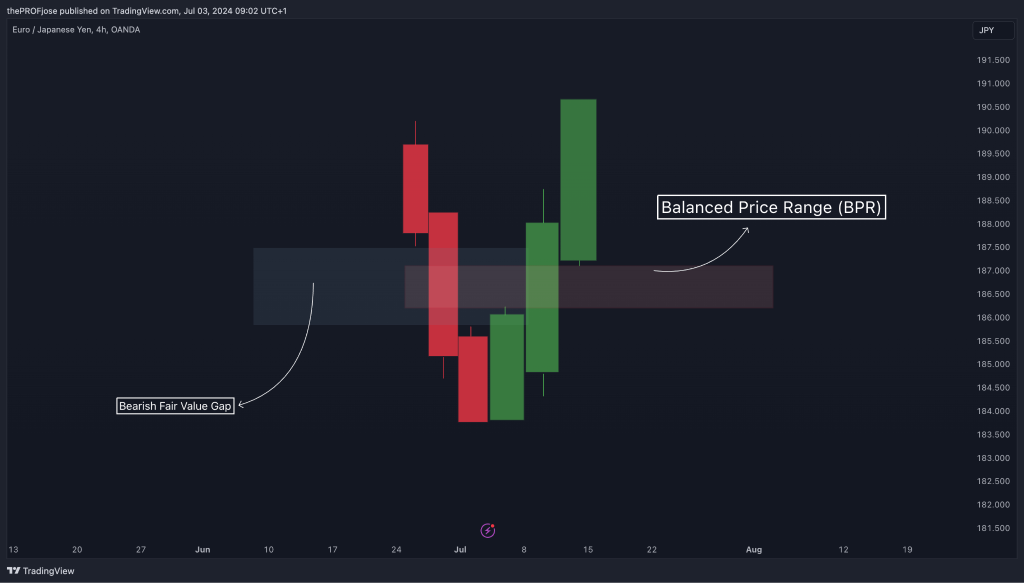

A balanced price range (BPR) in trading refers to a specific market condition where the price exhibits a quick upward movement followed by an equally rapid downward movement or vice versa. This pattern, among the key concepts of the ICT trading methodology, creates an overlap between two fair value gaps (FVGs), as you can see in the chart below.

These gaps represent areas where the price moved quickly, leaving behind a space in price action where few trades occurred. When the price revisits these areas, it often reacts strongly, making the BPR a crucial point of interest for traders.

Normally, the price fills the gap before moving in the same direction as the last price movement. For instance, in the example above, the price can decline to fill the bearish fair value gap and then rise again to break the highest BPR price level.

Why is a Balanced Price Range Important?

The importance of the ICT balanced price range lies in its sensitivity to price movements. When the market approaches a BPR, it often results in a quick and significant price reaction.

This is due to the presence of two fair value gaps, which attract the attention of smart money traders—those with significant capital who can influence market direction. As an integral part of the Inner Circle Trader (ICT) methodology, these traders see the BPR as an optimal trade entry, leading to substantial market movements.

Balanced price ranges are essential for several reasons:

- Market Retests: Before continuing a major movement, the market frequently retests the BPR. This retest is a critical moment for traders to identify potential entry and exit points.

- Price Sensitivity: The sensitivity of the BPR to price makes it a reliable indicator for predicting market reactions. Traders can anticipate strong moves when the price approaches these ranges.

- Smart Money Interest: The combination of two fair value gaps in the BPR makes it an attractive area for smart money traders. Their actions at these points can significantly impact market direction.

A balanced price range (BPR) in trading refers to a specific market condition where the price exhibits a quick upward movement followed by an equally rapid downward movement or vice versa. This pattern creates an overlap between two “fair value gaps” (FVGs).

How to Identify a Balanced Price Range on a Price Chart?

Identifying a balanced price range on a price chart involves a few key steps. The process revolves around recognizing fair value gaps on both the buy and sell sides of the price. These gaps represent areas where the price has moved swiftly, leaving a gap in trading activity. Here are two key steps you must take into consideration to identify a BPR on a price chart:

- Marking Fair Value Gaps: Begin by identifying a fair value gap on the sell side of the price. This gap appears when the price drops quickly, leaving a space between the closing price of one candle and the opening price of the next. Next, find a fair value gap on the buy side of the price, where the price rises rapidly, creating a similar gap.

- Finding the Overlap: Once you have marked both fair value gaps, look for the area where these gaps overlap horizontally. This overlapping zone is known as the balanced price range, and it potentially can be an area of market structure shifts. It is the region where the buy and sell gaps coincide, indicating a balance between supply and demand at that price level.

Same as any other chart pattern, the BPR has two versions – bullish and bearish:

Bullish ICT Balanced Price Range

A bullish ICT balanced price range is identified on the buy side of the price and is used by traders to initiate buy trades. Here’s how to trade a bullish BPR:

- Bullish Market Structure: Look for a bullish market structure shift, indicating that the overall trend is upward.

- Bullish Fair Value Gap in Discount Zone: Find a bullish fair value gap in the discount zone, which overlaps with a bearish fair value gap.

- Mark the Overlapping Area: Mark the overlapping area as the bullish balanced price range.

- Executing the Trade: Wait for the price to test this area before executing a buy trade. Alternatively, you can set a buy limit order with a stop loss below the recent swing low and aim for a profit target based on higher time frame liquidity.

Bearish ICT Balanced Price Range

A bearish ICT balanced price range is identified on the sell side of the price and is used by traders to initiate sell trades. Here’s how to trade a bearish BPR:

- Bearish Market Structure: Look for a bearish market structure shift, indicating that the overall trend is downward.

- Bearish Fair Value Gap in Discount Zone: Find a bearish fair value gap in the discount zone that overlaps with a bullish fair value gap.

- Mark the Overlapping Area: Mark the overlapping area as the bearish balanced price range.

- Executing the Trade: Wait for the price to test this area before executing a sell trade. Alternatively, you can set a sell limit order with a stop loss above the recent swing high and aim for a profit target based on higher time frame liquidity.

How to Add the Balanced Priced Range Indicator to a Trading Platform (TradingView and MT4)

Adding the BPR indicator to your trading platform can streamline the process of identifying these crucial price ranges. Note, however, that the PBR is not an indicator, per se; however, some of the leading platforms enable you to use third-party services that develop a balanced price range indicator.

Here, we will discuss how to add the BPR indicator to two popular trading platforms: TradingView and MT4.

How to Add the BPR Indicator to TradingView

Adding the BPR indicator to a TradingView chart is pretty straightforward. Once your chart is all set, navigate to the indicators at the top of your screen. Then, search for the balanced price range from tradeforopp. Add the indicator, and you’ll be able to automatically get BPR signals.

How to Add the BPR Indicator to MT4

Adding the BPR indicator to MT4/5 is not as easy as adding it to TradingView. This is because the BPR indicator is not built-in, and as such, you must download the indicator from a third-party provider and install it to your MT4/5. For more information, you can visit our guide on how to download and install custom indicators for MetaTrader 4 and 5.

Once you have downloaded a custom BPR indicator, you need to copy the file to the ‘Indicators’ folder in your MT4 directory. Then, restart MT4 to load the new indicator. Then, drag and drop the BPR indicator onto your chart and configure the settings according to your preferences.

Wrapping Up

In sum, the balanced price range is one of the most important ICT concepts. The formation of a double fair value gap, which is created by two displacements that move in opposite directions in a fairly short period, can provide accurate trade signals.

Yet, to correctly use BPRs, you must learn how to use other smart money concepts and know how to utilize the SMC trading strategy.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.