Key Points

- PMI’s to show contracting Europe?

- The US economy is resilient.

- Dollar breaks higher.

- EURUSD turning weaker.

PMI’s To Show Contracting Europe?

Last week, EURUSD paused after three consecutive weeks of gains and has since started this week on the back foot. Today’s Purchasing Managers Index (PMI) data is set to show a concerning contraction in the European manufacturing sector. However, the services sector could once again save the euro if the figure continues to show solid expansion.

There is also PMI data out in the US today, and the figures look a little brighter. The manufacturing sector has shown expansion in the last two months after figures above 50 have been recorded. As for the PMI services, the figure is currently around 55, and another strong print could fuel the current dollar rally.

The US Economy Is Resilient

The US economy has remained relatively stable despite the fastest interest rate hiking cycle in four decades. Tomorrow, traders will gain access to the latest Gross Domestic Product (GDP) figures, which will show the latest annualized economic growth in the US. The bar has been set high, with a figure of 2.0% growth expected, beating last month’s reading of 1.4% by a considerable margin.

If the figure disappoints, the current dollar rally could be temporarily halted. However, if the figure can live up to expectations, expect the dollar rally to be extended. This is a crucial time as interest rates are taking their toll.

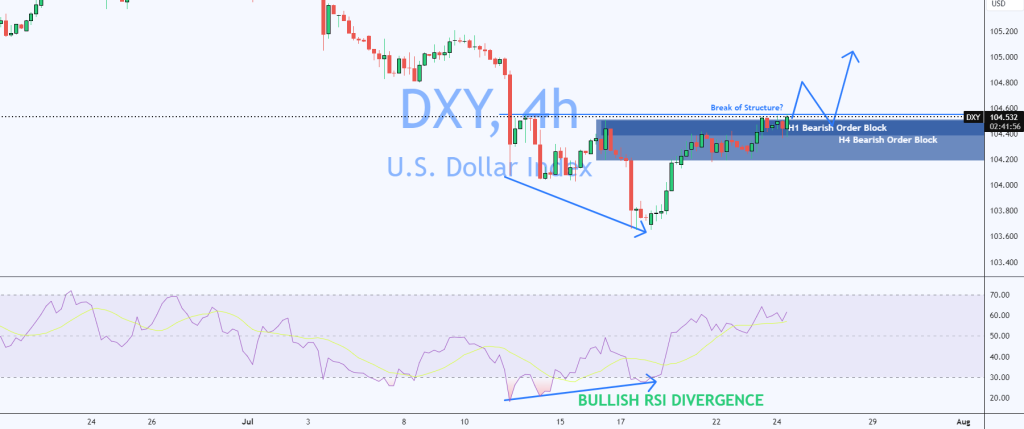

DXY Breaks Higher

In Monday’s article, it was hinted that the Dollar Index (DXY) was showing signs of turning bullish. This is despite being in a bearish trend since the beginning of July. Since then, the signs have grown stronger.

The price now trades above 104.500 and, more importantly, has breached the bearish order blocks on the H1 and H4 timeframe. With the added confluence of the bullish RSI divergence, we could now see the dollar make a move up to 105.000 if the data comes in as expected.

EURUSD Turning Weaker

The price of EURUSD currently trades at 1.08300, and it is probable to test 1.08000. This pair has started the week on the back foot, but the data coming out towards the end of the week will be vital in determining whether the weakness extends.

As per the Lux Algo Smart Money Concept Indicator, there has been a “Change of Character” on the H4 timeframe. However, four potential support areas (order blocks) highlighted by the blue boxes are where traders may want to buy. However, should the current support area break, then traders may just use the rest of them as target areas to scale out of shorts.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.