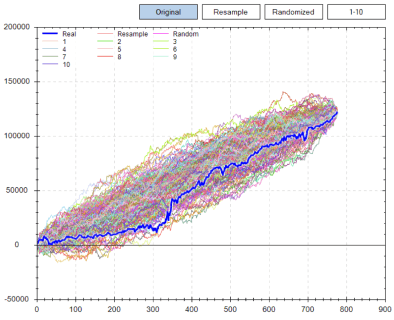

Profit from the power of random numbers. Project your future returns with our cutting-edge Monte Carlo Simulator.

The Monte Carlo Method is an automated technique that is used to project a trader’s different profit & loss outcomes. Through running Monte Carlo Simulations, individuals can estimate the efficacy of their trading strategies.

Our Monte Carlo tool is designed to help you accurately measure the variance of your profit & loss. Simply input strategic variables such as initial balance, risk percentage, risk vs reward ratio, win percentage, and a number of trades — the Monte Carlo Simulator does the rest!

* The Monte Carlo Simulator is an educational tool intended for risk analysis. It should not be viewed as investment advice.

The Monte Carlo Simulation method relies on the Law of Large Numbers and your past trading results to project future performance. How? Monte Carlo methods analyze risk by extensively modeling possible outcomes using random values in place of strategic variables. When complete, we are given a probability distribution for any variable that may impact our strategy’s efficacy.

Think of the old coin flip analogy, one side of the coin heads and the other side tails. If you flip a coin ten times, the distribution can range from 10:0 heads/tails to 10:0 tails heads. However, if you flip the coin a million times, the split is more likely to be near 50/50 heads/tails.

Think of each trade as a coin flip. If you take 10 trades, your returns can vary wildly. But over time, a true strategic expectation will emerge. Monte Carlo integration uses repeated random sampling and data analysis to establish these tangible performance patterns.

A Monte Carlo Simulation is much more than a profitability matrix. It is a window to a strategy’s real-world performance.

Probability distributions for critical items such as maximum drawdowns, risk of ruin, annual rates of return, and return/drawdown ratios are automatically calculated.

During WWII, John von Neumann and Stanislaw Ulam invented the process to streamline stressed decision-making. They named their system “Monte Carlo” after the famous gambling town in Monaco.

A Monte Carlo simulation executes a study based on filling in random values for input variables. In this way, a Monte Carlo simulation is a form of sensitivity analysis.

A multiple probability simulation is a statistical process that quantifies the chances of various outcomes based on repeated random sampling. When you input variables into our Monte Carlo Simulator, you are conducting a multiple probability simulation!