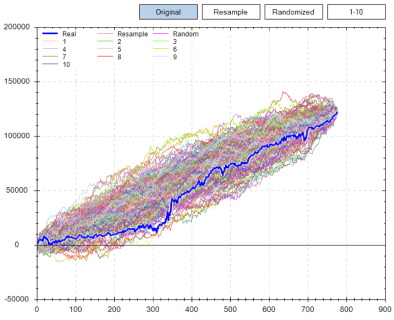

Profit from the power of random numbers. Project your future returns with our cutting-edge Monte Carlo Simulator.

The Monte Carlo Method is an automated technique that is used to project a trader’s different profit & loss outcomes. Through running Monte Carlo Simulations, individuals can estimate the efficacy of their trading strategies.

Our Monte Carlo tool is designed to help you accurately measure the variance of your profit & loss. Simply input strategic variables such as initial balance, risk percentage, risk vs reward ratio, win percentage, and a number of trades — the Monte Carlo Simulator does the rest!

* The Monte Carlo Simulator is an educational tool intended for risk analysis. It should not be viewed as investment advice.

The Monte Carlo Simulation method relies on the Law of Large Numbers and your past trading results to project future performance. How? Monte Carlo methods analyze risk by extensively modeling possible outcomes using random values in place of strategic variables. When complete, we are given a probability distribution for any variable that may impact our strategy’s efficacy.

Think of the old coin flip analogy, one side of the coin heads and the other side tails. If you flip a coin ten times, the distribution can range from 10:0 heads/tails to 10:0 tails heads. However, if you flip the coin a million times, the split is more likely to be near 50/50 heads/tails.

Think of each trade as a coin flip. If you take 10 trades, your returns can vary wildly. But over time, a true strategic expectation will emerge. Monte Carlo integration uses repeated random sampling and data analysis to establish these tangible performance patterns.

A Monte Carlo Simulation is much more than a profitability matrix. It is a window to a strategy’s real-world performance.

Probability distributions for critical items such as maximum drawdowns, risk of ruin, annual rates of return, and return/drawdown ratios are automatically calculated.

Harness our tools and analysis to make informed trading decisions.

You can use our Forex Compound Calculator and simulate the profits you might earn on your Forex trading account.

Use calculator

Our economic calendar showcases relevant events to help you trade these markets too.

View calendar

Our Forex heat map includes real-time data and can help you determine the strongest and the weakest currencies on the Forex market right at this moment.

Use heatmap

Use our Value at Risk Calculator to estimate potential losses. This tool can help you make more informed investment decisions and ultimately help protect your hard-earned money.

Use calculator

Use our simple yet powerful Forex Lot Size Calculator to calculate the exact position size for each trade and manage your risk per trade like a pro.

Use calculator

With our free Forex Profit Calculator, you can calculate your profits and losses before or after executing a trade so you'll know exactly how much profit or loss you can expect.

Use calculator

This free interactive currency strength meter is going to show you which currency pairs are strong and weak, in real-time.

Use this tool

Calculate the swap fee you will be charged on your trading account for holding your positions overnight based on the instrument you are trading, your account currency, and trade size.

Use calculator

Monte Carlo Simulation is a computer simulation technique used to estimate the possible outcomes of your trades and estimate your trading strategies' viability.

Use this tool

Calculate the pip value in the currency you want to trade in and manage your risk per trade like a pro. No more difficult calculations, just a smooth trading experience.

Use calculator

You can use our Forex Compound Calculator and simulate the profits you might earn on your Forex trading account.

Use calculator

Our economic calendar showcases relevant events to help you trade these markets too.

View calendar

Our Forex heat map includes real-time data and can help you determine the strongest and the weakest currencies on the Forex market right at this moment.

Use heatmap

Use our Value at Risk Calculator to estimate potential losses. This tool can help you make more informed investment decisions and ultimately help protect your hard-earned money.

Use calculator

Use our simple yet powerful Forex Lot Size Calculator to calculate the exact position size for each trade and manage your risk per trade like a pro.

Use calculator

With our free Forex Profit Calculator, you can calculate your profits and losses before or after executing a trade so you'll know exactly how much profit or loss you can expect.

Use calculator

This free interactive currency strength meter is going to show you which currency pairs are strong and weak, in real-time.

Use this tool

Calculate the swap fee you will be charged on your trading account for holding your positions overnight based on the instrument you are trading, your account currency, and trade size.

Use calculator

Monte Carlo Simulation is a computer simulation technique used to estimate the possible outcomes of your trades and estimate your trading strategies' viability.

Use this tool

Calculate the pip value in the currency you want to trade in and manage your risk per trade like a pro. No more difficult calculations, just a smooth trading experience.

Use calculatorDuring WWII, John von Neumann and Stanislaw Ulam invented the process to streamline stressed decision-making. They named their system “Monte Carlo” after the famous gambling town in Monaco.

A Monte Carlo simulation executes a study based on filling in random values for input variables. In this way, a Monte Carlo simulation is a form of sensitivity analysis.

A multiple probability simulation is a statistical process that quantifies the chances of various outcomes based on repeated random sampling. When you input variables into our Monte Carlo Simulator, you are conducting a multiple probability simulation!

Great, you've been entered into our monthly prize draw. We'll notify you if you've won.

Thank you for downloading our trading plan!

Thank you, you’re all set!

Login

Welcome back to HowToTrade

Or register using

Reset your password

Type your email and we'll send you a reset link

Done!

A password reset has been requested for . Check your email for your reset link.

Disclaimer: The information on the HowToTrade.com website and inside our Trading Academy platform is intended for educational purposes and is not to be construed as investment advice. Trading the financial markets carries a high level of risk and may not be suitable for all investors. Before trading, you should carefully consider your investment objectives, experience, and risk appetite. Only trade with money you are prepared to lose. Like any investment, there is a possibility that you could sustain losses of some or all of your investment whilst trading. You should seek independent advice before trading if you have any doubts. Past performance in the markets is not a reliable indicator of future performance.

HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Academy. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

The HowToTrade.com website uses cookies in order to provide you with the best experience. By visiting our website with your browser set to allow cookies, or by accepting our Cookie Policy notification you consent to our Privacy Policy, which details our Cookie Policy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Subscribe to our email newsletter below to be reminded then the next live stream begins.

Welcome Aboard!

Get ready to receive cutting-edge analysis, top-notch education, and actionable tips straight to your inbox.