- News trading strategy is about making trading decisions based on big economic news releases.

- Some of the key economic events include the NFP, CPI, interest rade decisions, GDP, employment data, companies’ earnings, and political news.

- Traders who utilize the news trading strategy can trade before, during, or after a major news release.

Generally, traders have varying opinions on trading the news. While some see it as a form of gambling, others only trade the news releases. In fact, there’s another class of technical analysts who use the news to interpret what price action is doing, sitting in the sweet spot between technical analysis and fundamental analysis.

Either way, after reading this article, we hope to help you understand this latter part. So, before we get into it, here’s a sneak peek into what you’ll learn in this article:

- What is the News Trading Strategy?

- Key News and Economic Events to Follow

- How to Trade the News

- Top News Feed Services for Trading

- How to Get a News Feed in MetaTrader 4/5

Table of Contents

Table of Contents

What is the News Trading Strategy?

The news trading strategy is all about making trading decisions based on big economic news releases and how the market reacts. Essentially, when major news drops, the market tends to go a little crazy, and this creates opportunities for traders who know how to play it right.

Contrary to what many trading influencers say, trading news releases can be highly profitable, but you’ve got to understand market expectations and some other things that we’ll cover later in this article.

For now, the basic idea here is that when news hits the headlines, the market moves. Sometimes, it moves a lot!

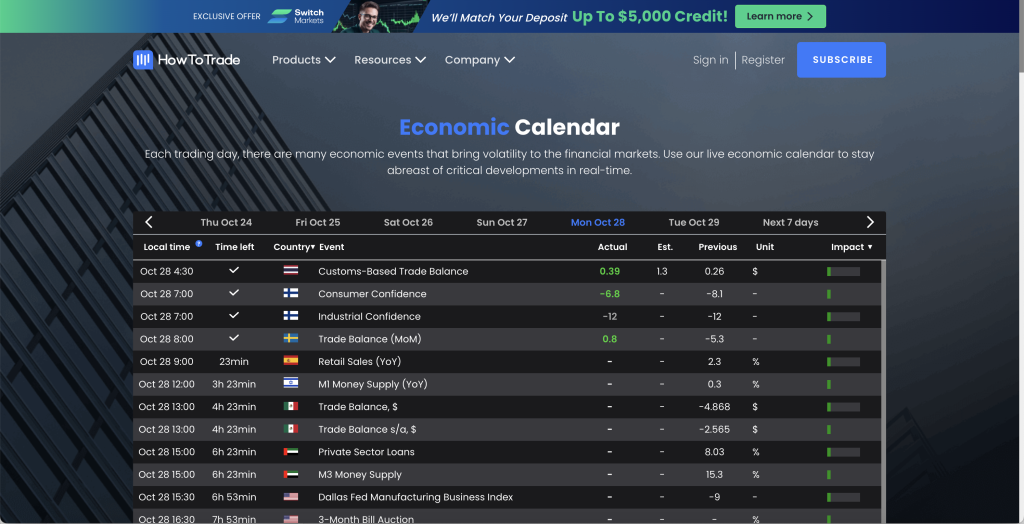

If you want to be successful with news trading, you need to understand what the market was expecting before it came out and how that expectation will influence market behavior. You’ll also need to learn how to use an economic calendar.

In general, when news comes out that surprises the market—something totally unexpected—that’s when you see the sharp price changes. And that’s where the opportunities lie. But that’s just the shiny side of things. Truth is, with big opportunities come big risks.

Key News and Economic Events to Follow When Trading the News

Your first time checking a news calendar will be overwhelming. You might not even know what to focus on when you hit the page. Let’s help you cut through the clutter.

First off, just like every trade setup, news releases are not created equal. While some really move the market, others have absolutely zero effect on price movement. With that said, here are the top economic data releases that typically have the biggest impact on the financial markets:

1. Non-Farm Payrolls (NFP)

Let’s start with one of the big boys: the U.S. Non-Farm Payrolls (NFP) report. This one is released on the first Friday of every month and is a huge deal. It measures how many jobs were added or lost in the U.S. economy and is a key indicator of economic health.

A positive NFP report usually means a stronger U.S. dollar, while a disappointing figure can lead to a drop. And it’s not just currencies that feel the heat here. Stocks, bonds, and even cryptocurrencies move, too.

A better-than-expected NFP often suggests the economy is doing well, which can lead to expectations of higher interest rates. However, if the economic data report disappoints, investors might start thinking about easier monetary policies from the Fed.

Another key data to watch out for when analyzing the NFP results is the revision of the previous month. Very often, this data can be even more significant than the one that relates to the current month.

2. Consumer Price Index (CPI)

Since the forex market is basically about buying and selling currency pairs and assets, it’s not far-fetched to imagine that inflation will play a huge role in price movement.

The Consumer Price Index (CPI) is all about inflation. It measures changes in the prices that consumers pay for goods and services. If inflation is on the rise, you can bet central banks will take action, usually by hiking interest rates. This kind of news impacts everything—from forex to bonds to equities.

When CPI numbers come out hotter than expected, central banks tend to take a hawkish approach, which can, for example, boost the currency. But if the numbers fall short, you might see the central bank ease up, which can lead to currency weakness.

3. Interest Rate Decisions

When it comes to market-moving events, interest rate decisions are right next to the first two news reports we have highlighted on this list.

Central banks like the Federal Reserve, the European Central Bank, and the Bank of England regularly meet to decide on interest rates. Rate hikes usually strengthen a currency, while cuts can lead to depreciation. But once again, it all should be in the right context, meaning analyzing the expectations and seeing if the actual result is above or below what the market was expecting.

Moreover, it’s not just the rate decision that matters, though. The tone of central bank statements is also critical—whether it’s hawkish or dovish can make a big difference. Central bank governors often provide forward guidance, which helps traders anticipate future moves.

So, knowing how to interpret these statements can give you an edge when trading around these events.

4. Gross Domestic Product (GDP) Data

GDP data gives insight into how well (or poorly) an economy is performing. Strong GDP growth is usually seen as a positive sign for a country’s currency and stock market, while weak growth can cause declines. Central banks use GDP figures to decide whether the economy needs a boost or some cooling off, which in turn influences monetary policy decisions.

If the GDP numbers are better than expected, you can bet that markets are going to react, and vice versa. Understanding these trends can help you figure out when to jump in or stay out of a position.

5. Employment Data

Employment data, such as the unemployment rate, is key to understanding the health of an economy. High employment levels indicate a strong economy, while rising unemployment is often a red flag. Employment figures directly impact central bank decisions, which is why they’re crucial for news traders.

If employment data is better than expected, currencies and stocks may surge. However, disappointing data can lead to declines and possibly prompt central banks to consider easing policies.

6. Companies’ Earnings Reports

When big companies report their earnings, the entire market can feel it. Earnings reports can move individual stocks and also have an impact on market indices. Positive earnings can push stocks higher, while negative reports can lead to sharp declines. Traders who follow these reports look at metrics like revenue growth, profit margins, and forward guidance.

Big deviations from expectations lead to quick price changes, and if you’re ready, you can capitalize on these moves. Following earnings reports can give you an edge, especially if you understand how the broader market might react.

7. Political News

Politics and markets go hand-in-hand. Political news, such as elections or changes in government policies, can create uncertainty and directly impact financial markets. As a rule of thumb, markets don’t like uncertainty, and political turmoil can drive prices down, while stability tends to boost confidence.

A good example of this is the market reaction after Japan changed its prime minister recently and also after Donald Trump was shot. Additionally, geopolitical conflicts like the Russia-Ukraine war and the conflict between Israel and Palestine/Iran/Lebanon can also impact the markets.

Keeping an eye on political events can help you anticipate market moves. Whether it’s elections, changes in government leadership, or major policy shifts, these events can lead to sharp movements in currencies, stocks, and other assets.

The news trading strategy is all about making trading decisions based on big economic news releases and how the market reacts. Essentially, when major news drops, the market tends to go a little crazy, and this creates opportunities for traders who know how to play it right.

News Trading Strategy – How to Trade the News

Knowing how to trade the news is basically knowing how to read the market’s behavior and expectations.

The most important factor in news trading is timing. When news hits, the market reacts, and if you can be in the right place at the right time, you can make some great trades.

But keep in mind, because market reactions can be unpredictable, nailing the timing isn’t everything. After all, timing is subjective. Some hit the trade immediately after the release, while others prefer to wait for several minutes before they execute a trade. That’s why we emphasize understanding market expectations and being ready to act fast.

Market Expectations and Pricing In

Often, traders and analysts have already made predictions about what a particular news release will show. For example, the market may already be expecting a certain number of new jobs in the U.S. Non-Farm Payrolls report. This means that, in many cases, the news has already been “priced in” to the market even before it’s released.

This is why simply trading based on the news outcome isn’t always the best move. If the news matches expectations, the market might not move much because traders have already reacted. Instead, it’s those unexpected results—the ones that deviate from expectations—that cause the biggest moves.

Being able to assess whether the market is leaning too heavily in one direction can provide valuable insights.

Trading Before, During, and After the Release

There are different approaches you can take when it comes to trading the news; here are the three major ones:

- Before the Release: Some traders like to take a position before the release, betting that the actual news will be better or worse than what’s expected. This is a high-risk, high-reward strategy because if the news doesn’t go your way, you could be in for a wild ride.

To improve your odds, you need to do your homework, analyze the data, and use proper risk management. - During the Release: Trading right as the news drops means dealing with a lot of market volatility. You need access to real-time data and a trading platform that’s fast and reliable. The market moves quickly, and if you’re not prepared, you could end up on the wrong side of the trade.

High-frequency traders thrive during these times because they can execute trades in milliseconds. For the rest of us, it’s all about staying sharp and being ready to act. - After the Release: If you’re not comfortable with the craziness that comes during the news events, you can wait until after the dust settles.

Trading after the news is released lets you see which direction the market is going and jump in when the trend is clearer. It’s less risky, but you’ll need to be patient and wait for a solid opportunity.

‘Buy the Rumor, Sell the News’ Technique

One classic approach to news trading is the ‘buy the rumor, sell the news’ technique. Here’s how it works: You buy an asset in anticipation of good news and sell it when the news is officially released. It is the opposite of selling an asset in anticipation of bad news and buying when the news comes out.

This strategy is based on the idea that markets often react to rumors well before the actual news drops, and by the time the news is out, prices have already moved in anticipation.

But once the news is out, a lot of traders start taking profits, and prices can reverse. That’s where the selling part comes in. It’s all about understanding market sentiment and how other traders are likely to react to news announcements. This technique works well when the market is clearly moving in anticipation of an event, and you have a good sense of where prices are heading.

The Free News Trading Strategy PDF

If you need something to read on the fly about trading news, here’s something for you:

Top News Feed Services for Trading

If you want to succeed with news trading, having access to reliable and fast news sources is non-negotiable. You need to know what’s happening as soon as possible, and for that, you need a top-notch news feed. Here are some of the best news feed services for traders:

- Reuters: A leading global news provider, Reuters offers in-depth financial news and real-time updates that are trusted by traders around the world.

- Bloomberg Terminal: The gold standard for financial data, the Bloomberg Terminal gives you access to real-time news, analysis, and all the data you could ever need. It’s pricey, but it’s worth it if you’re serious about trading the foreign exchange market.

- Dow Jones Newswires: Dow Jones provides highly reliable financial news and analysis, giving you the insight you need to stay ahead of the market.

- Forex Factory: A favorite platform among forex traders, Forex Factory offers a free economic calendar along with up-to-date news and analysis.

- MetaTrader News Feed: If you use MetaTrader, you’ve got a built-in news feed feature. It’s convenient and provides economic news directly within the trading platform.

Depending on your trading strategy and budget, you can choose the service that suits you best. If you’re just starting, free services like Forex Factory are a great way to get your feet wet, while more advanced traders might find the additional features of Bloomberg Terminal to be worth the investment.

In addition, you can also visit our daily market analysis section for insights and updates and join our live trading streams, where we cover live economic events.

How to Get a News Feed in MT4 and MT5?

MetaTrader is one of the most popular trading platforms out there, and if you’re using it, getting a reliable news feed is key. Here’s how you can add a news feed to MetaTrader 4 or 5:

Check the Platform’s News Section

MT4/5 comes with a built-in news section that provides economic news and announcements. You can access this by opening the ‘Terminal’ window and clicking on the ‘News’ tab. Here, you’ll find all the economic releases relevant to your trading.

Add a Custom News Feed

You can also add a custom news feed by installing third-party indicators like the one above. These indicators provide live news updates, which are crucial for making informed trading decisions.

To enable the news feature on MT4/MT4, you must follow the next steps:

- Navigate to the Tools and click on Options.

- In the Options box, navigate to the Server tab.

- Tick the Enable News box, and click on the Ok button.

- Navigate to the main page and click on the News tab.

Is News Trading Profitable?

So, there you have it—the news trading strategy in a nutshell. Now, you might be asking yourself, is news trading profitable?

Well, it certainly could be. I have seen many traders who rely solely on news and economic events to make trading decisions. They believe that news trading provides enough volatility and information to make consistent profits. Of course, like all trading strategies, you’ll have losing trades, but when you master the news trading strategy, it could be highly profitable.

In short, it’s a powerful way to take advantage of short-term market movements.

We recommend that you take the time to practice, start with a demo account, and slowly transition to live trading as you get more comfortable. Good luck out there!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.