Key Points

- This week’s economic calendar is much quieter than last week.

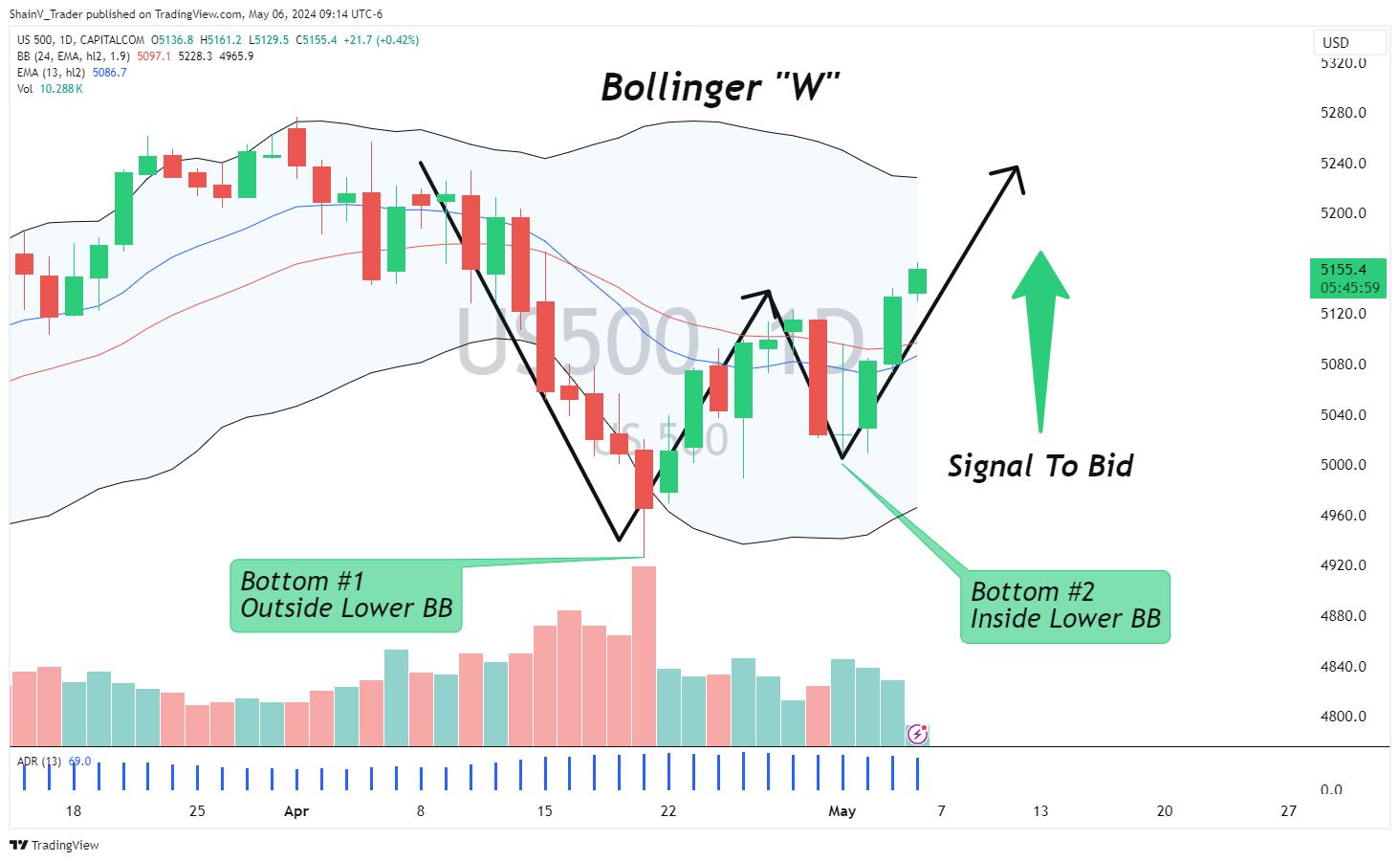

- The daily S&P 500 chart shows a near-perfect Bollinger W pattern. This is a bullish signal that suggests an upside reversal.

- Disney, Palantir, and Occidental are all due out with earnings in the coming five days. Friday’s UM Consumer Sentiment Index is this week’s key US economic release.

Last week was a fantastic time to be in the markets. The economic calendar was jam-packed with key events, headlined by the FOMC announcements and US non-farm payrolls. Subsequently, asset prices sprung to life, with volatility being the rule.

This week is a different ball game. Aside from Thursday’s BoE Interest Rate Decision, there isn’t much to trade from a fundamental perspective. For US large-cap stocks and the S&P 500, the coming five days offer a unique opportunity to view equities pricing free of news-driven turbulence.

Bids Hit S&P 500 To Open The Week

Wall Street is open for business, and traders are bidding stocks. At press time, the S&P 500 is up more than 0.5% and driving above last week’s high. Is the April correction over? It appears so; stocks are on the rebound and have a solid chance of extending their two-week winning streak.

US500 Technicals: A Perfect Bollinger “W”

The daily chart for the S&P 500 (US500) gives us a great look at a potential market reversal. In fact, it is a classic Bollinger “W” formation. The “W” is a chart pattern promoted by famous market technician John Bollinger. It is defined by an initial bearish move, a pullback, and then another bearish move. The result is a double-bottom pattern where the first bottom is outside the lower Bollinger Band, and the second is inside the lower band.

The W is a signal to buy the market. It suggests that sellers have become exhausted, and the price is poised to reverse course. Regarding the daily timeframe, this W certainly has the attention of swing traders looking to bid the US500 for the near term.

A Quiet Week Ahead

All in all, the coming five days on the markets will be much slower than last week. In fact, the only US market mover on the weekly docket is Friday’s University of Michigan Consumer Sentiment Index. The UM Consumer Sentiment Index will give us an idea of how the public views the current economic situation, inflation, and the road ahead.

For S&P 500 traders, it will be important to note that there are several companies due to report earnings this week. On the NYSE, Disney (DIS), Palantir Technologies (PLTR), and Occidental Petroleum (OXY) are the key reports. Each of these reports has the potential to drive participation to the markets. Whether it’s bullish or bearish remains to be seen.

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.