The Nasdaq 100 experienced a minor increase yesterday, closing up 0.03% at 17,881.25, despite concerns about sustained high-interest rates highlighted by Fed Chair Jerome Powell.

Key Points

- Tesla’s 3% drop constrained the index’s growth due to rising EV market competition.

- Upcoming speeches by Fed officials are expected to impact views on monetary policy.

- The index remains bearish, below the 200 EMA, signaling continued investor caution.

NASDAQ 100 Daily Price Analysis – 17/04/2024

The Nasdaq 100 saw a slight increase yesterday, closing at 17,881.25, up by 0.03%. Despite Federal Reserve Chair Jerome Powell’s remarks on sustained high interest rates due to persistent inflation, the index managed a modest rebound.

Powell’s cautious commentary, highlighting a lack of confidence in lowering inflation, surprisingly did not heavily impact major indices, as some traders capitalized on the lower prices.

Today, the Nasdaq opened at 17,936.00 and recorded a small rise to 17,936.75. Tesla’s 3% drop, amid intensifying competition in the electric vehicle market, has notably restrained the index’s growth potential.

Key Economic Data and News to Be Released Today

Later today, we are set to hear from Fed Board Governor Michelle Bowman and Cleveland Fed President Loretta Mester. Their speeches are highly anticipated for further cues on the Fed’s monetary policy outlook.

Following recent developments where top U.S. central bank officials, including Fed Chair Jerome Powell, indicated a more extended period of restrictive policy, today’s remarks could significantly sway market sentiment.

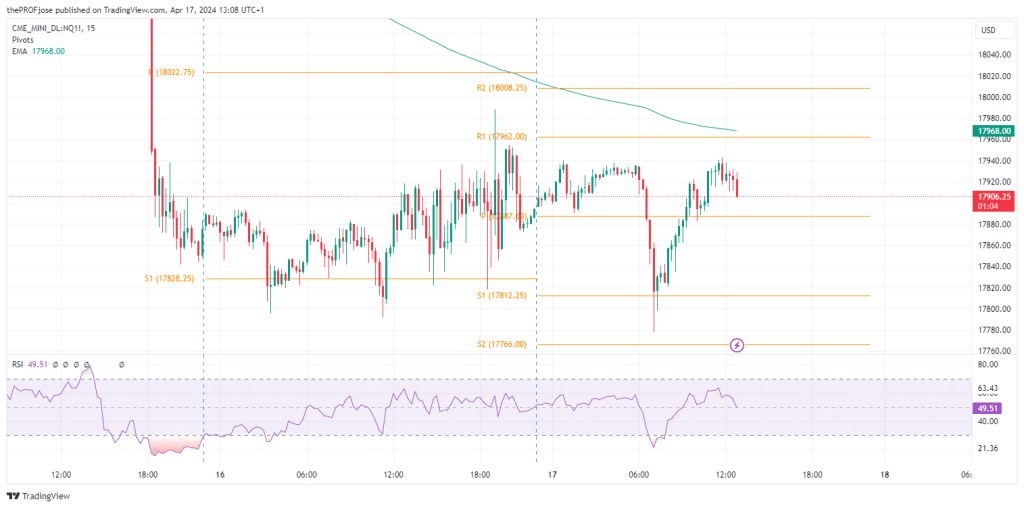

US100 Technical Analysis – 17/04/2024

The Nasdaq 100 is currently displaying bearish tendencies as it trends below the 200 EMA. When the price action remains below this level, it typically signals bearish sentiment among investors.

A break below this pivot could confirm a bearish entry signal, suggesting further downside potential. Additionally, the RSI indicates that there is considerable room for further downward movement. This implies that the decline could extend before any significant reversal or stabilization occurs.

NASDAQ100 Fibonacci Key Price Levels 17/04/2024

Here are some critical support and resistance levels to pay attention to:

| Support | Resistance |

| 17812.25 | 17962.00 |

| 17766.00 | 18008.25 |

| 17691.00 | 18083.00 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.