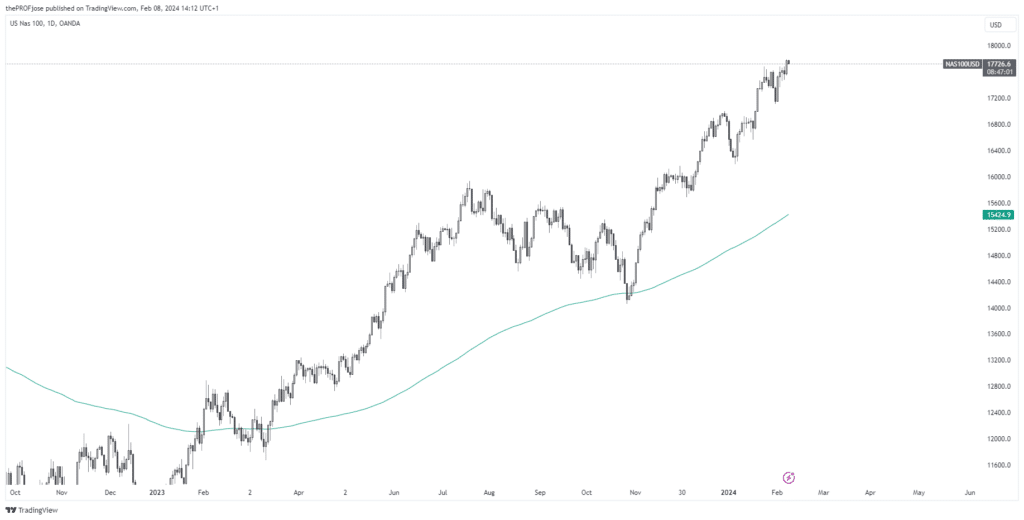

The NAS100 index climbed to new heights in recent days, bolstered by robust corporate earnings and optimistic market sentiment.

Key Points

- NASDAQ 100 is hovering around new highs, with technology stocks leading the charge.

- Corporate earnings, including those from CVS Health Corp and Uber Technologies, exceeded expectations.

- The market anticipates the release of key economic data and Federal Reserve insights.

NASDAQ 100 Daily Price Analysis – 08/02/2024

Yesterday, the market experienced a robust finish, notably with the Nasdaq 100 moving closer to its all-time high from November 2021, buoyed by a surge in technology and tech-adjacent stocks.

Earlier today, U.S. stock index futures indicated a slight downward adjustment as investors awaited big-ticket earnings reports and key economic data. This cautious approach follows the strong market performance seen yesterday. Companies like Walt Disney and Spirit Airlines have been in the spotlight due to their latest financial results and future plans, influencing a positive market sentiment.

Looking ahead, the market’s direction may hinge on upcoming economic data, including jobless claims and remarks from Federal Reserve policymakers regarding a potential rate cut. Continued strong earnings reports could also support market momentum, but any unexpected data or policy signals could introduce volatility before the end of the day.

Key Economic Data and News to Be Released Today

Looking ahead, high-impact economic data points such as jobless claims and the Consumer Price Index could sway market directions. Today, the eyes of the market are set on the speeches from regional Federal Reserve Presidents, which might offer further insights into the central bank’s outlook on inflation and interest rates.

As we speak, investors await the CPI data that is expected to be released next week. If inflation rates come out higher than expected, it could lead to a pullback in the NAS100 as investors anticipate tighter monetary policy. Conversely, if the data is in line with or below expectations, it could provide some relief to the markets, potentially leading to a bounce from support levels.

US100 Technical Analysis – 08/02/2024

Yesterday, NASDAQ100 showed a strong uptrend, with prices moving above the pivot point and breaking through the R1 resistance level. The momentum seemed to slow down as the prices neared the R2 resistance level, indicating a potential consolidation or retraction phase.

Today’s price action indicates that the prices have been consolidating around the R1 level, which is now acting as a support level. The flattening 50 EMA suggests a slowdown in the momentum, and the price is testing the pivot point, which could be a critical level for the day’s trading session.

NANDAQ100 Fibonacci Key Price Levels 08/02/2024

The technical setup suggests a cautious approach as the index is testing critical support levels. In view of this, here are some critical support and resistance levels to pay attention to:

| Support | Resistance |

| 17739.82 | 17772.22 |

| 17726.13 | 17790.91 |

| 17707.43 | 17804.61 |

Related Articles

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.