It’s been a flat week for the USDJPY. Yesterday was no different, and today looks set on the same path. Investors will hope the US Core PCE Price Index data will bring some direction other than sideways.

Key Points

- The USDJPY remains flat in a week-long consolidation.

- The US Index continues to show strength amidst signs of economic strength.

- The key levels for the pair are the $151 support and the $151.974 resistance.

USD/JPY Daily Price Analysis – 29/03/2024

This week has been calm for the USD/JPY. The pair closed yesterday with a flat 0.04% price increase from its opening price, and so far today, it has only given off a meager 0.02% decline.

The US Index (DXY) continues to gain strength amidst an expanding economy and potential delays in interest rate cuts. Thursday’s Initial Jobless Claims report came out less than anticipated, and the QoQ GDP was also better than expected. Additionally, Fed official Christopher Waller made hawkish remarks, hinting at a delay in rate cuts. As a result of these, the Greenback gains some positive momentum.

However, not much has happened in Japan since the BoJ decided to switch from its negative rates policy. Japanese Finance Minister Shunichi Suzuki mentioned that they are paying close attention to FX developments and will do whatever is necessary to address disorderly FX movements.

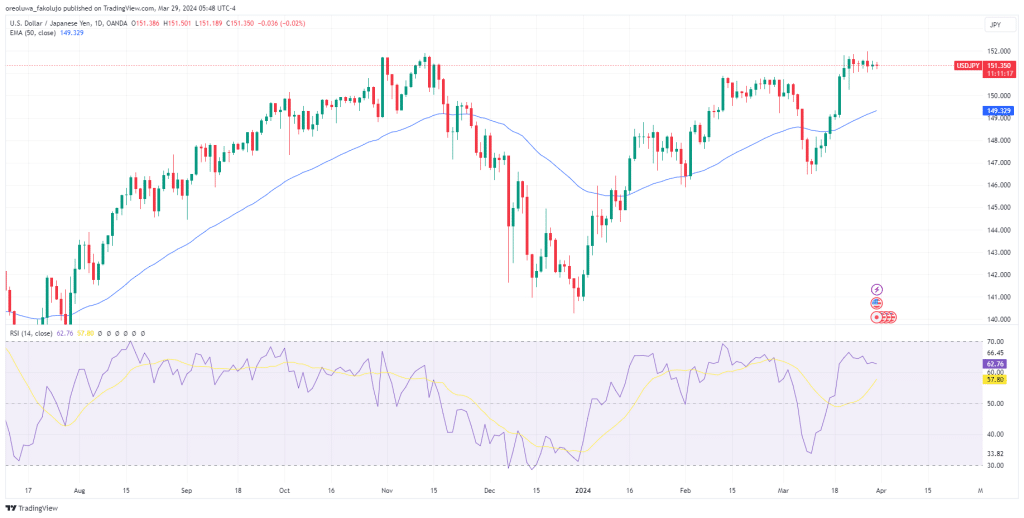

From the technical perspective, the pair maintains its bullish outlook. The price is well above the 50 EMA, and the RSI is also in the upper half of the midpoint.

USD/JPY Intraday Technical Analysis – 29/03/2024

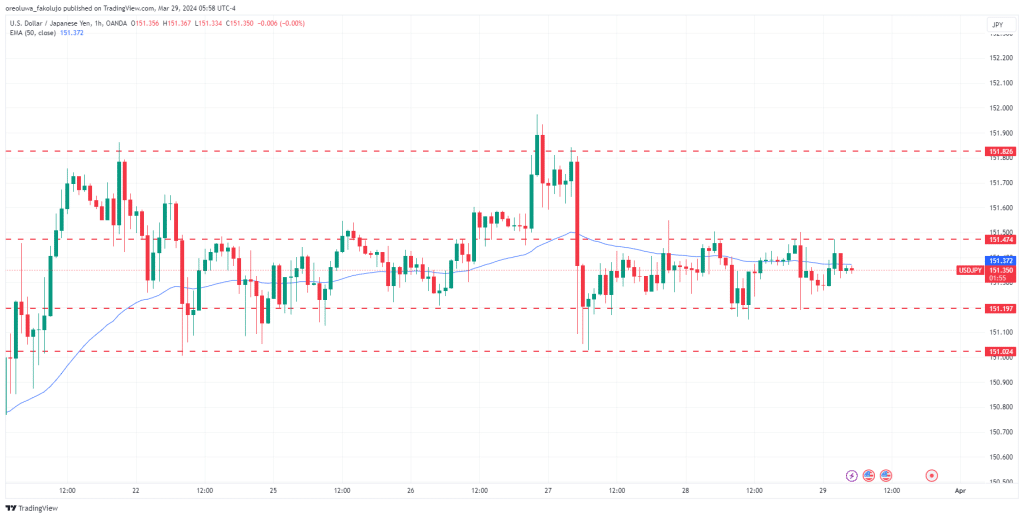

When looking at the hourly chart, you first notice the week-long consolidation with a low of $151 and a high of $151.974. Within those levels, the price has settled into a narrower support-resistance pair of $151.197 and $151.474. A break above the $151.974 high could send the pair into unprecedented all-time highs.

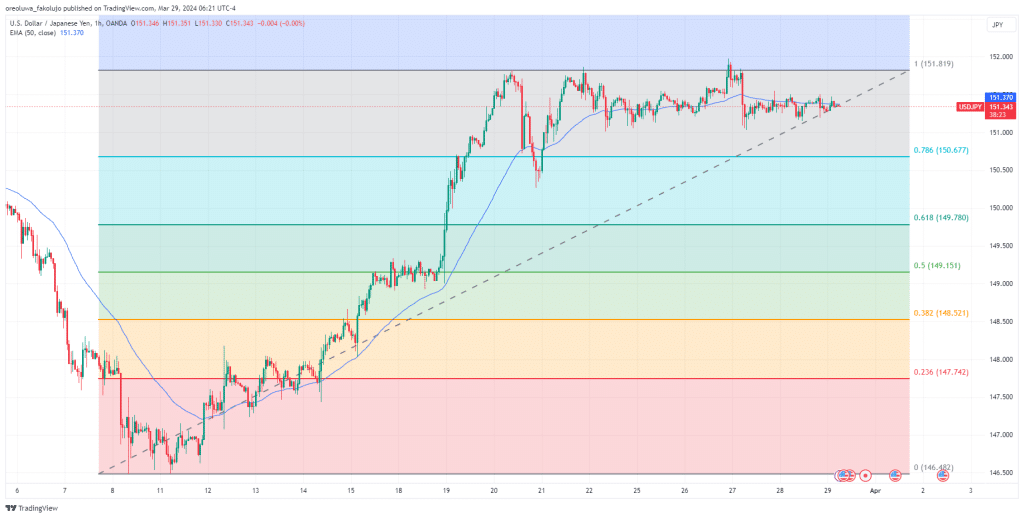

If the price does fall below the support and heads into a retracement, the 0.786 ($150.677) Fibonacci retracement level is the first level to watch. Further down are the 0.618 ($149.780), 0.5 ($149.151), 0.382 ($148.521), and 0.236 ($147.742) key levels.

Key Economic Data and News to Be Released Today

Things are busy in the United States on the Economic Data front today, with the release of the Core PCE Price Index by 8:30 (UTC-4) and Fed Chair Powell testifying three hours later. If the Core PCE Price Index data shows signs of more economic strength, the Greenback stands to benefit.

USD/JPY Key Fibonacci Price Levels 29/03/2024

Based on the 1hr chart, the key Fibonacci price levels for USDJPY are these:

| Support | Resistance |

| $150.677 | $151.819 |

| $149.780 | $150.887 |

| $149.151 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.