It’s been relatively flat trading days for the USDJPY, but the pair looks closer to breaking above the 152 resistance level and soaring into its highest level since the early 90s.

Key Points

- Despite the BoJ’s decision to exit its ultra-lose policies, the pair continues to push higher due to a wide interest rate differential between the two currencies.

- The pair currently ranges amid speculation of BoJ intervention, hanging below the 152 price mark at 151.7.

- The key levels for the pair are the 151.95 resistance and 151.15 support.

USD/JPY Daily Price Analysis – 02/04/2024

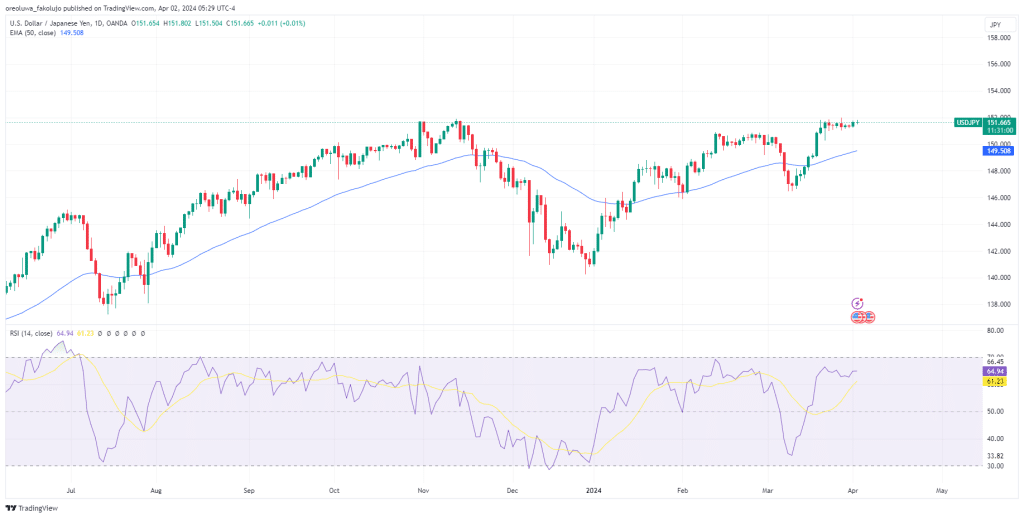

The USDJPY gained 0.21% yesterday, adding to the pair’s 7-day flat streak. So far today, the pair has barely moved, having only gone up by 0.01% and currently trading at 151.671.

The Japanese authorities’ never-ending dovish approach continues to undermine the Yen. As the BoJ finally exited a negative interest rate, they only pegged it at 0 – 0.1%. Judging by investors’ reactions, this move was not hawkish enough to reduce the long-term downward pressure on the JPY. And, with the recent comments by Federal Reserve officials, it appears that the wide interest rate differential is likely to continue.

Yet, the key question is whether the BoJ will intervene to defend the 152 level. Last week, the Japanese finance minister said the Japanese authorities may do whatever it takes to address disorderly FX movements. Currently, the USD/JPY is trading in a tight range amid speculations of intervention by the BoJ. If that happens, we might see volatility in the market.

Technically, popular technical indicators signal a bullish outlook for the pair despite it remaining flat for the past seven trading days. The price settles comfortably above the 50EMA, and the RSI edges closer to the upper boundary.

USD/JPY Intraday Technical Analysis – 02/04/2024

Last week, the price hit a hard cap just underneath the 152 psychological level, hitting 151.974 before sharply falling off. Since then, the pair has mostly moved in ranges, largely due to the ongoing speculations in the markets of BoJ intervention. For now, it hangs just below the 151.660 resistance. If it is going to retest the 152 resistance level, it’ll have to go through minor resistance levels of 151.66 and a higher one at 151.802.

On the support side, a key bullish trendline originates from the low of 151.78. Other notable support levels are 151.584, 151.501, 151.431, and 151.262

Key Economic Data and News to be Released Today

Later today, we have the JOLTS Job Openings report from the US, which will be crucial in getting new insight into the Fed’s interest rate cut probabilities. Also, a number of FOMC members will mount the podium.

USD/JPY Key Fibonacci Price Levels 02/04/2024

Based on the 1hr chart, the key Fibonacci price levels for USDJPY are these:

| Support | Resistance |

| 150.799 | 151.974 |

| 149.876 | |

| 149.228 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.