A fourth consecutive losing day for the JPY looks likely, as the interest rate differential between the US and Japan continues to weigh heavily on the pair.

Key Points

- Interest rate differential still weighs heavily on the JPY.

- According to the most recent CPI from the US, recent slowing inflation suggests an increased chance of a Fed rate cut this year.

- The key levels for the price today are the 155.069 support and the 157.03 resistance.

USD/JPY Daily Price Analysis – 21/05/2024

The pair looks to continue its fourth consecutive green day as the JPY continues to weaken against the Greenback. Monday saw a 0.41% rise in price, and so far, in the morning Session on Tuesday, the pair has gained another 0.06% in a muted market.

The last BoJ intervention was enough to stem the persistent USD rally against the JPY. However, the underlying fundamentals have remained pretty much unchanged. There are growing speculations that the BoJ may increase interest rates sooner than expected to bolster the weakening JPY, which may result in a correction or even a reversal. But for now, the interest rate differential still ultimately favors the greenback above the yen.

Overall, despite the BoJ intervention late in April, the USD has mostly remained at the top. The EMA and the RSI have retained their bullish outlook for the pair, with the 50EMA sitting below the price and the RSI line staying above the midpoint.

USD/JPY Intraday Technical Analysis – 21/05/2024

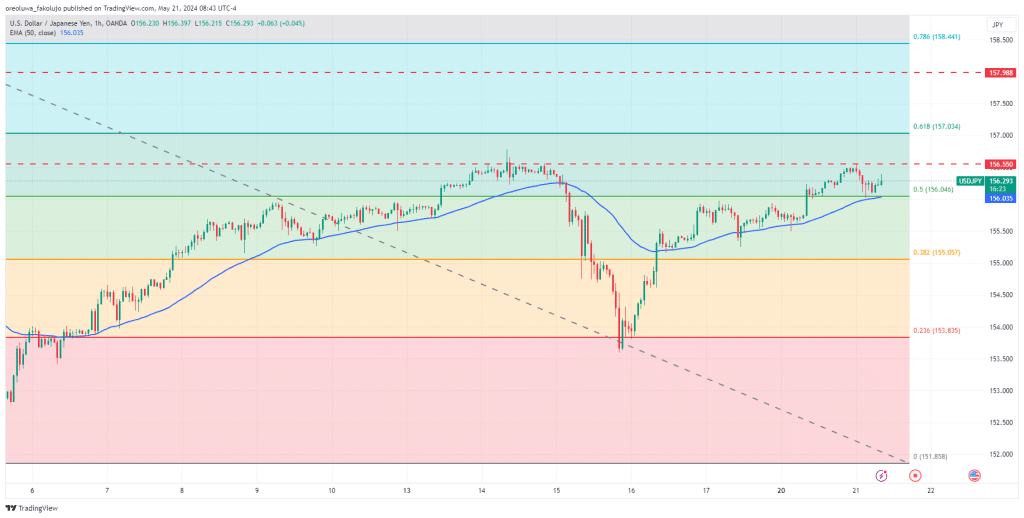

Caught in a range between the 160.233 high and the 151.858 low, the pair has the 156.550 as the most immediate resistance level to break for an upside movement on the hourly chart. After that is the 0.618 (157.034) fib resistance level. Further up are the 158 resistance level and the 0.786 (158.441) fib level.

On the bottom side, the pair has the 0.5 (156.046) fib level to contend with and then the 0.382 (155.057) fib level.

Key Economic Data and News to Be Released Today

The economic calendar is light on Tuesday, as only a handful of Fed officials are speaking. On Wednesday, though, the FOMC meeting minutes will be released. Investors will be paying attention to that for insights into the Fed’s position on rate cut matters.

USD/JPY Key Fibonacci Price Levels 21/05/2024

Based on the 1hr chart, the key Fibonacci price levels for USDJPY are these:

| Support | Resistance |

| 156.046 | 157.034 |

| 155.057 | 158.441 |

| 153.835 | |

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.