GBPUSD looks to have finally broken out of its 8-week consolidation to the downside as we await US Unemployment Claims.

Key Points

- The GBP/USD sheds gains on Thursday morning as investors react to Fed officials’ comments regarding a delayed rate cut.

- In the short term (1hr), things are looking somewhat bullish, but there’s a bit of hesitation before the opening of the London Session.

- US Unemployment Claims and notable speakers today may cause the pair to see some volatility.

GBP/USD Daily Price Analysis – 8/02/2024

The GBP/USD traded at 1.2626 in Thursday morning session after gaining 0.24% yesterday. The pound has pushed higher in recent days amid a weak us dollar and rate-cut expectations.

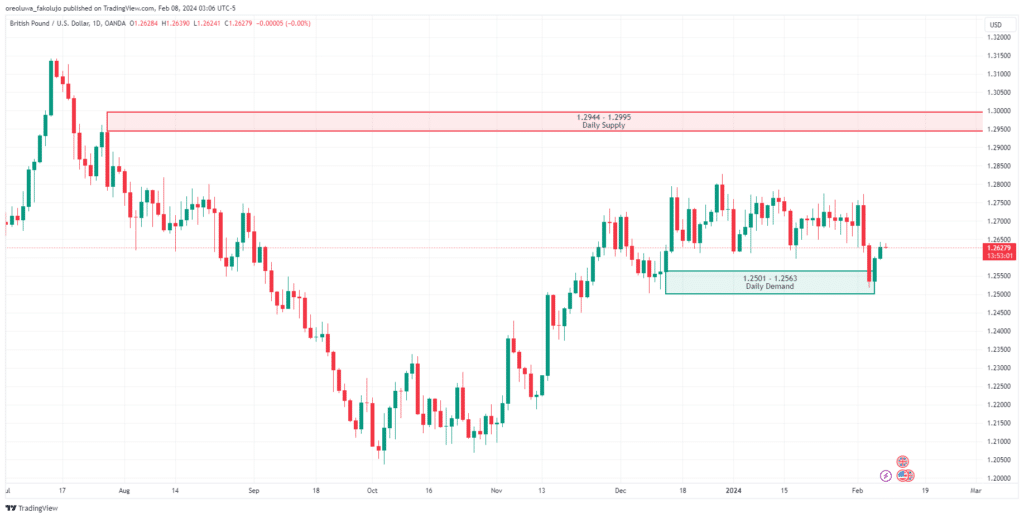

Before then, the price had been in an 8-week consolidation, out of which it broke on Monday. It entered into the 1.2501 – 1.2563 demand zone, lying just underneath the range on the daily timeframe.

From here, the GPB/USD might continue its bullish structures to the upside as it did in November 2023. If this bullish run holds, we might see a test of the 1.2944 – 1.2995 supply level. On the contrary, if the bulls fail to resume their charge and lose to the bears, the pair might fall to lows of 1.2412 or even 1.2236.

GBP/USD Technical Analysis – 08/02/2024

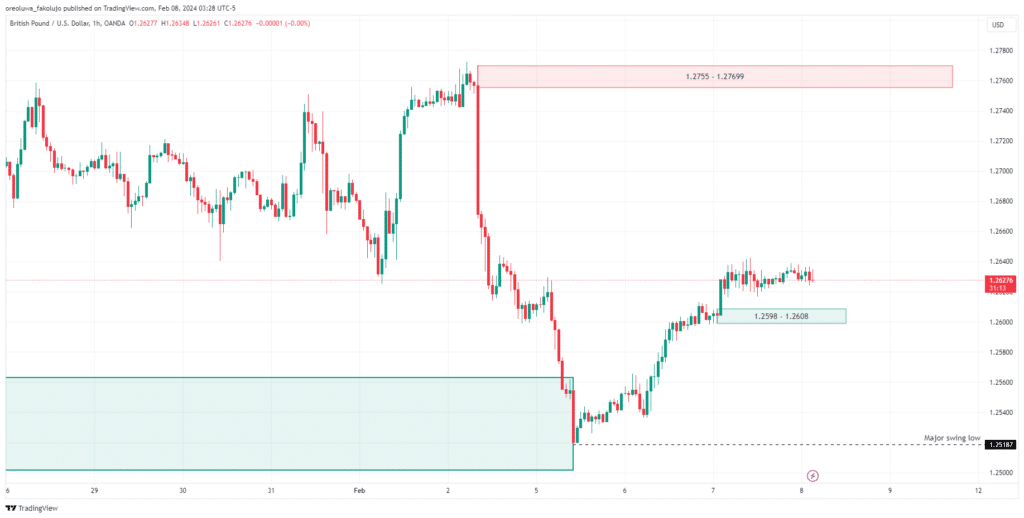

In the 1-hour timeframe, all the momentum has fizzled out ahead of the London session. We expect significant moves to happen as soon as the session opens. When this happens, key levels to watch are the 1.2598-1.2608 demand zone below and the 1.2755 – 1.2769 supply zone above. The demand zone is, however, closer to the current price. And should the price break it, we might see the price fall way down to the major swing low of 1.2518.

These significant moves are possible, as we expect the release of the US Unemployment Claims today.

Key Economic Data and News to Be Released Today

FED and BoE officials are going to be mounting the podium today. The Initial Jobless Claims and 30-year bond auction tomorrow are also worth keeping an eye out for.

GBP/USD Key Pivot Point Price Levels 8/2/2024

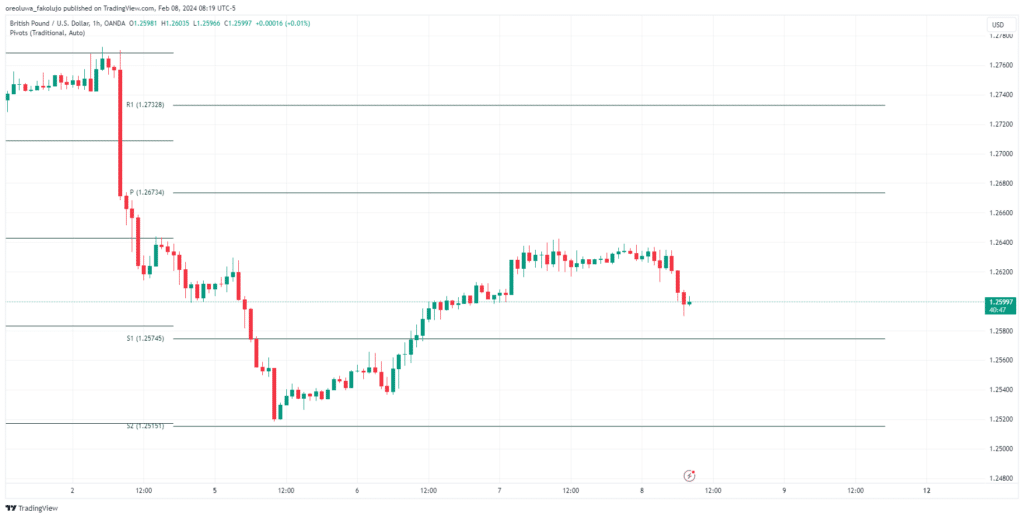

Based on the 1hr chart, the key standard pivot point levels for the GBP/USD are these:

| S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| Pivot Points | – | 1.2515 | 1.2574 | 1.2673 | 1.2732 | 1.2831 | – |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.