Key Takeaways

- An uptick in Core CPI has tempered Fed rate cut expectations.

- Thus far, ECB rate cuts haven’t hurt the EUR.

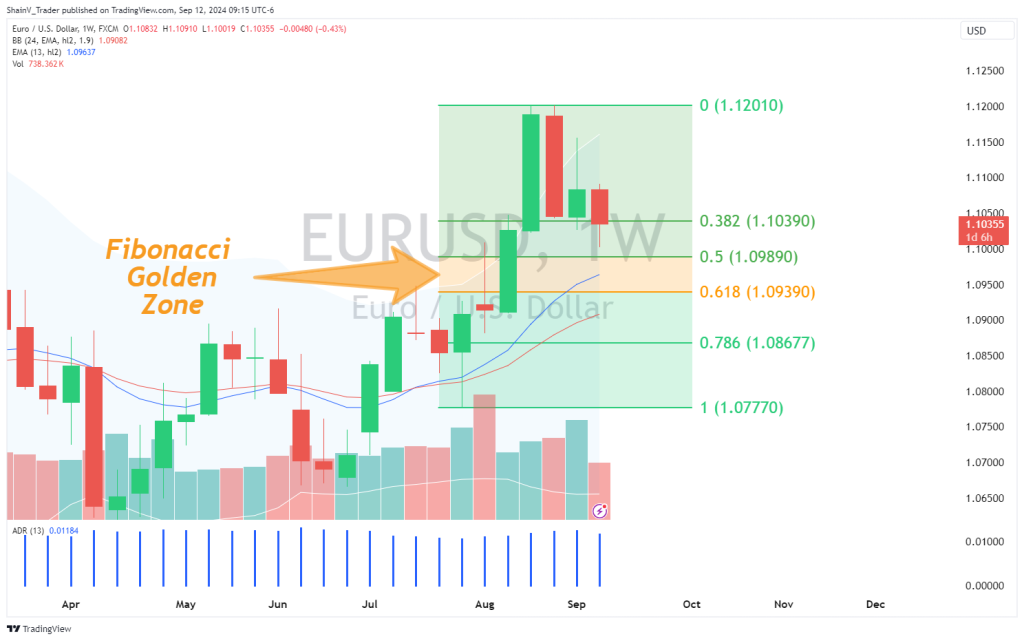

- The Weekly Fibonacci Golden Zone (1.0989 – 1.0939) is vital downside support for the EUR/USD.

Market Overview

It’s a key time for the USD versus the global majors. A recent uptick in Core CPI has significantly impacted September’s Fed Announcements and sent the Greenback reeling. With so many market drivers now in play, it is an ideal time to trade the EUR/USD.

Core CPI Comes In Hot!

Wednesday brought the much-anticipated US CPI report for August. Consensus estimates suggested that inflation was to remain unchanged. And, this was largely the case. However, there was one outlier — Core CPI.

Core CPI is CPI without energy or food included in the basket of goods and services used to measure the rate of inflation. Many economists consider this metric a more accurate tool for quantifying pricing stability. For August, Core CPI came in at 0.3%, above the 0.2% expected and 0.2% previous.

The Core CPI print prompted market angst, sending US Treasury yields higher and tempering rate-cut expectations. As of this writing, the CME FedWatch Index assigns an 87% chance of a ¼ point rate cut at the 18 September meeting. This is up from 60% a week ago when the markets were split 60/40 between a 25 bps or 50 bps rate cut.

Bottom line: the USD is receiving a bump in value from shifting interest rate expectations. Rising T-bill yields evidence this sentiment shift.

ECB Slashes Rates

During Thursday’s pre-US open, the European Central Bank (ECB) slashed interest rates to promote economic growth. The ECB elected to drop the Deposit Facility Rate by 0.25% and cut the Prime Rate by 0.60%. The Deposit Facility Rate now stands at 3.5%, and the Prime Rate is at 3.65%.

Despite the cuts, ECB interest rates remain near 25-year highs. Theoretically, these moves point to a dovish euro; thus far, the EUR’s reaction has been anything but.

EUR/USD: Technical Outlook

Since the lows of June, the EUR/USD has posted a solid uptrend. However, two of the last three weeks have been losers as the USD has regained strength.

The weekly Fibonacci Golden Zone is vital support for the EUR/USD. It is the area between the 50% and 61.8% retracements, in this case, 1.0989 to 1.0939. Golden Zone buys aren’t a bad way to play the action through next Wednesday’s Fed Announcements.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.