Key Takeaways

- EU CPI and the Fed Announcements headline a massive week for the EUR/USD.

- The market consensus is split between a ¼ and ½ point Fed rate cut on Wednesday.

- Multi-year highs and macro resistance are in view for the EUR/USD.

Market Overview

It’s a big week for the EUR/USD. The news cycle is jam-packed for eurodollar traders, headlined by EU CPI and the Fed Announcements. Are exchange rates to rise or fall? The answer to that question will come into view following Wednesday’s forex session.

Inflation Is The World’s #1 Market Driver

During Wednesday’s European session, EU CPI for August is due out. Analysts expect CPI to come in at 0.2%, rising from July’s 0.0% reading. Core CPI is to also jump to 0.3% from -0.2% month-over-month. All in all, eurozone inflation is anticipated to rise significantly for August.

Last Thursday, the ECB slashed rates by ¼ point, its second rate cut this year. Also, the ECB lowered its 2024 economic growth forecast to 0.8% from 0.9% due to lagging domestic demand. Of course, the ECB’s Governing Council stated that its policy “is not pre-committed to a particular rate path.”

At this time, the ECB is in wait-and-see mode regarding inflation and economic growth. If Wednesday’s CPI numbers come in higher than expected, then a policy shift may be in the offing. This would be a bullish market driver for the EUR/USD, which is already trading near multi-year highs.

Up Next: Fed Rate Cuts

On Wednesday, the Fed is due to cut interest rates for the first time since 2020. This marks the first interest rate reduction since the COVID panic and the launch of “Unlimited QE.” Traders have been pricing this move all year long. Now, the only question is whether the rate cut will be ¼ or ½ point in size.

As of this writing, the CME FedWatch Index assigns roughly a 60 percent chance that the Fed will slash rates by 50 basis points; only a 40% chance of 25 bps reduction. The FedWatch estimates have been extremely volatile since last Thursday — it’s anyone’s guess what Jerome Powell and the FOMC will do at 2:00 PM EST Wednesday.

Conventional wisdom says that the deeper the rate cut, the weaker the USD. And that may very well be true. But, one can’t discount just how long the market has been waiting for the September meeting and all rate cuts being already baked into the cake. If we see a ¼ point cut, the USD may show some strength; if we see a ½ point cut, the USD is likely to flatline or slide moderately.

The bottom line: this is the biggest Fed Announcement in recent history. Traders must be ready for anything!

EUR/USD: Technical Outlook

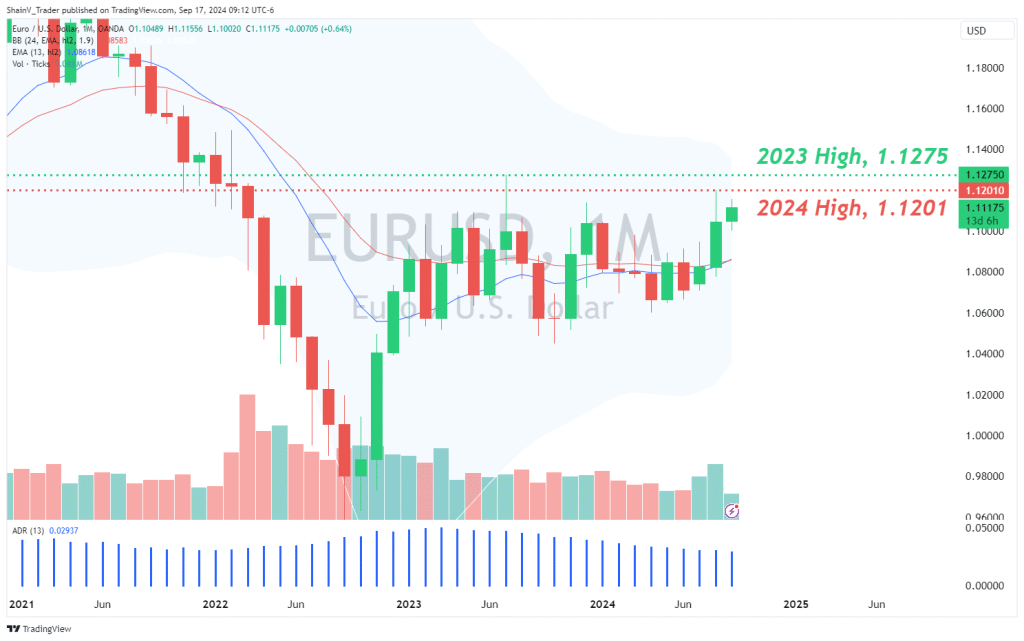

Key levels are an extremely important part of trading. And, they are frequently obvious. For the EUR/USD, we have successive yearly highs coming into play.

Both 2023’s High (1.1275) and 2024’s High (1.1201) are within a stone’s throw of current pricing (1.1117). This area has a solid probability of setting up as robust short-term resistance for the EUR/USD. If the 1.1275 – 1.1200 area is tested, there will likely be heavy two-way action when buyers and sellers collide. Should this scenario play out, sells from 1.1250-75 are at a premium.

The Wednesday forex session is a vital time for eurodollar traders. If you are active in the EUR/USD, be sure to have your risk management dialed-in going into EU CPI and the Fed Announcements. Caution is the better part of valor, and truly anything can happen during such a super-charged news cycle.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.