Key Points

- The EUR/USD is in consolidation around 1.0500.

- December US Non-Farm Payrolls (NFP) is the eurodollar’s key short-term market driver.

- A combination of EU CPI contraction and a more hawkish Fed tone point to a bearish trend extension for the EUR/USD.

Market Overview

November was a massive month for the USD. Values rose across the majors as traders aggressively priced a newly hawkish US Federal Reserve. November is over. December is a fresh month, featuring another round of employment numbers, a Fed Meeting, and CPI data.

Make no mistake — the EUR/USD may be in a very different place on 1 January 2025.

US Labor Takes Center Stage

Central banks are the big dogs of global finance. They craft and institute monetary policy designed to ensure commerce thrives. At the core of any central bank’s function are two missions: promote maximum employment and ensure pricing stability. The Fed, BoE, ECB, RBNZ, RBA, and BoC adhere to this directive.

At times, policy decisions are obvious. The onset of COVID-19 brought emergency rate cuts to zero percent. Once the pandemic subsided, banks raised rates to remove excess liquidity from the global financial system.

Since March 2020, Fed policy moves have been predictable. Now, the waters are murky. Inflation remains above the 2% objective while the jobs market is weakening. October’s US Non-Farm Payrolls (NFP) reading came in at a dismal 12,000; this gain was largely attributed to the governmental and healthcare sectors. And, 2024 has been the year of downward NFP revisions; it won’t be a big surprise if October’s numbers are dropped into negative territory in the 6 December press release.

December NFP is projected to come in at 202,000 for November, up significantly from October numbers. If this figure falls below expectations, the USD will likely experience some short-term selling.

Bottom Line: Fed policy is now in flux, and the 6 December NFP release has the potential to be a primary EUR/USD market driver.

EUR/USD: Technical Outlook

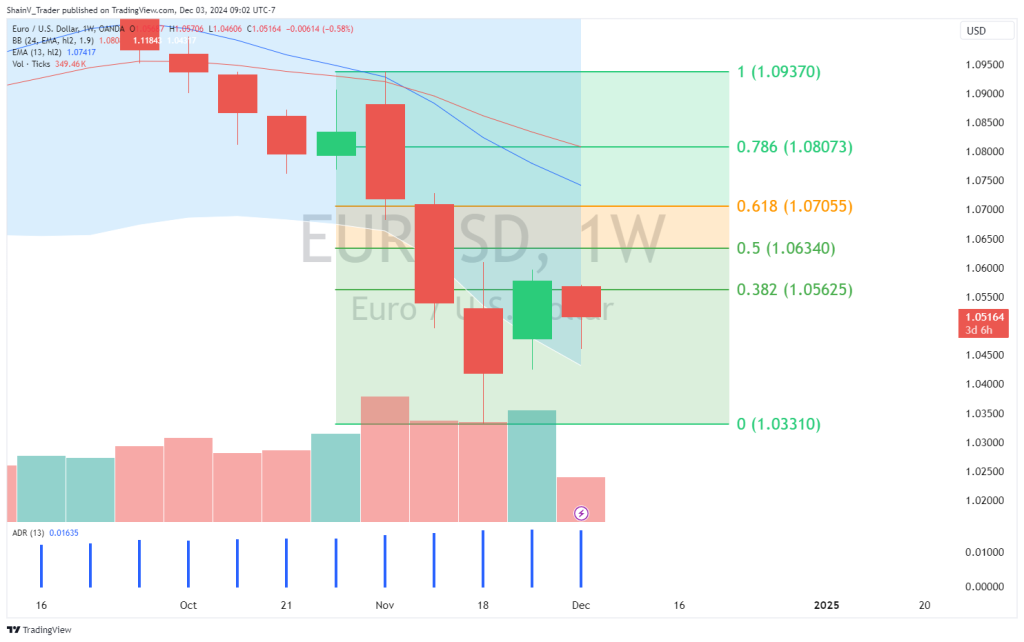

The weekly chart for the EUR/USD says it all: the intermediate-term trend is down, and a bearish bias is warranted. Rates have stabilized around the psychological level of 1.0500.

The Weekly 38% Fibonacci Retracement level at 1.0562 is a key resistance. The 1.0562 – 1.0600 zone has attracted sellers on multiple occasions. Technically, one can build a strong case to hold shorts beneath 1.0562 and build longs above 1.0600.

At press time, the EUR/USD is in compression around 1.0500; the slow conditions won’t last forever, and we anticipate a significant move in the coming days.

EUR/USD Forecast

Last week, Eurozone CPI actually fell on a monthly basis. While it was a small decline, it still measured a physical pullback in consumer pricing — something that has yet to materialize in the United States.

Falling inflation ensures rate cuts. Could a dovish ECB send the EUR/USD lower? It’s possible. The CME FedWatch Index now assigns a 70% chance of a ¼ point rate cut at the December Fed meeting; after that, it’s anyone’s guess.

Given these fundamentals and technicals, par value may be in EUR/USD’s future in 2025.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.