Key Points

- EUR/USD continues its revival as the US dollar begins to sell off.

- The US elections hang in the balance and will likely be decided by a small margin, so expect plenty of volatility this week.

- The Federal Reserve will likely cut rates by 25bps this week, but forward guidance will be key.

- With a busy week ahead, EURUSD traders should be ready for all possibilities this week.

Market Overview

After a bearish majority of October, the last week of the month provided hope for the EUR/USD bulls. It has since started November on the front foot, up nearly 1% so far. This is thanks to an oversold Euro receiving a bid and an overbought dollar showing signs of weakness.

The dollar sell-off can be attributed to the uncertainty surrounding the US presidential election and the unusually weak jobs number on Friday, which saw the US add just 12,000 jobs in the month prior. This is the lowest number since January 2021, over three years ago!

US Elections Hang In The Balance

Market participants expect one of the closest US presidential election races in history, with the polls changing their minds daily between former President Donald Trump and current Vice President Kamala Harris. Traders should be prepared for any scenario when the votes are counted starting tomorrow.

The recent Mediacom Iowa Poll over the weekend showed Harris up three points on Trump in a state that Trump won easily in 2016 and 2020. Trump is seen as positive for the US dollar, which meant that this news created a fresh wave of dollar selling over the weekend, and this will not be the last of the action.

Does The Federal Reserve Decision Matter?

There has been a lot of debate as to whether the Federal Reserve interest rate decision on Wednesday will have any impact on the market because of the US presidential election, and the short answer is yes!

The Federal Reserve setting interest rates is a huge market driver in any environment, and this will be no different. Admittedly, it is pretty nailed on that a 25bps rate cut is on the way, but the forward guidance around future rates after the NFP miss will be crucial for markets. If Jerome Powell acknowledges rising inflationary pressures and the need to be less dovish, then expect the dollar to rise. However, if he seems concerned about the jobs market in any way, expect a dollar sell-off and EURUSD to rise.

EURUSD Prediction

The truth is, no one truly knows who will win between Trump and Harris, and traders should not hang their hats on the polls. Therefore, traders must remain prepared for any scenario this week. One thing is for sure, and that is that we should expect plenty of action in EUR/USD!

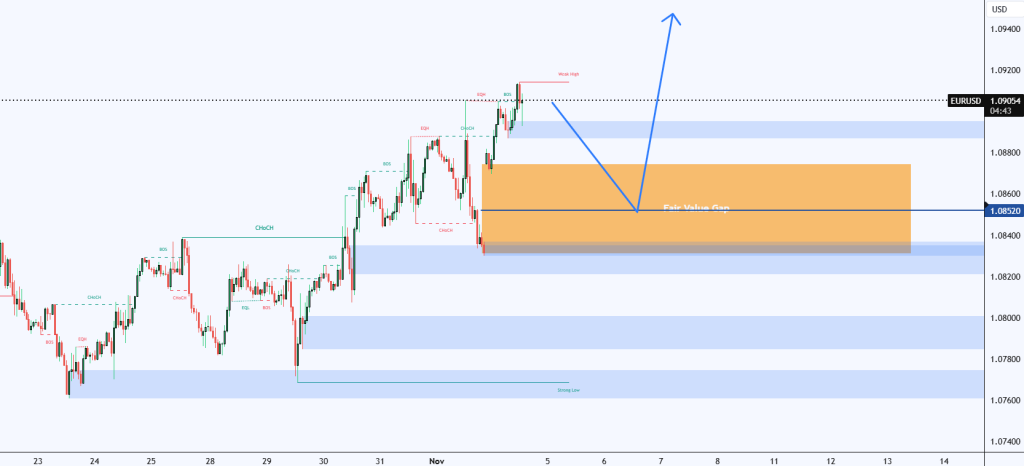

The bulls will be looking for this H1 momentum to continue, as a series of higher highs and higher lows have been identified. The 50% of the Fair Value Gap (FVG) created over the weekend sits at 1.08520, and this could act as a support area to send the price higher. This would be helped if Harris wins, but a Trump win is likely to break this trend, and therefore, a move down to 1.07606 is likely.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.