Key Takeaways

- Fed rate cuts and forward guidance have brought heavy action to the EUR/USD.

- Jerome Powell’s speech (Thursday) and the PCE Price Index (Friday) are the key events on this week’s economic calendar.

- Until Friday’s close, pullback buys from the 1.1150-32 area are a solid way to trade the EUR/USD.

Market Overview

The past week has been a chop fest for the EUR/USD. Exchange rates have been all over the board following last Wednesday’s Fed rate cuts. Is a period of relative calm headed this market’s way? Not necessarily. Several key events are scheduled for later this week that can shake up exchange rates across the majors.

Fed Expectations Are Everything

The 18 September 2024 Fed Announcements were a historic event. Chairman Jerome Powell and the FOMC slashed interest rates by a surprise 50 basis points. The rate cut was the first since March of 2020 and the onset of COVID-19.

Perhaps more important than the cut itself was the forward guidance issued by the FOMC. FOMC members projected that two more 25 basis point rate cuts were to be executed by the end of 2024. Also, more cuts were expected for 2025 as the Fed appeared content with the ongoing progress on inflation.

Forward guidance is a vital aspect of Fed policy. Fundamentally, these projections from the FOMC are extremely dovish, suggesting that the USD may be in for a major correction. Despite the gravity of the Fed’s actions, the EUR/USD is only modestly higher since the rate cuts.

Economic Calendar

Several releases may shake up the EUR/USD by the weekly closing bell. On Thursday, Jerome Powell’s speech is scheduled for early in the US session. Powell’s comments will be his first since the 18 September FOMC Presser. Although Powell isn’t likely to talk about official policy, any hints regarding the future of Fed actions can bring swift volatility to the EUR/USD.

Friday features the monthly PCE Price Index, the Fed’s go-to measure of inflation. Analysts expect PCE and Core PCE to remain unchanged at 0.2% month over month. If accurate, these projections will lend credence to the Fed’s rate cut narrative; if PCE comes in hotter than expected, the EUR/USD may be in for a significant correction.

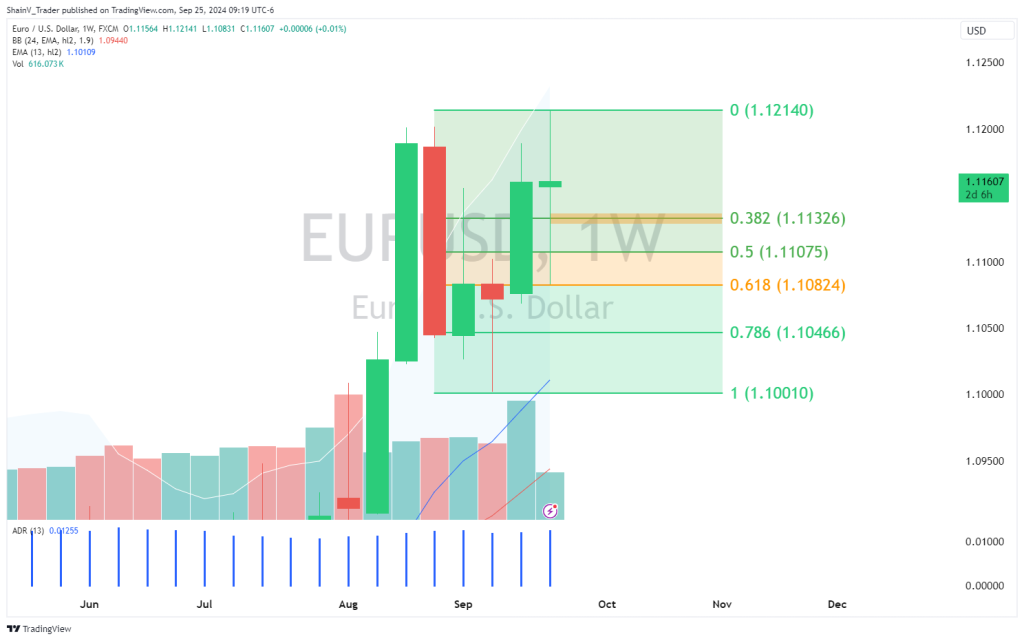

EUR/USD: Weekly Technicals

Fed Week was a key time for the EUR/USD. Exchange rates rose by 0.80% as the USD lost strength against the FX majors. Now, prices are pulling back as forex players fully digest the data.

The Weekly 38% Fibonacci Retracement (1.1132) is a solid trade location to the bull. Don’t be surprised if this area comes into play on either Powell’s speech (Thursday) or the PCE Price Index (Friday) release.

Making money trading forex takes patience and discipline. That’s one reason a weekly chart is such a powerful tool — it gives us a comprehensive view of price action and important technicals to trade. If you’re struggling trading forex, try adjusting your charts to a larger timeframe. You just might find that the larger timeframes give you the edge you need to meet your financial goals.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.