Key Points

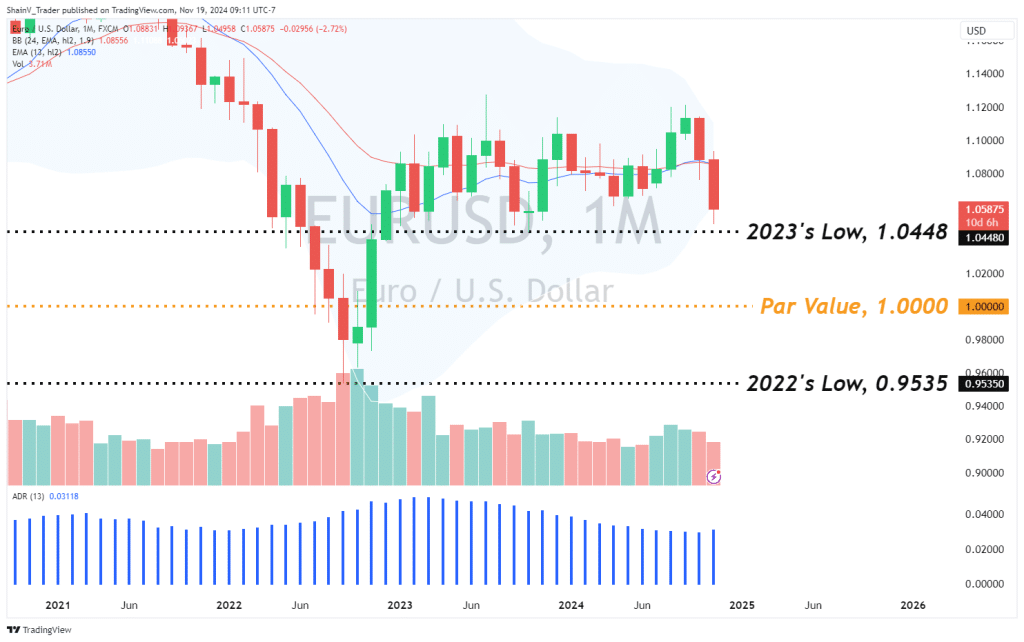

- The EUR/USD is posting a major two-month correction.

- A newly hawkish Fed and the aftermath of the US election are the key market drivers.

- The key technical support levels to watch are 2023’s Low (1.0448), Par Value (1.0000), and 2022’s Low (0.9535).

Market Overview

Since mid-August, the EUR/USD has experienced consistent selling. The exchange rate has fallen from above 1.1200 to just under 1.0500 in roughly two months. Now, many FX analysts are suggesting that the EUR/USD may drop to par value. While that may seem like a stretch, anything is possible given the current market dynamic.

Fed Uncertainty

At the September Fed Announcements, there was tremendous optimism that the hawkish policy of the past two years had begun to win the inflation battle. However, since Election Day, it’s been a different story from the FOMC. Another round of hot CPI figures has put a new spin on the inflationary situation. In turn, rate expectations have shifted toward a more hawkish policy.

As of this writing, the CME FedWatch Index assigns a 58% chance of a ¼ point December rate cut. This probability stood at 76.8% one month ago. So, the market expects interest rates to remain higher for longer, a dramatic change from pre-election sentiment.

Hawkish policy leads to a stronger USD and bearish price action in the EUR/USD. That’s precisely what we are witnessing: a bullish move by the dollar sparked by a more hawkish FOMC.

EUR/USD: Technical Outlook

The market has a memory. It may sound like an old cliche, but time after time, the market repeats itself. Accordingly, it’s important for us as traders to recognize and respect the long-term technical levels facing any market we trade. For the EUR/USD, there are several yearly lows worth noting.

There are three key support levels to watch for the EUR/USD:

- 2023’s Low, 1.0448

- Par Value, 1.0000

- 2022’s Low, 0.9535

Be ready for two-way action around each of these levels. One can bid these zones to take countertrend scalps. Also, be on the lookout for patterns to develop around these price points. It won’t come as a shock to see a bearish pennant, double bottom, or descending triangle set up at or near these zones.

A safe strategy is to bid these levels and apply a conservative risk vs. reward ratio. If a pattern suggests a bearish breakout may be in the offing, one can sell to join the macro trend.

The Bottom Line

From a fundamental standpoint, a bullish bias toward the USD is warranted. A hawkish Fed and new Trump administration economic policies have attracted bidders to the Greenback. Subsequently, a significant correction in the EUR/USD is underway.

It isn’t out of the question that the EUR/USD will test Par Value by the end of Q1 2025. Ultimately, time will tell, but the fundamentals all point to falling eurodollar exchange rates for an extended period of time.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.