Silver prices rise on Monday morning after falling from 3-month high levels. The current price reflects indecision amidst rising global demand for silver and inflationary pressure.

Key Points

- Silver price consolidates following Chair Powell’s speech, finding support at $24.8.

- Silver price seems to have regained its bullish stance as the dollar weakens.

- Investors are expected to pay attention to market reactions around key levels.

Silver Daily Price Analysis – 25/03/2024

On Friday, the Silver market experienced a moderate pullback, closing the day at $24.6632, a decrease of 0.41% from its opening price of $24.7228. Despite reaching a high of $24.9543, the market saw a consolidation phase, pulling back to a low of $24.3951 before settling. This movement followed a notable surge in price after Chair Powell’s speech, indicating a quick retracement and stabilization in the market. All in all, the indecision in silver markets is notable in recent days as investors contemplate the implications of Powell’s speech.

Today, Silver showed a positive turnaround, with the current price marking at $24.8095, reflecting a 0.54% increase from the opening price of $24.7025. The trading session witnessed a high of $24.8925 and a low of $24.5595, signaling a bullish sentiment among investors today. This upswing from the opening price underscores a renewed confidence in the market, driven by broader market trends and investor anticipation of impactful economic releases.

Key Economic Data and News to Be Released Today

Although there are no high-impact data releases today, the general sentiment among investors toward Silver could be attributed to a mix of macroeconomic factors and market dynamics.

Investors are likely positioning themselves ahead of high-impact economic data releases expected later in the week. Such data can significantly influence silver prices by affecting the strength of the USD, as silver is priced in dollars. A weaker dollar makes Silver more affordable for investors holding other currencies, thus potentially driving up demand and prices.

Looking ahead to the upcoming week, traders and investors will closely monitor the release of key economic indicators, such as new home sales on Monday, durable goods orders, and CBConsumer Confidence on Tuesday, GDP for Q4 on Thursday, and Core PCE on Friday. These indicators provide insights into the economy’s health and influence the Federal Reserve’s monetary policy decisions, which in turn impact the value of Silver.

Silver Technical Analysis – 25/03/2024

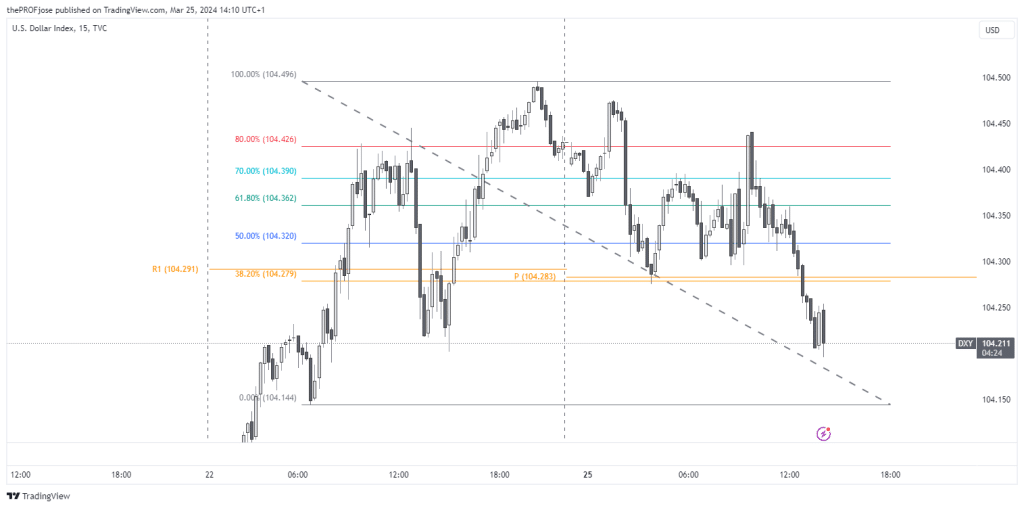

Following several high-impact data releases last week, the Dollar Index has switched gear and turned bearish. From the chart below, we can see that the DXY is breaking down the structure to the downside after reacting to the 80% Fibonacci Retracement level. At the same time, the index has closed below the intraday pivot point, suggesting a bearish sentiment.

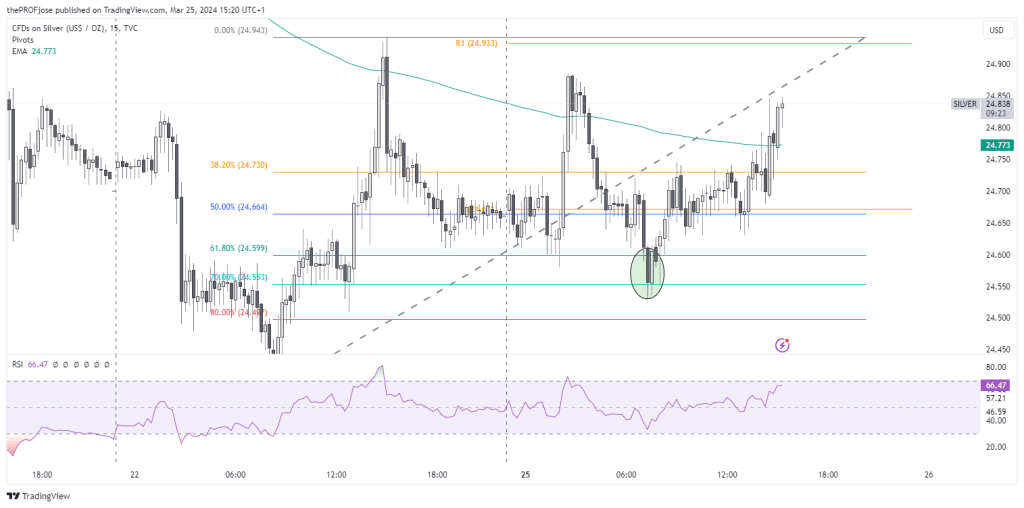

In parallel, Silver has executed a retracement to the 70% Fibonacci level, a movement attributed to the dollar’s weakening stance. Notably, Silver has concluded its trading session above the intraday 200-day Exponential Moving Average (EMA). This development may signify that Silver is re-establishing its bullish momentum, reflecting a positive outlook amidst the dollar’s retreat.

Silver Fibonacci Key Price Levels 25/03/2024

Short-term traders planning to invest in Silver today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 24.6362 | 24.7136 |

| 24.6576 | 24.7268 |

| 24.6708 | 24.7482 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.