Key Points

- Silver (XAG/USD) is in the midst of a strong bullish breakout.

- The gold-to-silver ratio is 78:1, well above the two-decade average of 60:1. Many investors expect the silver rally to bring this ratio back to historic norms.

- A bullish bias toward the XAG/USD is warranted as are pullback buys from daily Fibonacci retracement levels.

May has been a huge month for silver (XAG/USD). Prices are up nearly 20% as bidders have dominated the action. At press time, silver is trading above $31.50 per ounce, levels last seen in 2013.

Recent USD weakness and geopolitical uncertainty are being dubbed the primary culprits for the silver rally. Without question, a bullish bias is warranted, and long-side market entries are a solid way forward.

Market Drivers

Last week’s US CPI figures have brought major participation to the precious metals markets. Gold is trading above 2400, platinum is bullish, and even copper is catching consistent bids. USD weakness stemming from last Wednesday’s modest CPI numbers is the primary catalyst for the metals rally.

Why is CPI playing so big in the metals markets? The reason is shifting interest rate expectations. According to the CME FedWatch Index, the markets are now pricing a 67% chance of at least a ¼ point rate cut at the September FOMC Meeting. This is a big shift since the last FOMC Announcements.

The bottom line: inflation appears to be coming down, thus the chances of the Fed lowering interest rates later this year are growing. The result is a lagging USD and a bullish metals market.

Gold To Silver Ratio At Historic Highs

One tool that silver traders use to price silver is the gold-to-silver ratio. The ratio estimates the relative value of silver by dividing gold’s market price by silver’s market price. Over the past two decades the ratio has averaged 60:1. Currently, the ratio is around 78, the highest level in 27 years.

The lofty gold-to-silver ratio suggests that silver is undervalued. Armed with this information, many investors are piling into silver in anticipation of the ratio returning to historically normal levels.

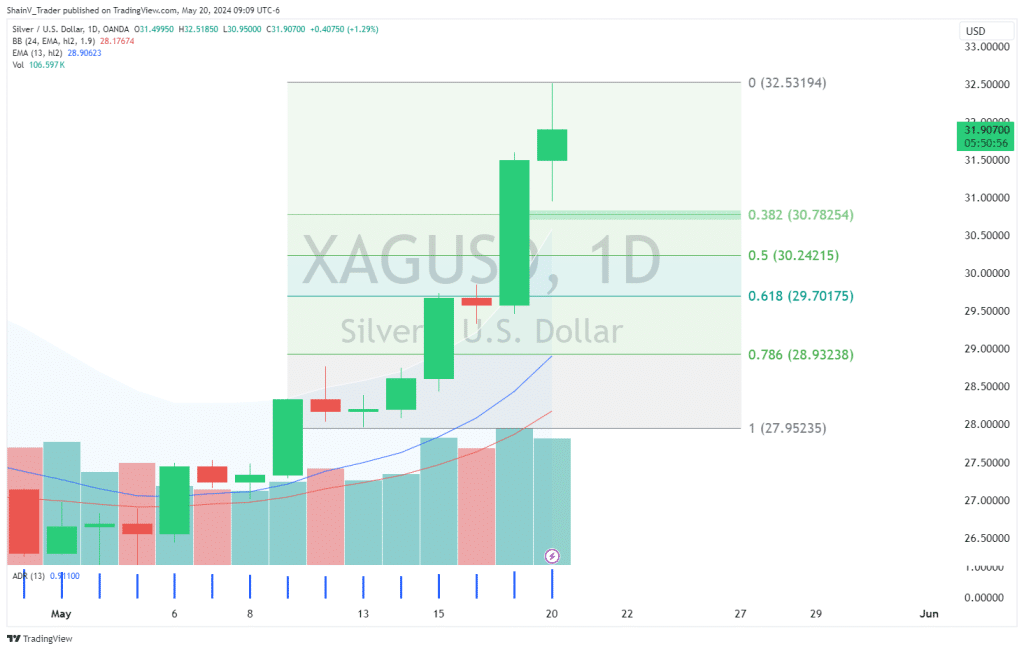

Buying Pullbacks In Silver

Silver (XAG/USD) is clearly in the midst of a bullish breakout. Uptrends are present on the monthly, weekly, and daily charts. Buying pullbacks isn’t a bad strategy ahead of Friday’s closing bell.

As long as the current daily high (32.51) remains the session’s high water mark, bids from the 38% Fibonacci Retracement (30.78) aren’t a bad way to play the action. In the event that price pushes above 32.51 before retracing, buying the new 38% retracement will remain a solid long-side entry.

The key event to watch this week will be Wednesday’s FOMC Minutes. The minutes may give us hints regarding what the Fed is planning for the near term. Any forward guidance from the FOMC Minutes is a potential volatility driver in silver. The FOMC Minutes will hit newswires at 2:30 PM EST on Wednesday.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.