Key Points

- Russia/Ukraine peace talks are anticipated for early 2025.

- The key market driver for silver this week will be Wednesday’s US CPI release.

- A silver buy was issued on 3 December by the Daily 5-8-13 EMA trading strategy.

Market Overview

Autumn 2024 has been a tumultuous period for the metals markets. Following a big 2024 rally, the November trade brought the gold and silver bears out of hibernation. Prices fell by a whopping 6.25% as the markets digested the US election outcome. December has been a different story as silver has pared November’s losses.

What’s next for silver (XAG/USD)? The answer to that question will depend on Fed policy and war escalation.

Read More: Copper Price Forecast – How High Can Copper Price Go?

Peace Or WWIII?

Without question, war is a primary bullish market driver for precious metals. That has been the case throughout 2024, with Russia/Ukraine and Israel/Hamas/Iran bringing significant uncertainty and bidders to the marketplace.

Russia/Ukraine dominated the November news cycle. Escalation was the theme, with Ukraine striking deep into Russia with US-supplied ATCM missiles and UK-build Stormshadow munitions. The result was Russia revising its nuclear policy, launching an ICBM on Ukraine, and multiple large-scale attacks targeting key electrical infrastructure.

December has been a different story. Now, peace talks are being proposed by both NATO and Russia. Only hours ago of this writing, Poland’s Prime Minister Donald Tusk publicly addressed the possibility of Russia/Ukraine peace talks in the near term. As of 1 January, Poland will assume the European Union’s rotating presidency. Tusk went on record with the following statement regarding Russia/Ukraine negotiations:

“I will have a series of talks concerning primarily the situation beyond our eastern border. As you can imagine, our delegation will be co-responsible for, among other things, what the political calendar will look like, perhaps what the situation will be like during the negotiations, which may, although there is still a question mark, start in the winter of this year.”

To sum up Tusk’s statement, Poland looks to place peace talks on the front burner of EU policy as early as January of 2025. This isn’t a coincidence. Incoming US POTUS Donald Trump will be inaugurated on January 20th; Trump has promised peace in the region. Without question, official EU/Ukraine/Russia/US peace talks will likely begin shortly after that.

For silver, peace talks will be a short-term bearish market driver. If an agreement to stop the Russia/Ukraine War is reached, then a high degree of geopolitical uncertainty will be resolved. Although a long-term bullish bias toward silver is appropriate, a Q1 2025 “peace pullback” is certainly possible.

XAG/USD: Technical Outlook

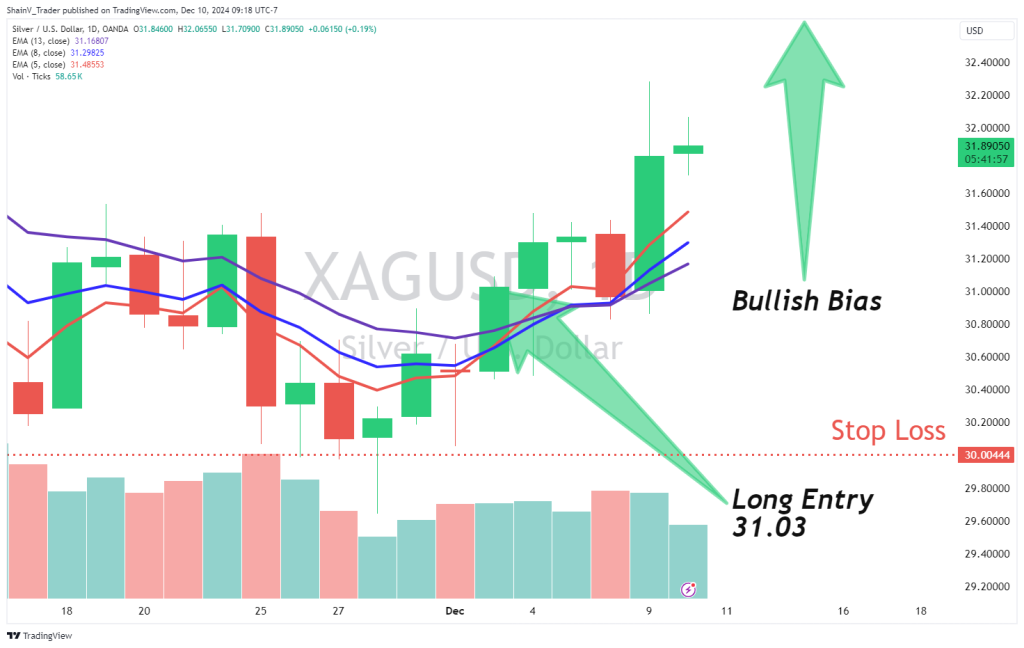

The chart below looks at the Daily XAG/USD chart via the 5-8-13 EMA strategy. Executing this strategy is simple: when the 5 EMA crosses over the 8 EMA, and the price is above all three EMAs, one buys the market. On 3 December, the 5 EMA crossed above the 8 EMA and closed above all three EMAs. This technical event marks a buy entry and a long position.

With any moving average crossover strategy, the secret to success is to dial in risk to reward. One way to do this is to hold positions until another crossover develops. In this case, one is long from 31.03, with a stop loss beneath the previous Swing Low; profit is taken when the 5 EMA crosses under the 8 EMA. So, the long position remains technically valid for the time being.

High CPI = Hawkish Policy

Wednesday is a huge day on the markets. November US CPI is due out during the pre-Wall Street hour. Analysts expect this figure to hold firm at previous levels. In the event CPI surprises, be ready for extreme volatility in the silver market.

As of this writing, the CME FedWatch Index assigns an 88% of a ¼ point rate cut at next week’s Fed Meeting. If CPI comes in hot, these expectations will likely decrease significantly. Be aware of CPI and its potential impact on silver; it will pay to be ready for anything when this report hits the newswires on Wednesday at 8:30 AM EST!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.