Key Points

- Silver has benefitted from gold hitting the $2,500 level.

- The GSR is a vital tool for trading precious metals, specifically silver. It now stands at 87.62.

- A bullish bias is warranted, with key resistance at 29.736.

Market Overview

It’s been a wild Friday on the precious metals markets. Spot gold (XAU/USD) finally hit $2,500, making headlines in every trading house worldwide. Silver (XAG/USD) benefited from the same participation, rallying more than 1.3%.

So, what’s next for silver? If the action in gold is any indication, silver may be headed north in the short term.

The Gold/Silver Ratio

Historic events are often viewed as proxies in the markets. Friday brought just such an event, with gold hitting $2,500. Given this bullish participation, aren’t all precious metals positioned to benefit? Maybe, maybe not.

Enter ratio analysis. At its core, ratio analysis compares one thing to another, intending to establish relative values. That’s the concept behind the gold/silver ratio: to determine whether either of the metals is undervalued or overvalued with respect to the other.

The gold/silver ratio (GSR) is the price of an ounce of gold divided by the price of an ounce of silver. Currently, the GSR stands at 87.62, meaning that gold is almost 88 times more valuable than silver. Over the past five years, the GSR has posted a high of 123.50 and a low of 63.14.

Trading The GSR

Silver analysts typically point to a high GSR as a signal to buy silver and sell gold. At the moment, the GSR is closer to five-year lows. Not much help to silver bulls.

However, in the panic of 2012, the GSR plummeted to 33. At that time, silver was priced at $48.00 per ounce, nearly $20 higher than where it now stands. 2012 was a period of financial strife, recession, and a housing market meltdown. Many analysts point to current debt levels and evolving Fed policy as commonalities between 2024 and 2012. The current GSR suggests that silver is vastly undervalued if they are correct.

The bottom line? There is a lot of room to the upside for silver in the coming months. Interest rate cuts, possible recession, and political uncertainty all point to the development of a sustained uptrend. If one factors increased industrial use in military and technology applications, then physical demand will grow. All of these market drivers point to a bullish silver market.

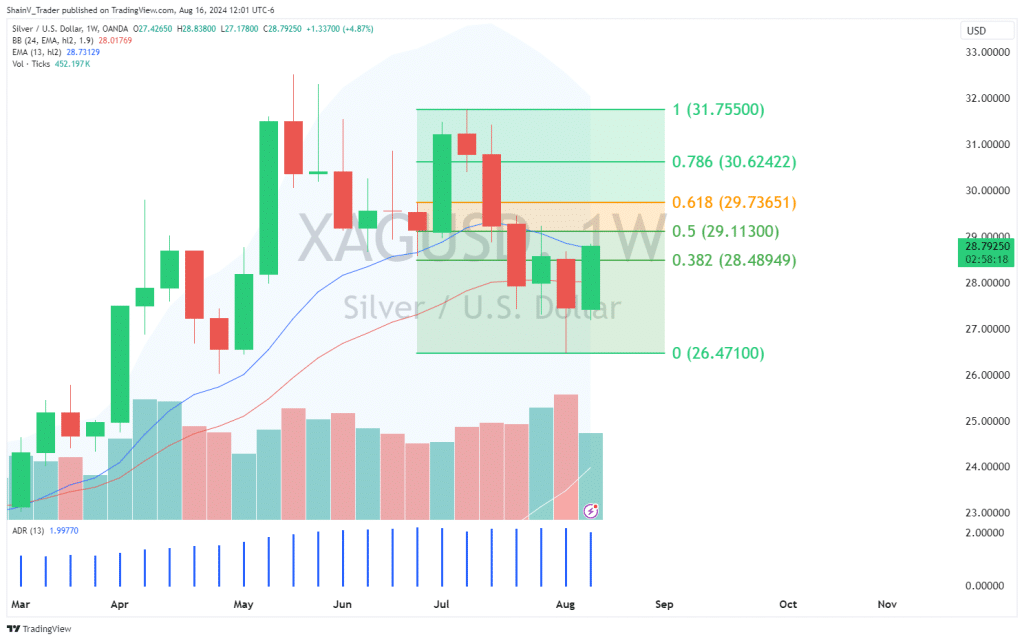

XAG/USD: Technical Outlook

It’s been a solid week for silver. The XAG/USD is up nearly 5.0% as money pours into the precious metals markets.

Earlier today, XAG/USD pricing broke above the key Weekly 38% Fibonacci Retracement at 28.489. This was a substantial technical event, suggesting that the current five-week downtrend is now being challenged.

The next resistance level worth watching is the Weekly 62% Fibonacci Retracement at 29.736. Longs are advised until this level is reached, where a short-term pullback is expected.

Next week’s key event will be Wednesday’s FOMC Minutes. The markets are eagerly anticipating the first Fed rate cuts in several years taking place in September. Will it be a ¼ point or ½ point cut? Perhaps the FOMC Minutes will shed some light on the subject. Either way, volatility will prevail, especially in silver.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.