Key Points

- Gold remains bullish amid a quiet news week.

- The PBoC has added to its gold reserves for the 18th consecutive month. As a whole, Chinese consumption of gold is up 6% year-over-year for Q1 2024.

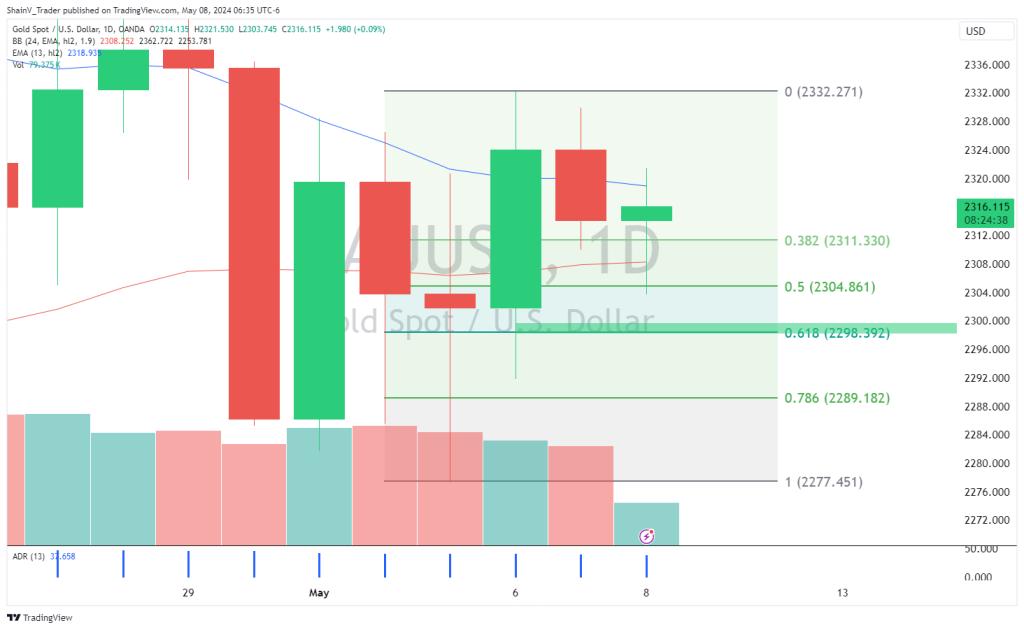

- Key daily support resides at the 2300-2298 zone for the XAU/USD.

Following last week’s FOMC and NFP fireworks, not much was expected out of gold (XAU/USD). However, bullion is up more than ½ percent on the week, trading just short of the 2325.00 quarter handle.

It’s an interesting time in the precious metals markets. Both silver and gold are bullish, fueled by economic and geopolitical uncertainty. Traders and investors around the world, specifically in the Asian markets, are stockpiling gold. As we drive deeper into Q2 2024, one has to wonder if the bullion bull run is over or has it just begun.

The Global Appetite For Gold Is Rising

Periods of uncertainty fuel the gold market, and 2024 has brought mass uncertainty on several different levels. First, the future of Fed policy has many investors concerned about USD strength. Second, geopolitical strife in the Middle East and Eastern Europe has driven concerns over widespread global conflict. Lastly, economic issues such as high debt loads and slowing growth suggest that a worldwide recession may be in the offing. Add it all up — the upside of gold is attracting hordes of investors.

Since 2022, China has been one of the world’s largest buyers of gold. In fact, for 18 straight months, the People’s Bank of China (PBoC) has added to its reserves. According to Bloomberg, the pace of PBoC buying slowed in April, but continued to add to 2023’s record purchases. Chinese consumers are also acquiring gold in record numbers, driving a 6% year-over-year increase in consumption for Q1 2024.

Gold is a commodity. Thus, gold’s price relies on the supply/demand dynamic. Given the robust demand from China, it’s little surprise that bullion is being valued near all-time highs.

Market Drivers

Aside from the macro gold dynamic, there isn’t much on this week’s economic calendar positioned to move the market. Until the closing bell, the key events will be the Bank of England (BoE) Interest Rate Statement (Thursday) and the University of Michigan Consumer Sentiment Index (Friday). Compared to last week’s FOMC/NFP blitz, the coming 48 hours will likely be relatively quiet.

Of course, surprise news items can instantly sway the gold market. If you’re trading the XAU/USD pair, it pays to be on the lookout for any geopolitical news suggesting escalations between Israel/Iran and Russia/Ukraine.

2300.00 Back In Play For The XAU/USD

As of this writing, the XAU/USD is trading sideways. In fact, prices remain inside of Monday’s range (2332.22 – 2291.85). The daily chart formation is non-committal, as traders seem content to stay on the sidelines.

If XAU/USD prices remain flat, a bidding opportunity may set up from the lower quartile of the Friday/Monday range. The daily 62% Fibonacci retracement resides just above 2298.00, so the area between 2300 – 2298 has a great chance of acting as significant downside support. With an initial stop loss in the neighborhood of 2294, bids from 2300 have a positive chance of producing $6.00 on a 1:1 risk vs reward ratio.

Although it’s a slow week on the economic calendar, there are still opportunities to trade gold. In the event, the XAU/USD pulls back to 2300, a nice rotational buy may turn out to be a solid bullish entry.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.