NG prices dropped over 4% yesterday amid demand reduction and high storage levels. Key Federal Reserve speeches later today could impact natural gas markets, with a hawkish stance possibly strengthening the USD and pressuring commodity prices. Today, NG prices rebound amid fears of Middle East escalation.

Key Points

- Natural Gas prices dropped 4.41% yesterday, closing at $1.691, affected by decreased demand and reduced feed gas supplies at Texas’s Freeport LNG plant.

- Prices rebounded modestly to $1.703 amid Middle East tensions and a supply disruption at Norway’s Nyhamna plant.

- Colder weather forecasts may increase heating demand, potentially pushing natural gas prices higher.

Natural Gas Daily Price Analysis – 16/04/2024

Natural Gas prices experienced a notable downturn in the previous trading session, closing at $1.691 per MMBtu, down 4.41% from an opening price of $1.772. The decrease in U.S. natural gas futures, which fell nearly 5% to a more than two-week low, was primarily influenced by reduced demand forecasts for the week, linked to a significant drop in feedgas to Texas’s Freeport LNG export plant.

Today, prices have shown some resilience, opening at $1.683 and inching up to $1.703, reflecting a modest gain of 0.71%. This recovery could be attributed to escalating tensions in the Middle East, where recent attacks by Iran on Israel could lead to geopolitical uncertainties that typically favor energy commodity prices. According to the latest news, Israel’s response to the attack may be imminent. Additionally, the unplanned outage at Norway’s Nyhamna gas processing plant has tightened supply momentarily, further supporting price stabilization.

Weather forecasts predict lower winds and temperatures could increase heating demand, potentially pushing prices upward. Investors will also monitor any updates on the Nyhamna plant outage and its resolution, which could alleviate some supply-side pressures.

Key Economic Data and News to Be Released Today

Later today, the financial markets are set to hear from key figures at the Federal Reserve, including speeches from Fed Governors Jefferson and Williams, followed by Fed Chair Jerome Powell. These speeches are highly anticipated and could significantly influence investor sentiment on commodities like natural gas.

If the speeches suggest a more hawkish monetary policy due to inflation concerns, this could strengthen the U.S. dollar, typically leading to lower commodity prices, including natural gas, as they become more expensive in other currencies.

Natural Gas Technical Analysis – 16/04/2024

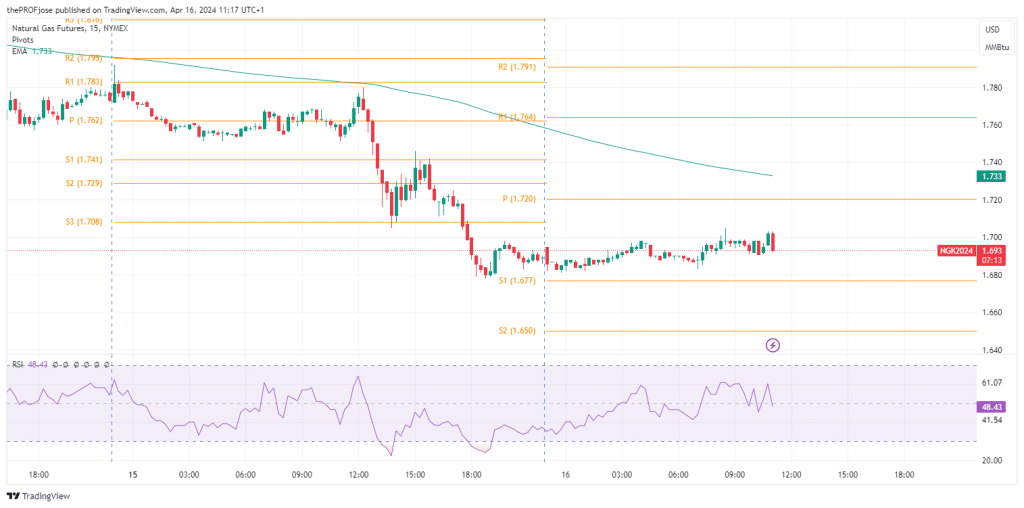

Technically, Natural Gas prices are currently trading below the 200 EMA. The positioning of the price below this EMA suggests a dominant downward momentum over the medium to long term.

In the short run, we anticipate a potential pullback to the 200-day EMA before continuing its downward movement, finding resistance at the average. Traders might consider positioning for a short setup at the 200-day EMA resistance, anticipating a rejection to enter bearish positions.

Natural Gas Fibonacci Key Price Levels 16/04/2024

Short-term traders planning to invest in NG today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 1.677 | 1.764 |

| 1.650 | 1.791 |

| 1.606 | 1.834 |

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.