Key Points

- The weekly EIA natural gas supply reports missed expectations to the downside.

- By 2030, Artificial Intelligence (AI) is projected to drive NG demand up by 10 billion barrels per day.

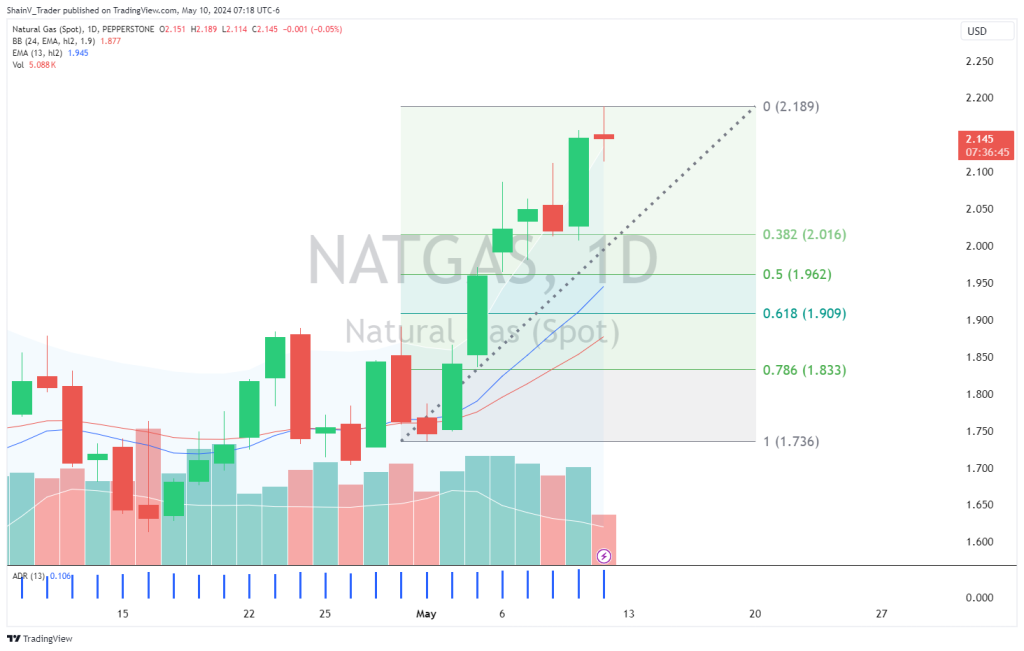

- On the daily chart, NG is in the midst of a bullish breakout. This move defies spring seasonality, but does suggest buying pullbacks in the short-term.

According to the US Department of Energy, natural gas (NG) accounts for nearly 30% of all energy used in the United States. This number is expected to rise in the coming decades as energy demand increases.

As natural gas’s importance grows, its tradability will also. Currently, CME Henry Hub NG futures average between 100,000 and 200,000 contracts per day. CFDs bring even more depth to the natural gas market, albeit in an OTC capacity. Still, many traders believe that NG is a budding superstar on the financial stage.

The Weekly Inventories Are In

Every Thursday, holidays permitting, the US Energy Information Administration (EIA) releases its US underground natural gas supply numbers. The report is a primary market driver for NG as it spikes participation and intraday volatility.

This week, the EIA’s figures showed that NG supplies rose from 59 billion cubic feet to 79 billion cubic feet week-over-week. The number missed expectations of 87 billion cubic feet, suggesting that gas consumption came in higher than expected despite the onset of spring.

A major factor in commodity pricing is the traditional supply/demand curve. In this case, lagging supply contributed to a 5% daily gain.

AI = Bullish NG?

2023 was a huge year for artificial intelligence. The exploding popularity of AI revitalized big tech and prompted many to go all-in on its future. From chat GPT to AI trading bots, the world quickly became even more digitized.

2024 has brought one question to the forefront: what will power the AI revolution? Many futurists, economists, and traders believe natural gas is the leading candidate. Last Sunday, CNBC published an article suggesting AI could drive an unprecedented natural gas boom. In it, Wells Fargo estimated that energy demand will increase by 20% by 2030; natural gas is expected to supply 60% of this demand. If these projections are accurate, NG demand will grow by 10 billion cubic feet per day, 28% over current levels (35 billion cubic feet).

Bottom line: the bullish correlation between AI and NG will be scrutinized for years to come.

A Spring Time Rally For NG?

On the daily chart, spot NATGAS has broken out to the bull. This move defies conventional seasonality. As of yet, the spring/summer lull hasn’t developed.

At press time, NATGAS is pulling back from weekly highs just short of 2.200. If the sellers continue their dominance, an early week buy from the daily 38% retracement (2.016) is a solid Monday/Tuesday play. However, this level is likely to act as short-term support, not a long-term market bottom. Intraday or day trading buy-side strategies are advised.

At this point, a tentative bullish bias is warranted. Although it’s been a big week for NG, spring/summer seasonality is still upon us. And, since the Russia/Ukraine invasion highs, this market remains in a steep bearish trend.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.