Key Points

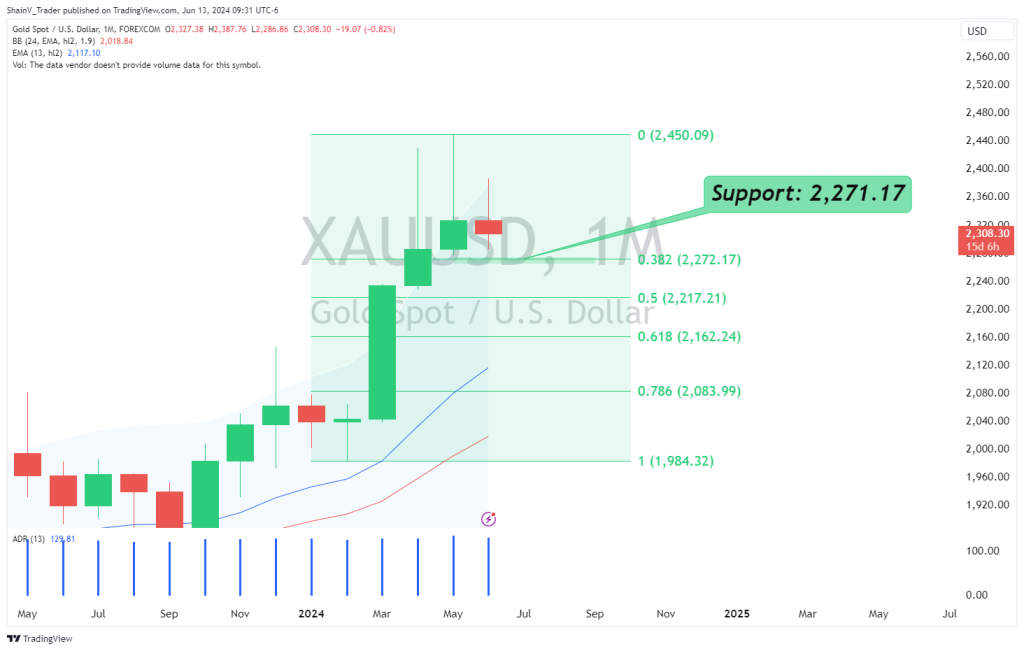

- June has been a pullback month for gold (-0.75%).

- May CPI and PPI suggest that inflation is cooling.

- The markets are now pricing a 70% chance of a September rate cut.

- Monthly support is present at $2,271.

Market Overview

Gold (XAU/USD) has been on a bullish tear throughout 2024. Prices are up 12.25% since 1 January, firmly establishing valuations above $2,000. Two market drivers are responsible for the rally: interest rate cut anticipation and geopolitical tensions.

Inflation Fades, Rate-Cut Hysteria Begins

This week has been a key period for US inflation. Wednesday, US CPI was released to the public. CPI came in at 0.0% for May, the first flat figure reported this year. During Thursday’s pre-market hours, US PPI hit newswires. For May, PPI came in at -0.2%, well below expectations of 0.1%.

The May CPI and PPI paint a positive picture of the inflationary cycle in the United States—at least, that’s how the market is pricing the reports. Since CPI and PPI became public, the CME FedWatch Index has adjusted the probability of a September rate cut upward to 70%, a 24-hour move of 10%.

The bottom line? Perceived receding inflation has the markets actively pricing in Fed rate cuts. This devalues the USD and sends commodities like gold higher. However, in his presser, Fed Chair J. Powell cautioned that Wednesday’s cooling CPI is not enough to cut rates:

“We see today’s report as progress and as, you know, building confidence. But, we don’t see ourselves as having the confidence that would warrant beginning to loosen policy at this time.”

Ultimately, significant uncertainty continues to plague the future of Fed policy. This dynamic will be a primary gold market driver for the remainder of 2024.

Technical Outlook

The XAU/USD is riding a four-month winning streak. The biggest gain was a 9.29% rally in March. June is currently in a pullback phase, off more than 0.75%. Now, a key macro support level is coming into play.

As we roll toward the end of Q2 2024, a bullish bias remains warranted toward gold. Accordingly, pullback buys aren’t a bad way to play bullion. Bids from the Monthly 38% Fibonacci retracement (2,271.17) area are top trades ahead of 1 July.

Market drivers such as CPI, PPI, and Fed Announcements enormously impact gold prices. Friday features a much slower market cycle; be ready for anything as traders and investors adjust their positions going into the weekend break.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.