Opening at $2,381.4 and currently trading around $2,387.2, gold shows resilience in response to softer U.S. CPI data and expectations of an impending Federal Reserve rate cut.

Key Points

- China’s retail demand and central banks’ opportunistic buying influence gold’s trajectory.

- The market anticipates direction from today’s speeches by Fed Governors Waller, Dari, and Kashkari.

- Gold is bullish, with buying signals above $2,392 and support at the 200 EMA.

Gold Daily Price Analysis – 17/05/2024

Gold experienced a mild decline in yesterday’s session, closing at $2,385.5 after opening at $2,391.5, marking a change of -0.39%. The precious metal retreated slightly from its weekly high of $2,397 per ounce. Despite this dip, gold prices remain buoyed by broader market expectations and risk sentiment. Notably, other risk assets also saw subdued performances yesterday, highlighting a cautious market environment.

As of today, gold opened at $2,381.4 and is currently priced around $2,391.2, showing an increase of +0.24%. Recent softer U.S. Consumer Price Index (CPI) figures and weaker retail sales have lowered Treasury yields and weakened the dollar, supporting gold prices. The market is now pricing in an approximately 85% chance of a Federal Reserve interest rate cut by September, up from 75% earlier in the week, which could further underpin gold’s attractiveness.

Central banks’ buying patterns and the global retail demand, especially from China, remain critical to gold’s price trajectory. The stabilization efforts in China’s property sector may bolster gold demand, as suggested by increased retail buying. However, high gold prices earlier in the month have led to a slowdown in purchases by major buyers like China’s central bank, which now opts for a more opportunistic approach to buying gold—favoring purchases on price dips.

Key Economic Data and News to Be Released Today

While no high-impact economic data releases are scheduled for today, the market’s attention is directed toward speeches from Federal Reserve officials, including Governors Waller, Dari, and Kashkari. Comments from these Fed members are crucial as they could provide further insights into the central bank’s current thinking and future monetary policy directions.

Gold Technical Analysis – 17/05/2024

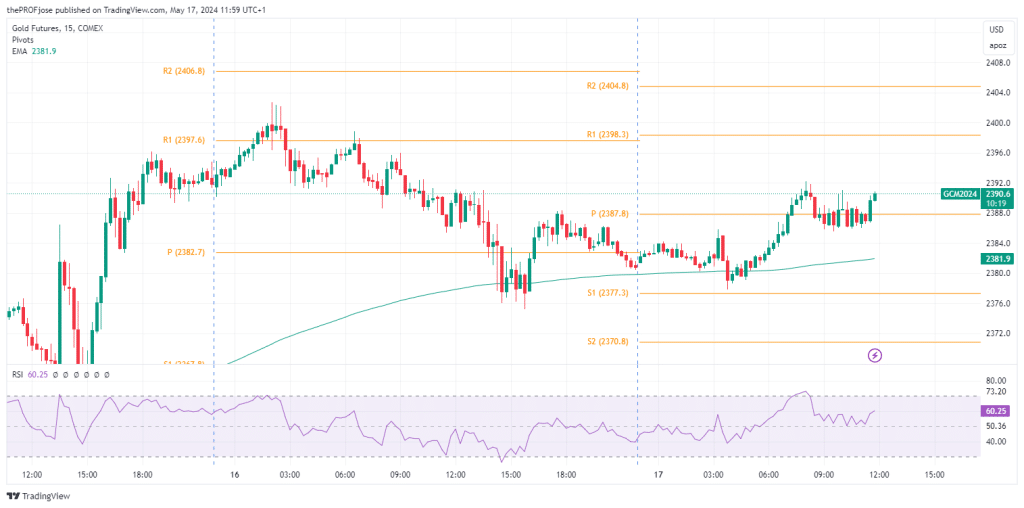

Gold is currently bullish. Although it saw a steady decline yesterday, it found support at the 200 EMA earlier today, and the price seems to have rebounded and is on its bullish track. At the same time, the RSI also confirms the current bullish sentiment as the indicator is far from being overbought.

For traders looking to buy the yellow metal in the short term, a more reliable entry will be above the daily high of $2392. However, should the price break below the low of the day, we may be expecting a further decline to a deeper support level before the price takes off again.

Gold Fibonacci Key Price Levels 17/05/2024

Short-term traders planning to trade gold today should keep a close eye on the following key price levels for the day:

| Support | Resistance |

| 2377.3 | 2398.3 |

| 2370.8 | 2404.8 |

| 2360.3 | 2415.3 |

Related Articles:

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.