Key Points

- The Philadelphia Fed Manufacturing Index badly missed expectations. The number came in at 1.3, well below the 4.5 expected.

- The CME FedWatch is now pricing a 64.1% chance of a Fed rate cut in September.

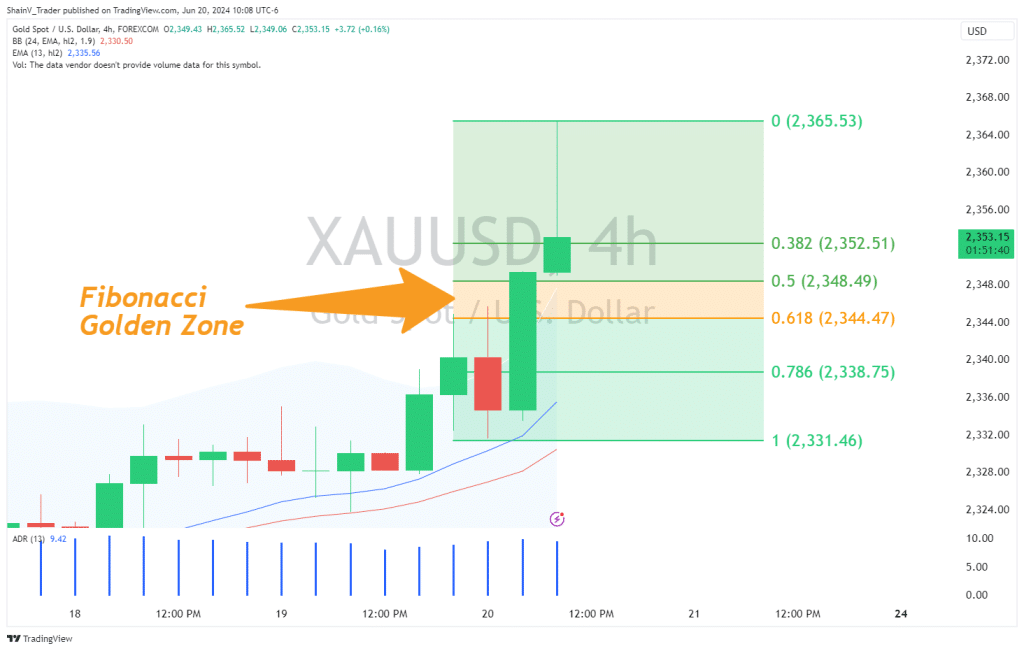

- 4-hr support is present in the Golden Zone between 2,348.49 and 2,344.47.

Market Overview

Geopolitics and monetary policy — these are the two primary market drivers in the current gold (XAU/USD) market. As the end of Q2 draws near, palpable uncertainty continues to surround each of these issues. The result has been gold price entering an intermediate-term rotational phase between 2,450 and 2,275. At press time, the XAU/USD is pricing the center of this range.

Economic Calendar Sparks Gold Rally

Following a flat US overnight session, gold is up more than 1%. A rush of bids hit the market following the Wall Street cash open at 9:30 AM EST. The spike in participation represents a return of institutional money following the Juneteenth holiday.

During the US trading day, several noteworthy events unfolded. The most significant was the Philadelphia Fed Manufacturing Index (June), which reported a figure of 1.3, significantly lower than the previous release (4.5) and the consensus forecast (4.8). This substantial lag in the Philly Fed suggests a significant manufacturing downturn in the US Northeast, a factor that can potentially impact the gold market.

Generally, an economic contraction signals Fed rate cuts. In turn, commodities have the propensity to rally as the supply of USDs in circulation reduces purchasing power. Subsequently, investors begin buying gold as an inflation hedge and insulation against economic uncertainty. In short, economic contraction and rate cuts equal bullish gold pricing.

Interest Rate Expectations

It is 41 days until the next meeting of the US Federal Reserve. According to the CME FedWatch Index, the odds of interest rates remaining unchanged at the 31 July meeting stands at 89.7%. The first Fed rate cut in several years is anticipated in September. However, the odds stand at 64.1% of at least a ¼ point rate cut, far from a foregone conclusion.

Ultimately, Fed policy will play a huge role in the gold market. And, while many are banking on policy easing in September, this assertion is far from assured. Fed uncertainty remains, and many in the markets are currently in limbo.

XAU/USD Technical Outlook

Technically, the 2,350 area has been a huge zone for today’s trade. XAU/USD pricing cannot seem to break from the vicinity of 2,350, although the momentum is bullish.

On the four-hour timeframe, a topside breakout has developed over the past eight hours. Pullback bids are warranted going into the Friday session. Long entries from the 4-hr Golden Zone middle (2,346.50) aren’t bad short-term trades. With an initial stop loss beneath the Golden Zone, this trade has a positive expectancy of 6.00. Low leverage is recommended as the stop loss location is relatively large.

Friday is always an interesting day in the gold market. Be ready for anything as long-term investors and short-term traders manage their market exposure ahead of the weekend break.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.