Key Points

- Thursday was a huge day on the economic calendar.

- The probability of a ¼ point September Fed rate cut continues to grow.

- The key technical level for gold is the $2,500 handle.

Market Overview

August has been a big month for gold (XAU/USD). Prices have been all over the place, but can’t seem to deviate from the $2,500 handle. As of this writing, the XAU/USD is trading just beneath this key level and headed south. Prices are off nearly 1% on the session, trading just north of $2,480.

Economic Data

Thursday was a big day on the economic calendar featuring a collection of scheduled events. On the employment front, US Initial Jobless Claims showed an uptick in the weekly unemployment roles. The number rose to 232,000, above the 228,000 of last week. Following last month’s dismal NFP, and Wednesday’s reports of downward revisions, many questions surround the US labor market. This week’s growth of Initial Jobless Claims reinforces these concerns.

The S&P Global PMI numbers hit newswires during the early US session, prompting a spike in participation. In short, the S&P Global Manufacturing PMI fell while the Services PMI rose. The mixed figures illustrate the complex economic conditions August has brought. While many traders emphasize the S&P PMI figures, one has to question their importance.

Lastly, US Existing Home Sales (July) dropped at 10:00 AM EST. The number came in at 3.95 million homes, above expectations (3.94 million) and the previous release (3.90 million). The uptick represented a 1.3% gain, no doubt a product of falling mortgage rates.

Evaluating Thursday’s Data

In the aggregate, Thursday’s economic reports suggest uncertainty. The growth in Initial Jobless Claims is peripheral evidence that the US Jobs market continues to soften. Remember, the Fed has a dual mandate: ensure pricing stability and promote maximum employment. With inflation tapering, rate cuts to support economic growth are the likely way forward.

The S&P Global PMI numbers are ambiguous and tough to evaluate. Basically, manufacturing is down while services are up. For the time being, it’s best not to jump to any conclusions with this set of numbers.

Existing Home Sales was a pleasant surprise for the markets. The growth in this area indicates that consumption remains strong; a good sign for the US economy. However, this suggests that a ¼ point September rate cut is more appropriate than a ½ point. If consumption of big-ticket items is steady, is there any hurry to abandon a more restrictive policy? We’ll find out the answer in 27 days.

Bottom line: gold is positioned to stabilize in the vicinity of $2,500 as the probability of a ¼ point September rate cut grows.

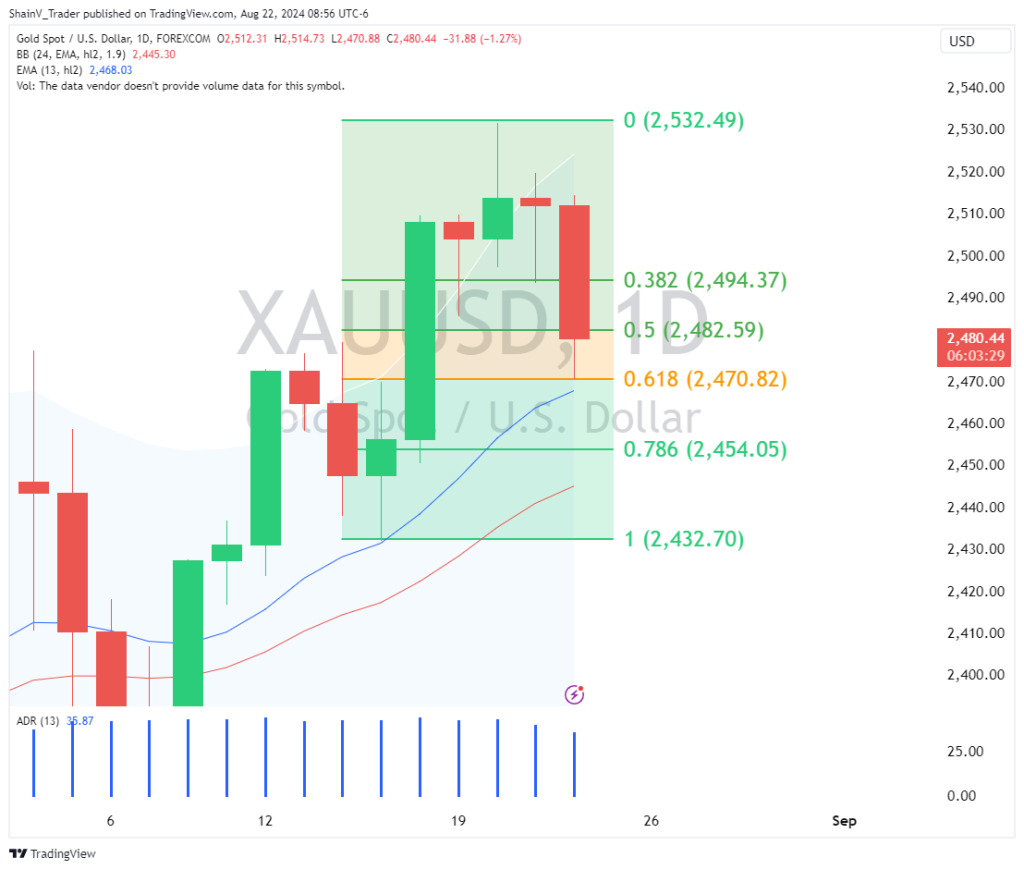

XAU/USD: Technical Outlook

It’s been a bearish day for spot gold as traders actively price the jam-packed economic calendar. At press time, the XAUUSD is testing a vital technical level.

The Daily 62% Fibonacci Retracement (2,470.82) is setting up as a potential short-term bottom for the gold market. This level has withstood a hard test following the Existing Home Sales release. However, if the 62% retracement doesn’t hold, then be ready for a plunge to the Daily 78% Fibonacci Retracement (2,454.05).

At this point, a long-term bullish bias is warranted toward gold. The daily uptrend remains intact but is being challenged. If available, buying dips from 2,450-2,454 is great trade location to the bull. We’ll see if this zone comes into play soon.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.