What Are Forex Brokers?

You can’t have access to the forex market as a retail trader without an establishment called a broker. So, in this lesson, we’ll teach you everything you need to know about forex brokers and their types.

Let’s get to it.

What is a Forex Broker?

Forex brokers are financial intermediaries through which you trade forex. They match buyers with sellers for a commission paid by the initiator of the trade or by both parties. Simply put, a retail currency trading broker is the middleman between retail forex traders and the interbank global market.

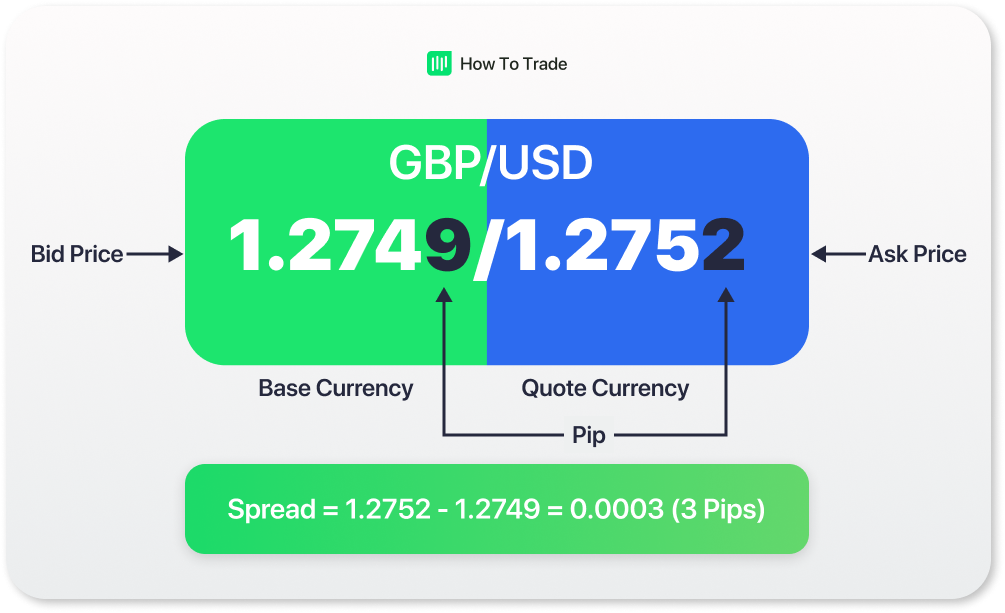

Primarily, a forex broker makes money through bid-ask spread, which is the difference between the bid price and ask price of a currency pair.

In addition to providing a connection to the forex markets, a retail forex broker also gives users access to a forex trading platform (or several trading platforms) where forex traders can view quotes of currency pairs, analyze the markets, and manually place orders. Also, forex brokers offer traders significant leverage ratios that allow traders to increase their earning potential per trade.

Finally, to attract new traders, many brokers offer a variety of trading tools and promotions. For example, most forex brokers enable users to trade on mobile platforms, utilize the negative balance protection tool, and to be able to practice different trading strategies on a demo account before risking real money.

How Modern Forex Brokers Came About

Decades ago, you had to call a forex broker through the phone to place an order. Of course, this was slow and inefficient. Also, not everyone had easy access to the charts for analysis. As a result, there weren’t as many forex traders as we have today. Forex was a luxury only the rich could afford.

Another disadvantage was that there were high transaction costs. The broker had to pay their workers who were picking up traders’ calls round the clock.

But thanks to the internet. We have trading platforms where you can easily place your order and have them executed within a second. You can also access trading charts and historical information about your currency pairs, helping you make better-informed trades.

Ultimately, the modern forex broker makes it possible for retail traders like us to access the largest financial market in the world.

How Do Forex Brokers Work?

You now know that a forex broker allows you to access the forex market. And as far as you’re concerned, all you want is to click the “buy” or “sell” button on your trading platform. And as soon as you close the trade in your favor, you want your trading balance to reflect your profit. As long as a broker achieves this, most traders are satisfied.

However, how the broker makes this happen varies. And to understand that, we first need to understand the types of forex brokers.

Types of Forex Brokers

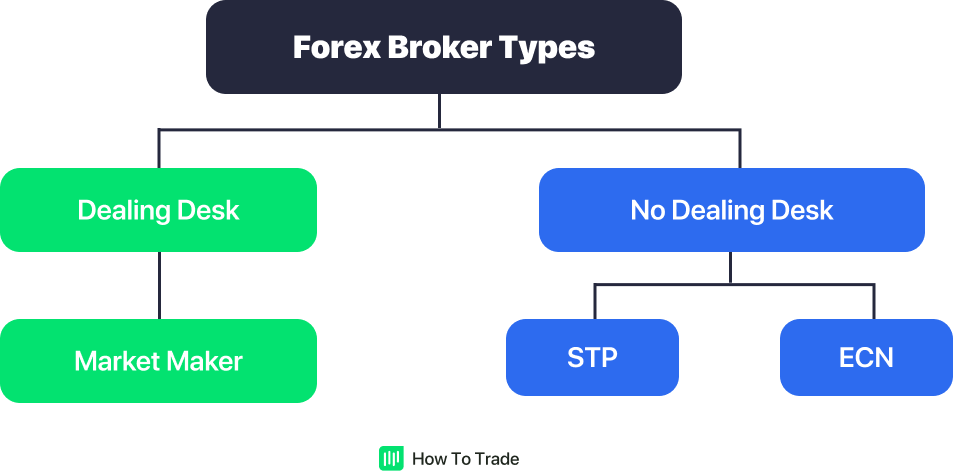

There are two main types of brokers, depending on their mode of operation.

- Dealing Desks (DD) Forex brokers (B Book Brokers)

- No Dealing Desks (NDD) Forex brokers (A Book Brokers)

While we have a lesson that goes into fuller detail about the differences between a dealing desk and a non-dealing desk forex broker, we’ll do a quick overview of each type.

1. Dealing Desk Forex Broker

Dealing desk forex brokers make it possible for you to trade forex by taking the other side of your trade. They’re also called market makers.

For instance, if you’re long on a currency pair, you’re counting on the rise of its exchange rate. But on the other side of your trade is your forex broker, counting on the fall of the currency pair’s exchange rate.

Why? Because someone has to be the one buying a currency pair you’re selling, just as someone has to be the one selling a currency pair you’re buying. So, for every long trade you take, the broker goes short. And for every short trade you take, the broker goes long. This way, if the trade goes your way, the broker pays you, and if the trade goes against your prediction, you pay the broker with your trade margin.

You’re probably thinking, “Does that mean this broker wants me to lose?” Well, they truly make their money from your loss using this model. But it may be too far to say they want you to lose.

2. Non-Dealing Desk Forex Broker

A non-dealing desk forex broker simply connects market participants in the market via their trading platforms and charges a small transaction fee for that service. This means an NDD forex broker matches you with another trader, taking an opposite trade to yours. If you’re buying, the other trader is selling. NDD brokers also match orders with those from liquidity providers, the interbank markets, and financial institutions. At the end of the day, the job of a non-dealing desk forex broker is to find a seller for your buy order and a buyer for your sell order.

Non-dealing desk brokers also offer two kinds of trading accounts: ECN (Electronic Communication Network) and STP (Straight-Through Protocol).

The good thing with an NDD foreign exchange broker is that you do not have any conflict of interest with your forex broker, you get tighter spreads, and you always get the best exchange rates in the market. The bad thing with NDD brokers is that their execution is not guaranteed, and it’s harder to trade non-liquid currency pairs.

How do you Choose the Right Forex Broker?

Choosing a forex broker may seem simple at a glance, but it isn’t all that. Most beginner traders will just go with the first broker they get to know. And when they begin to understand the foreign exchange market a bit more and how the little things matter in this game, they return to pieces like this one, relearning how to choose the right forex broker.

So, do yourself a favor. Do the hard work now and consider these factors when choosing the right forex broker.

1. Regulation

The first step in choosing a Forex broker is determining if it is regulated. Regulated brokers are required to follow the rules and guidelines of their regulatory agency and are generally considered safe and secure. They also must keep their retail clients’ funds in segregated accounts separate from their own accounts. They must submit regular audits and their financial reports to the regulatory body.

2. Trading Costs and Broker’s Commission

This factor is perhaps the most crucial one. Obviously, it would be much easier to start trading forex pairs with a discount broker and not lose money paying high trading fees. For this matter, take a quick tour of the broker’s site to find out if they offer fixed spreads or variable spreads. Then, browse around and see what the spreads are for trading the most popular currency pairs, especially major currency pairs.

Also, compare the broker’s trading costs on a certain currency pair to other forex brokers in the industry (preferably major currency pairs like the EUR/USD, GBP/USD, and USD/JPY).

Other trading costs you should be aware of are commissions, overnight fees, and inactivity fees. Commissions are charged per forex lot. And not all the account types provided by the brokers have these commissions. Overnight fees are the broker’s charges for keeping your trades open from one trading day to another.

Finally, inactivity fees are charges the broker takes from your account if you do not trade for a specific amount of time. Other fees include deposit fees and withdrawal fees.

All of these fees are ways the broker makes money, and they differ from one broker to the other. The broker with the lowest fees isn’t always the best, by the way. Just remember that brokers are businesses too. They have to make their money one way or the other. So, be careful when considering these fees.

3. Trading Platform

Then, you also need to check the trading platform and the trading tools offered by the forex broker. Trading platforms differ in the number of tools they allow you to use, how you use them, and the ease of use and customization, among other things.

The MetaTrader trading platforms are by far the most popular among forex traders because they’ve been around for so long. They also have features, such as the expert advisor and strategy testers.

However, not all brokers offer the MetaTrader. Other platforms include Ctrader and Ninjatrader.

4. Education

This may not be a deal-breaking factor. In fact, it shouldn’t because if you’re opening a demo or live account to trade with a broker, the assumption is that you already know how to trade forex to a reasonable extent.

However, it’s nice to know that your broker is offering you opportunities to improve the craft of trading. Some brokers even take things to the next step by offering live webinars and seminars to help beginner and intermediate forex traders up their games.

5. Research and Analysis

As a forex trader, research and analysis are your bread and butter. You can’t do without them. And if a broker supports you in these with research and analysis tools, even better!

Some of these tools may be as simple as an economic calendar or lot-size calculators. For the most part, you can do without these tools. But it’s these little things that count.

Key Takeaways

- A forex broker gives you access to the forex market. All your orders are routed through them.

- The two categories of forex brokers are dealing desk brokers and non-dealing desk brokers.

- Dealing desks make their money by taking the opposite sides of your trades. Non-dealing desks make most of their money off commissions and spreads.

- Some of the factors you should consider when choosing a broker for yourself include regulation, trading costs, education, trading platform, and research and analysis.

The bottom Line

A forex broker is your gateway to the forex markets. You need them to access the foreign currency market and trade currencies. And on the flip side, they need you to make money.

Also, choosing a broker is not that easy these days, partly due to the paradox of choice. However, as long as you do your own research and try using a forex broker’s platform with a demo account before depositing money and opening a live forex trading account, you’ll be fine. It’s not a wedding or having kids. You can always leave your forex broker.