- Donald Trump has won a majority in the Electoral College and the Popular Vote.

- The markets reacted violently to Trump’s election. US stocks moved higher, commodities fell, and crypto spiked.

- Tax cuts, tariffs, and energy independence are to be foundational elements of the new Trump Administration’s economic policy.

Market Overview

Election 2024 was hotly contested, highlighted by fiery rhetoric, assassination attempts, and a huge turnout. Shortly after 5:30 AM EST, Republican Candidate Donald Trump was declared the winner. This decision has enormous implications for stocks, commodities, and the USD. Let’s recap the election and examine which markets will be most impacted.

Election 2024: A Decisive Trump Win

On election day, political platforms estimated that Trump was a 60/40 favorite to win the White House over Harris. As Tuesday evening unfolded, these odds went to 80/20, then 90/10 within a few hours of the polls closing.

The reason for the sudden shift was obvious: Trump outperformed 2020’s metrics, and Harris underperformed. The result was a mammoth win in the Electoral College, with Trump easily securing the 270 electors necessary for securing the presidency.

However, two other US political events are impacting the markets: the Senate and Popular Vote. The Republican Party gained three seats and now sits at a 52 – 42 Senatorial majority. Many point to this gain in the Senate as being a “mandate” for the new Trump administration.

Perhaps the most surprising event from Tuesday was Donald Trump’s performance in the Popular Vote. As of this writing, the New York Times is projecting that Trump will win the US Popular Vote over Harris. This is the first time since 2004 that a Republican has won a national plurality.

At this hour, the race for control of the US House of Representatives remains hotly contested, with many close races. The final decision on the House won’t be rendered for days, but currently, the Republicans hold an edge in seats.

Market Impact

Republican control of the White House and Senate brings several issues to the financial forefront. Increased tariffs, energy production, sweeping deregulation, and tax cuts are several of the largest. These are primarily positive for stocks and crypto while bearish for commodities.

The markets wasted no time pricing in Trump’s victory. On Wednesday’s Wall Street Open, the Dow Jones Industrial Average (DJIA) spiked by more than 1,100 points. The S&P 500 and NASDAQ 100 also posted gains of more than 2.5%. The Russell 2000, often used as a leading indicator for major US indices, gained 5.84%, rising to its highest level since 2022. Cryptocurrencies rallied across the board, with industry leader Bitcoin posting 6% gains to trade around all-time levels.

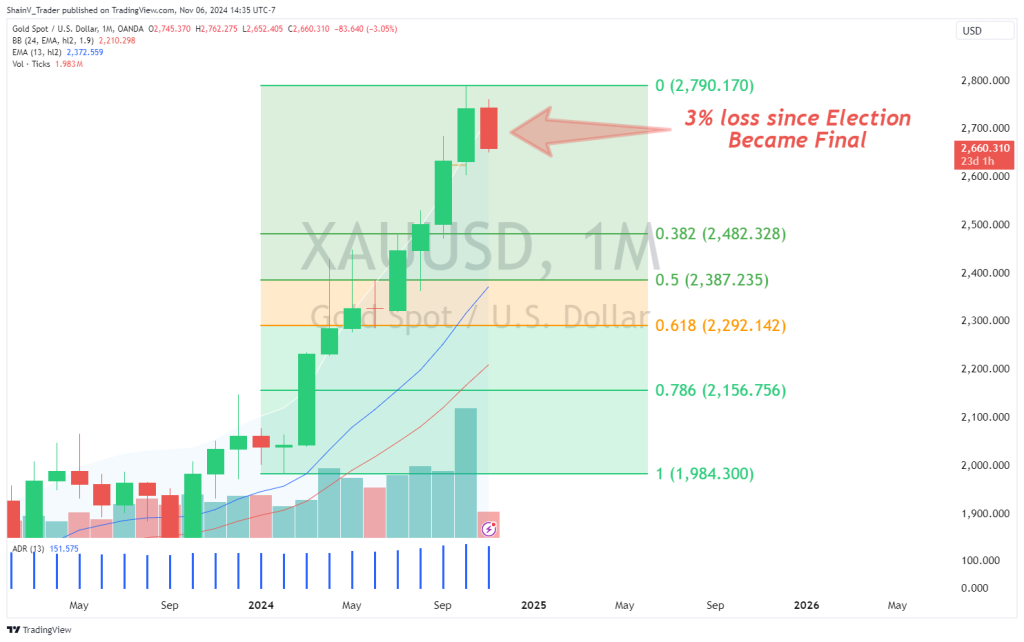

Conversely, gold plunged by more than 3%; silver was a bigger loser, crashing by 5%. Energies showed weakness, with UKOIL and USOIL falling by more than 1%. Natural gas posted a 2% gain as traders favored gas over oil.

What Will Happen To Commodities?

The intense volatility following the election came as little surprise. And, the market drivers outlined above will profoundly affect the markets. None will be more impacted than commodities.

With Republicans controlling the Senate and potentially the House, “drill baby drill” will be on the table in the next nine months. Also, going live with assets such as the Keystone Pipeline can potentially deliver tremendous fossil fuels to the markets. These are strong bearish market drivers for WTI crude oil and liquified natural gas.

The key level for WTI is 64.70, the 38% Fibonacci retracement of the five-year range. If this level fails as downside support, be prepared for a swift bearish break to the $55-$45 range.

For precious metals, the future outlook isn’t so clear-cut. Fed rate cuts and geopolitical uncertainty can prop gold and silver prices up for some time. However, an end to the Israel/Hamas and Russia/Ukraine wars has the potential to undermine metals prices via geopolitical stability.

For gold, the long-term trend remains bullish. Pullback buys from monthly retracement levels (2482, 2290, 2154) aren’t bad trades for the intermediate term.

Protectionism And The USD

One issue that may dominate Trump’s first 100 days is negotiations with BRICS nations. Currently, BRICS is in the process of launching its own centralized currency, which is 40% backed by gold. Trump has been an outspoken critic of BRICS and advocate for protecting the USD:

“You leave the US dollar, then you’re not doing business with the United States because we are going to put a 100 percent tariff on your goods.”

Following the declaration of Trump’s victory, many emerging market currencies tanked. One of the biggest losers was the South African rand, which fell more than 1.5% versus the USD.

The outlook for the US dollar under the new Trump administration is cloudy at best. On the bullish side, one can argue that tariffs and protectionism will boost the value of the USD. On the other hand, aggressive Fed rate cuts and quantitative easing are likely to put a ceiling on USD values.

As you can see on the chart, the USD Index (DXY) remains in bullish territory. Rates are slightly above 105.00 and holding firm above the 50% retracement from 2021’s low to 2022’s high. Without question, the 101.95-100.00 area will be key downside support for the Greenback.

The Trump Doctrine

The new Trump administration will attack a collection of societal, political, and financial priorities in its first six months. Within the arena of finance, several policy points were announced on the campaign trail:

- Tariffs: Tariffs facing imports from the BRICS nations will be on the front burner. Massive tariffs facing Chinese automobiles and technology imports are possible as the US enters a potential new trade war.

- Tax cuts: Trump has hinted at cutting taxes across the board if re-elected. The elimination of the income tax, a corporate tax rate reduction, and “no tax on tips” have been proposed.

- Energy: An impetus will be placed on the United States becoming “energy independent” once again. This will mean more oil and gas cultivation/exploration.

These three policies’ effect on the markets is hard to quantify. The increased tariffs will likely be bullish for sectoral US stocks but may be a temporary drag on the tech sector (NASDAQ). Tax cuts may contribute to corporate wealth and consumer spending, likely contributing to economic growth. Lastly, boosted energy production will position oil and gas prices to fall from current levels.

Of course, campaign promises and enacted legislation are two different things. At this time, it is difficult to project any definite market trends for Trump’s first year back in office. Investors are well-advised to take a wait-and-see approach for the first 90 days before committing significant capital to the markets.

For traders, it will pay to be ready for anything! Keep a close eye on the news cycle, manage risk aggressively, and be receptive to opportunity. Do those things, and the coming four years may be filled with promise.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.