- New tariffs and trade wars are primary concerns for 2025.

- Goldman Sachs views across-the-board tariffs as the most prominent risk facing global markets.

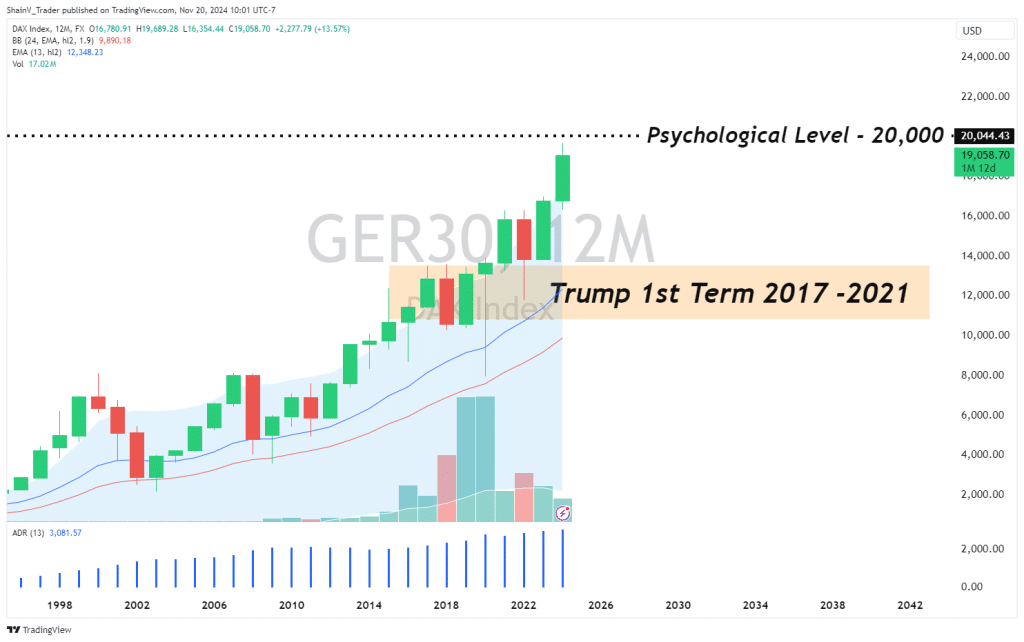

- Germany’s DAX (GER30) is among the most vulnerable assets to a US/EU trade war.

Overview – The Risks of Trump’s Economic Policy

Donald J. Trump’s victory in the November 2024 election sent shock waves throughout the financial world. Early winners were US large caps, Bitcoin, and big tech. Despite these rallies, palpable concern remains over issues such as a rekindled US/China trade war, the imposition of universal tariffs, and USD protectionism.

Each of these items marks a massive shift from Biden administration policies. Economists, journalists, traders, and investors are all wondering the same thing: What risks does the new Trump doctrine pose? What are the risks of Trump’s Trade War 2.0?

Trump’s economic plan may be a reboot of 2016-2020. Many proposed policies have been enacted before; however, the global economic environment vastly differs from Trump’s first term. There are some unique risks to be aware of after Trump is sworn in for his second term as the 47th President of the United States.

Despite the recent rally in the markets, palpable concern remains over issues such as a rekindled US/China trade war, the imposition of universal tariffs, and USD protectionism.

Trump 45: 2016 – 2020

Several critical economic policy moves highlighted Trump’s first term. Among the most well-known were the passage of the Tax Cuts and Jobs Act (TCJA), the launch of sweeping tariffs, and deregulation.

From January 2017 to January 2020, the pre-Covid-19 Era, stock, commodity, and currency market performance was significantly impacted by Trump’s policies:

- The Dow Jones Industrial Average (DJIA) rose 44% (19872 – 28,638).

- USD values fell, with the USD Index (DXY) trading down 6.2% (102.870 – 96.477).

- Spot gold (XAU/USD) witnessed solid appreciation, rising 31.9% ($1,150 – $1,517 per ounce).

- Crude oil (USOIL) prices rose 13.5% ($53.87 – $61.19).

It’s important to note that the COVID-19 pandemic was a true Black Swan event. Thus, focusing on the period of January 2017 to January 2020 accurately illustrates Trump’s true policy impact on the markets.

A few conclusions can be drawn based strictly on financial performance. Lower tax rates and deregulation produced steady economic growth. This led to a downturn in the USD as investors snapped up stocks and commodities in response to the American economy operating at near “sugar-high” levels.

Deregulation of the US fossil fuel industry boosted production and brought stability to crude oil prices. Accordingly, WTI crude oil traded in a three-year range between 42.08 and 76.88. In September 2019, the US became a net exporter of petroleum for the first time since monthly records began in 1973.

History has a way of repeating itself, and it’s possible that the markets behave in the same fashion as outlined above. But, it’s essential to recognize that the new Trump administration faces a very different global dynamic than it did in 2017. Let’s look at one critical risk posed by the 2025 Trump Economic Doctrine: tariffs.

The Impact Of Tariffs

On the campaign trail, Trump touted instituting a collection of aggressive tariffs if elected. How large or where they will be placed remains a mystery, but there are a few safe bets.

In the first Trump administration, a significant trade war developed with China. A series of tit-for-tat tariffs brought international trade to the forefront of the financial news. On the 2024 campaign trail, Trump has pledged tariffs as high as 100% on Chinese automobiles made in Mexico and exported to the US. Other tariffs have been proposed, such as a 10% across-the-board tariff on all global exports to the United States.

The most cited risk regarding a new trade war and tariffs is the impact on global economic growth. According to Goldman Sachs Research Chief Economist Jan Hatzius, the effect of tariffs could be substantial:

“The biggest risk is a large across-the-board tariff, which would likely hit growth hard. We expect US productivity growth to remain significantly stronger than elsewhere, and this is a key reason why we expect US GDP growth to continue to outperform.”

Estimates from Goldman Sachs claim that a global trade war would hardest hit the Eurozone. A repeat of the 2018-1019 trade war uncertainty is projected to subtract 0.3% from US GDP and 0.9% from Eurozone GDP. In addition, a spike in US tariffs could subtract 0.7% from Chinese GDP in 2025.

Add it all up: tariffs and a global trade war could have dire implications for international stock indices such as the Nikkei, China A50, and the DAX.

Risk Profile: DAX (GER30)

In the EU, Germany is the largest exporter of goods and services to the United States. The numbers aren’t even close — for 2023, exported goods were valued at US$171.8 billion.

According to German Federal Bank President Joachim Nagel, new Trump tariffs could shave 1% off Germany’s GDP. Nagel says, “If the new tariffs actually materialize, we [the German economy] could even slip into negative territory.”

If Nagel’s concerns are valid, German stock indices may be severely affected. The DAX (GER30 CFD) is a highly vulnerable asset to an international trade war.

For most of Trump’s first term, the GER30 traded around 12,000. While the DAX may not return to this level, a trade war could bring heavy selling to German stocks. Should significant tariffs be placed on the EU, a 15% retracement in the DAX from current levels (approximately 19,000) isn’t out of the question.

Given the uncertainty regarding natural gas imports and a potential EU/US trade war, 20,000 may be the ceiling for the GER30. Only time will tell, but 2025 is widely anticipated to be the year of the tariff. It’s tough to see the GER30 catching bids above 20,000 in such an environment.

The Art Of The Deal

When the markets evaluate trade wars, “uncertainty” is the most important aspect of price discovery. And, with Donald Trump, uncertainty is guaranteed. In his book The Art Of The Deal, Trump outlines his negotiation strategy:

“The worst thing you can possibly do in a deal is seem desperate to make it. That makes the other guy smell blood, and then you’re dead.”

If Trump is to be taken at his word, the markets will have a difficult time pricing potential US/International trade wars. Basically, a trade war is just an enormous deal—don’t expect to know what Trump and the US are going to do before it’s done.

By nature, traders and investors are forward-thinking. This will be problematic as trade wars are often excessively complex. Accurately predicting timelines for deal-making and adding or subtracting tariffs will be extremely difficult. Hints regarding the future of US policy will be hard to come by; ultimately, the markets will have to adapt to a new level of policy opacity.

Patience will be the key to prospering amid a fresh round of tariffs and new trade wars. Pricing corrections will come and go across all asset classes, placing an impetus on market timing. All in all, 2025 will be a fantastic time to be in the markets.

Good traders will manage the new tariff and trade war risks by being patient and not becoming financially overextended. If one can accomplish those two things, “trade war risk” can quickly become “trade war opportunity.”

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.