Key Points

- In typical fashion, the S&P 500 has followed a 5-day losing streak with a 5-day winning streak.

- Traders are still torn between a 25bps or 50bps rate cut from the Fed in September.

- Is there more weaker data to come today with retail sales due out?

- The S&P500 trades in a key resistance area and faces a very important test.

Market Overview

The current rally in the S&P 500 shouldn’t come as a surprise to anyone, as often even the biggest bear markets have the sharpest pullbacks within the move. This index has now followed a 5-day losing streak with a 5-day winning streak, which sets us up perfectly for today’s session and beyond.

Yesterday, the US Consumer Price Index (CPI) ticked slightly lower to 2.9% from 3.0%, with the Core CPI remaining fairly robust. The price action represented the report; choppy. However, Wall Street still found a way to end the day in the green, but we are not out of the woods yet by any means.

How Aggressively Will The Fed Cut?

According to the CME Fed Watch Tool, there is now a 62.5% chance that the Federal Reserve will cut rates by 25bps in the 18th September meeting. The inflation report slightly moved the goalposts, as before that, it was a 50/50 shot. However, with all options still on the table, we could have an exciting few weeks on our hands.

Most of the big “crashes” in the stock market have come when the Federal Reserve signals rate cuts because often it is because they “have to” rather than because of a “soft landing.” Therefore, it makes sense to bring rates down at a more gradual pace, but if the data continues to show weakness, the probabilities could shift toward a 50bps rate cut, and this may not be good for the S&P500.

There Could Be More Weaker Data Today

The concern, or panic, about the US economy entering a recession has eased, but the situation remains jittery. Today, traders will get some high-impact data in the form of retail sales and reports on the manufacturing sector. The forecast for retail sales can be inaccurate, so if the figure comes in significantly weaker, we may see some weakness in the S&P 500 today as recession fears creep back. The same goes for the manufacturing sector, so the bulls will be hoping for a figure in line with expectations or even slightly higher.

S&P 500 About To Slump Again?

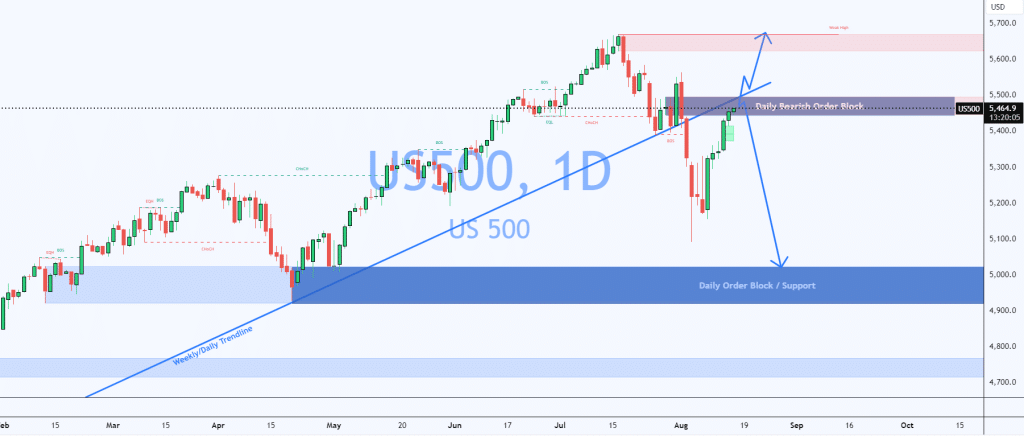

The S&P 500 now trades back at 5465, an impressive turnaround from the low printed at 5085 just 10 days ago. This wild swing is a representation of the tense situation in the markets at the moment, and the S&P 500 is now at a critical level.

The daily/weekly trend line from October 2023 was evidence of the bullish structure, but this was breached during the latest downside move. The price has now run back up toward that trend line and now trades inside a daily bearish order block. This makes it a tempting selling opportunity, and if this market is to continue to the downside in the short term you feel it needs to be from this area. Should this fail to act as resistance, then it is probable this index could go on another run back to all-time highs. These are crucial times.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.