Key Points

- Traders have ignored some signs that inflation is still here, and Wall Street has surged this week as a result.

- Traders are now betting on a 25bps rate cut from the Federal Reserve. Is a soft landing a real possibility?

- Michigan Consumer Sentiment data could help end the week with a bang in the S&P500.

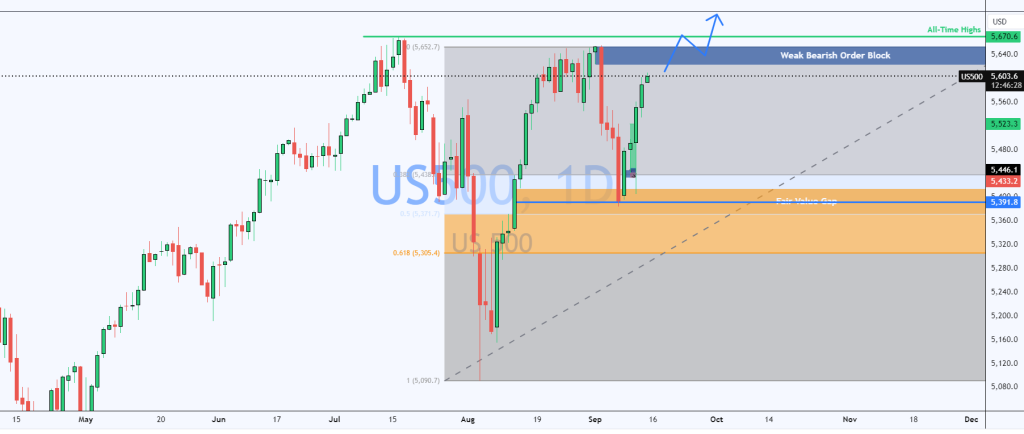

- The S&P500 is now gunning for all-time highs after a textbook Fair Value Gap (FVG) reaction.

Market Overview

The stock market is on track to see the biggest weekly gain this year and has nearly erased all the losses witnessed last week. In fact, this current rally across Wall Street has topped $1.3 trillion so far, and after surging past most of the resistance in its way, only the all-time highs stand in the way of the S&P500.

On Wednesday, the US Consumer Price Index (CPI) dropped 0.4% to 2.5%. Although this was expected, it is welcome news for the Federal Reserve. However, the Core PCE Price Index remained robust once more and ticked 0.1% higher month-on-month. Furthermore, yesterday’s Producer Price Index readings were higher than forecast, although there were downward revisions to both numbers from last month. This is not a sign of an unhealthy economy, and the markets took it that way, with the S&P500 surging past 5,500.

Is A Soft Landing Possible Now?

According to the CME Fed Watch Tool, there is now a 59% chance that the Federal Reserve will cut rates by 25bps in the 18th September meeting. The inflation report slightly moved the goalposts; it was a 50/50 shot before that. However, with all options still on the table, we could have an exciting few weeks on our hands.

At the beginning of the year, multiple analyst reports claimed a soft landing from the hiking cycle is about 10% likely. However, there is a disconnect between this and the current market pricing. With inflation falling as it is and the US economy still adding jobs (albeit at a slower rate), the early indications are that this is not an economy about to “crash.” Of course, this can change with interest rates still at 5.5%, but this will only be for another week.

How Positive Are Consumers Feeling?

The concern, or panic, about the US economy entering a recession has eased, but the situation remains jittery. Today, traders will receive some high-impact data in the form of the Michigan Consumer Sentiment Index. August’s figure improved after five consecutive months of lower consumer sentiment from March to July. It is expected to do so again today, in line with falling inflation, which could send the stock market into another Friday buying frenzy.

S&P500 To Test All-Time Highs?

The S&P500 trades back at 5600, a remarkable reversal from the low printed at 5391 last week. This wild swing represents the volatile nature of markets, but it seems the bulls are coming out on top once again.

As predicted in one of our live streams this week, there was a golden opportunity to buy the S&P500. This prediction was based on the 50% Fair Value Gap (FVG), a key area in the Fibonacci retracement. The price must surpass the order block at 5630 to complete the move. However, considering this order block did not break any meaningful structure, there may only be minor resistance here. Instead, traders may want to use this as a break and retest area to send the S&P500 officially into all-time highs and beyond.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.