Key Points

- The S&P500 and Dow Jones both touch all-time highs as traders and investors eagerly anticipate the Federal Reserve interest rate decision.

- It is not often that traders are split on the FOMC decision, which is one reason this is the biggest day in the markets this year.

- Inflation vs economy: the case for 25bps and 50bps leaves all options open today.

- Volatility is promised across Wall Street today, and history could repeat itself.

Market Overview

The world will be watching later today when the Federal Reserve delivers its next monetary policy decision, and there is every reason to expect fireworks in the markets. Does anything else matter? No, not really. This is no normal decision either, as it will mark a new era of policy for the Fed, i.e., rate cuts. The million-dollar question is, 25bps or 50bps?

The mood on Wall Street has been buoyant over the last week or so as investors look to the Fed to front-load rate cuts. The dollar index bounced yesterday, and stocks were marginally higher. This is a classic sign that the markets are shaping up for some out-sized moves today.

The Biggest Day In The Markets In Years?

According to the CME Fed Watch tool, there is now a 61% chance that the Federal Reserve will cut interest rates by 50bps to 4.75%. There is a 39% chance that the cut will be 25bps, with the chance of holding rates practically 0. It is rare that the decision is a near 50/50 split like this, adding extra volatility to the markets today.

The last time the Federal Reserve cut rates by more than the forecast, as per Forex Factory, was December 16th, 2008, and September 18th, 2007. On that day in 2007, the Federal Reserve cut rates from 5.25% to 4.75%, and the stock market was sent into a buying frenzy, ending the day nearly 4% up. The reasons it did this are not dissimilar to what we see today, with inflation falling to near target and the higher risk of breaking the economy with a restrictive policy.

The Case For 25bps

The debate will rumble on all day today, and the time for talking will end at 2:00 pm (EST). The case for 25bps stems mainly from a robust jobs market coupled with a higher core inflation figure.

Core inflation in August was higher than expected at 0.3% MoM, which indicates that the inflation war has not yet been won. The Federal Reserve’s mandate is “pursuing the economic goals of maximum employment and price stability.” Jerome Powell would risk inflation not spiking higher again by cutting rates too much, too quickly.

As for the U.S labor market, it has remained robust throughout the entire hiking cycle, which is a sign of economic resilience. September NFP report showed that the Non-Farm Employment change figure, the average hourly earnings, and the unemployment rate all improved from the month prior showed an improvement from the month prior. That is not a sign of a breaking economy; therefore, we see a 25bps rate cut as having a 65% probability.

The Case For 50bps

The case for 25bps stems from the general trends in inflation and employment. Although core CPI came in higher in August, the headline CPI figure now sits in the 2-3% range the Federal Reserve is comfortable with. If the inflation rate is 2.5%, but the interest rates are 5.50%, it can be argued that this 3% gap is too restrictive.

The data has been trending down in business surveys for quite some time now, and the jobs market is the last domino to fall. In August, data showed there were 800,000 fewer jobs than what the Non-Farm Payroll data had been reporting over the last year. This has questioned the accuracy of the Federal Reserve’s forecasting tools. Even without this, the unemployment rate has increased by over 0.5% since the hiking cycle began, and the employment figures have been falling. Given interest rates are lagging and are at very restrictive levels, there is certainly a case for a 50bps cut today. We see it as 35% likely due to the message it could send, i.e., “we are behind the curve.”

Dow Jones Prediction

The Dow Jones printed a new all-time high of 41,837 this week and now trades at 41,640. The promising sign for the bulls is that the market did close above the previous all-time high and has stayed above it for a couple of days.

If the Fed cuts 50bps today, there will likely be an initial surge in the Dow Jones. With prices already being elevated, traders may look to target 42,000. However, if the Fed opts for a 25bps cut, it may be seen as a disappointment given that 50bps seems nearly priced in. We could see a drop in price to the Fair Value Gap (FVG) at 41,224 in this case.

NASDAQ Prediction

In the Great Recession of 2008, there was a housing bubble. Is there now a tech bubble? The NASDAQ has lagged unusually behind the other two major indices, sitting way below the all-time high of 20,750. The current price is 19,340 but has experienced a bullish run in the last week.

If the Fed cuts 50bps today, it could give the NASDAQ bulls a welcome shot of euphoria. The key level to the upside is 20,000, a key psychological level representing a break above the equal highs marked on the chart. However, should the Fed opt for a smaller cut, the market sentiment could be squashed, leading to a fall to 19,000.

S&P500 Prediction

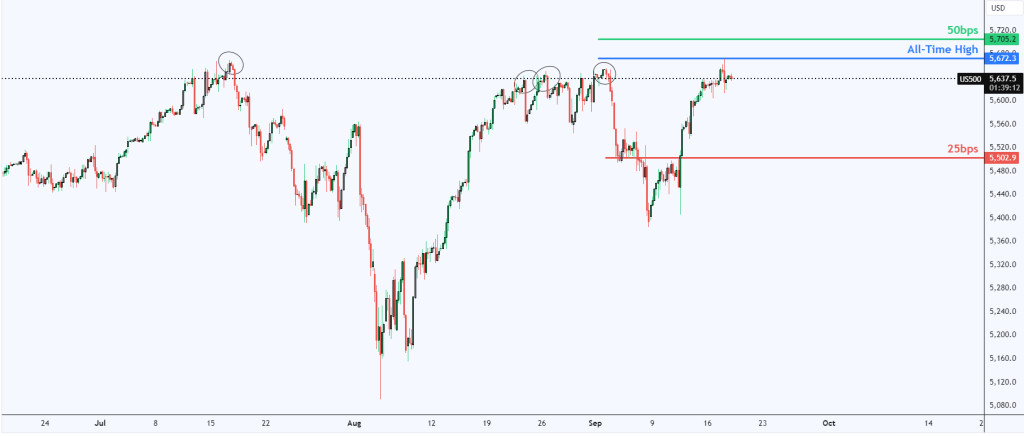

The S&P500 printed a new all-time high yesterday of 5672 but did not close as convincingly as the Dow Jones. The current price is 5638, which, as you can see, has been a resistance area for this index on multiple occasions since July.

If the Fed cuts 50bps today, we could see a full candle closure in uncharted waters, i.e., beyond 5700. However, should the Fed opt for a 25bps cut, we may see a sell-off to the next area of support at 5500. It feels there is more to lose than gain in this index today.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.