Key Points

- NASDAQ breached milestone 20,000.

- Rate cuts being pushed back.

- NVIDIA dips 3%.

- Is this the top for the NASDAQ?

Market Overview

The NASDAQ snapped an 8-day winning streak yesterday after briefly trading above a record high of 20,000. After two failed attempts to reach this milestone, the NASDAQ finally breached it during yesterday’s Asia session. However, as the US session came to life, the NASDAQ dropped 300 points. This is most likely down to profit-taking.

Rather than calling this the top of the market, traders will now wonder where the next “buy the dip” opportunity comes from and who can blame them. The NASDAQ has been rampant so far this year despite a more hawkish stance from the Federal Reserve than most expected. Is there anything that can stop the bulls?

Rate Cuts Are Being Pushed Back

According to the CME FedWatch tool, there is now a 90% chance that the Federal Reserve will keep interest rates where they are in the upcoming July meeting. This is after some hawkish comments from Jerome Powell in last week’s conference. The markets now believe the Federal Reserve will only cut once this year; however, if you check the percentages, nothing is set in stone.

This emphasizes the data coming out before the meetings, such as today’s PMI data. The services and manufacturing PMI in the US are in expansive territory, meaning the sectors are growing. Unless the figures come in extremely weak, i.e., both below 50, it is hard to imagine the NASDAQ falling when they are released. We could, therefore, be in for a bullish close today.

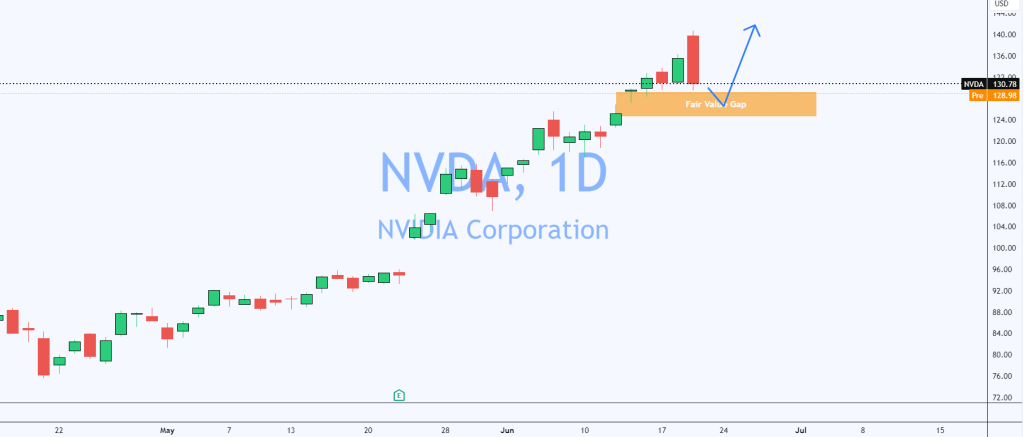

NVIDIA Dips 3%

Much of the NASDAQ’s gains this year can be attributed to the buzz surrounding AI. No one has felt this more than NVIDIA, whose stock price has been defying logic with its gains. At the time of writing this article, the stock price is up 177% YTD.

NVIDIA was the most valuable company in the world this week, but only briefly. Yesterday, the stock price fell 3% and is approaching a Fair Value Gap. Traders may use this as an opportunity to buy the stock once more.

Is This NASDAQ Top?

Due to NVIDIA’s weighting in the NASDAQ, the tech index also fell quite aggressively from the 20,000 mark and was down 300 points at one point yesterday. The price has since rebounded but remains under pressure.

Looking at the current market structure, it would be brave to call 20,000 the “top of the NASDAQ.” This looks like a classic bout of profit-taking at a huge milestone figure, so there is no need to panic. Furthermore, the price ran into an H4 order block and reacted twice. Traders may look for the sell-side liquidity to be taken at the equal lows within the order block to send the NASDAQ back to 20,000 once more.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.