Key Points

- The Yen “carry trade” is over.

- JP Morgan and ING believe there is more unwinding to come.

- Volatility to come back next week?

- Where is the next big USD/JPY move coming from?

The Yen Carry Trade Is Over

As per Investopedia, a carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return. So, as a trader, you would pick a currency whose central bank keeps rates high and buy it against the currency whose central bank keeps rates low, i.e., USDJPY.

The Federal Reserve has had to hike interest rates aggressively to combat inflation and has opted to hold rates where they are at 5.25% until more evidence of falling inflation has occurred. Conversely, the Bank of Japan has kept rates ultra-low/negative for eight years to stimulate the economy until now.

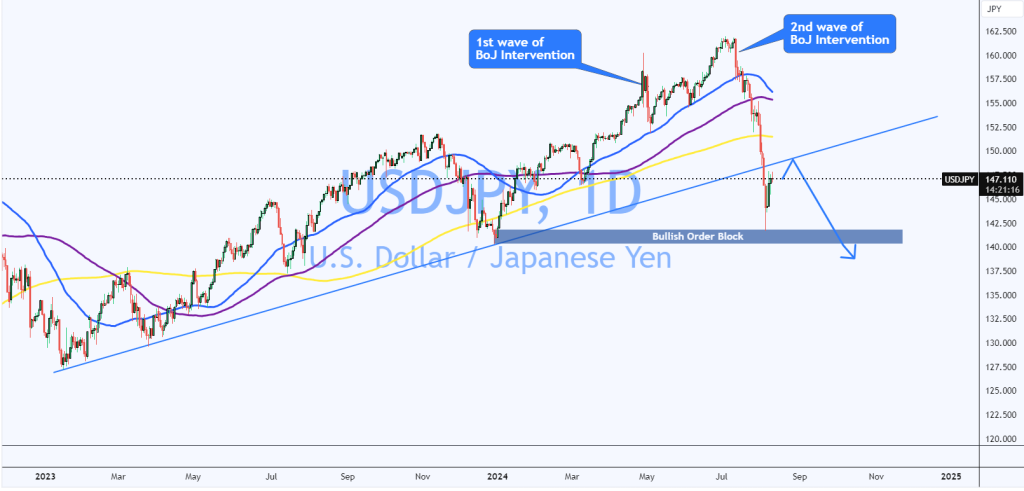

This all changed when the Bank of Japan decided to hike rates by 0.15% to 0.25%. At the same time, weaker data from the US has triggered recession fears and, therefore, likely cuts from the Federal Reserve in every remaining meeting this year. This has led to a sharp decline in the USD/JPY as the unwinding of the ultimate carry trade looks over.

How Much More Unwinding Will There Be?

According to a JP Morgan strategist, the carry trade unwind “is maybe somewhere between 50% and 60% complete, so we are not done by any stretch.” This would suggest another 700-1000 pip fall and a test or breach of 140, the price level at which the year opened.

According to ING, declarations of a yen carry trade being 50-75% unwound should be taken with a pinch of salt. “For now, however, it looks as though USD/JPY can hang around this 145/148 area. Over the next couple of months, we doubt it sustains a move over 150 and would expect the softer US rate environment to bring it back to the 138/140 area.”

In summary, it feels like there may be more medium-term declines to come. However, traders should not rule out a short-term bounce in USD/JPY if the US data holds up in the next few weeks. This would somewhat ease recession fears and boost the dollar against a still accommodative Bank of Japan. The data comes back to our screens next week, and this is likely to mean more volatility, so traders should be on high alert, especially on Tuesday when US inflation is out.

The Next Big USD/JPY Move

The story for USDJPY had been simple: “Buy any dips and hold on.” However, now the narrative has changed, as USDJPY has fallen 1500 pips (or 9%) from the high. The market has rallied from a bullish order block, and anyone who would have been brave enough to buy here would be in fantastic profit right now.

The price has broken out of the daily trendline without struggle, indicating the veracity of the unwinding. Also, it trades comfortably below the 50, 100, and 200-day moving averages, and a bearish “death cross” could be coming. USD/JPY could reach 149.000 in the short term, but this previous trendline could be used as resistance to pull the market down to the 140 area.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.