Key Points

- The USD/JPY is challenging the weekly downtrend.

- US NFP has shifted interest rate expectations to a more hawkish read of future Fed policy.

- The key events for this week are the FOMC Minutes (Wednesday) and US CPI (Thursday).

Market Overview

July 2024 marked the beginning of a significant pullback in the USD/JPY. Rates fell consistently over the summer as the Bank of Japan (BoJ) committed to a path of intervention for the yen. Subsequently, the USD/JPY plummeted from just above 162 to 139.50.

So, is the bearish USD/JPY move over? There’s a case to be made that the selloff is winding down. Let’s dig into the key market drivers and examine the technicals.

Fed Policy Uncertainty

Last Friday brought an epic US Non-Farm Payrolls release. September’s jobs report shattered expectations, coming in at a lofty 254,000 new jobs. The Unemployment Rate fell from 4.2% to 4.1% as the American labor market unexpectedly ticked higher.

The impact of NFP on Fed interest rate expectations was immediate. The CME FedWatch went from pricing at ½ point November rate cut to favoring only a ¼ point move. At press time, the CME FedWatch Index is assigning an 86.7% chance of a ¼ point cut and a 13.3% chance of the Federal Funds Rate being held static at 4.75-5.00%.

September’s jobs numbers brought a hawkish tone to the Greenback. For now, the markets are walking back expectations of a series of ½ point cuts in favor of a more conservative policy. For the USD/JPY, the result is bullish price action, as evidenced by last week’s 4.25% rally.

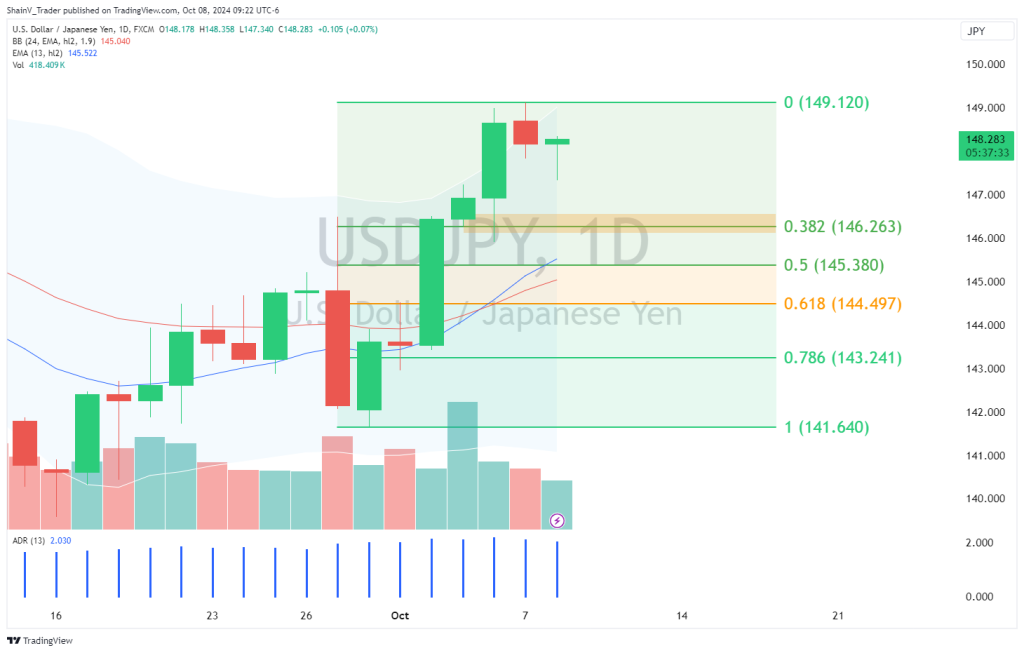

USD/JPY Technical Outlook

On the weekly timeframe, the USD/JPY downtrend remains valid. However, a strong daily uptrend is now in play. Pullback buys into last week’s bull run aren’t bad ways to play the action.

Bids from 146.25-50 offer a good trade location to the topside. A conservative profit target of 50-75 pips offers a positive expectancy trade that aligns with the current fundamentals facing the USD/JPY.

Inflation Back On The Front Burner

The keynote economic event for this week is the release of US CPI (Thursday). Remember, the Fed has a dual mandate: promote maximum employment and pricing stability. At this juncture, the employment end of the mandate is looking up. Conversely, high inflation persists, although progress has been made to slow pricing growth.

The market consensus is that CPI is to fall slightly month over month. Estimates have CPI for September coming in at 0.1%, beneath the 0.2% of August. It will pay to be ready for anything as these numbers hit newswires. A hot CPI will surely send the USD/JPY higher, while a low CPI reading may send the yen sideways against the USD.

Also, Wednesday afternoon brings the FOMC Minutes disclosure. This installment of the minutes will be fascinating as traders attempt to decipher the future of Fed policy. Once again, this is a market-moving event that can drive volatility to the USD/JPY. If you’re active in this market, be sure to respect the FOMC Minutes and CPI releases; being positioned correctly going into these events can lead to solid profits!

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.